IAG – Recovery Trade?

IAG:ASX is a potential counter-trend recovery trade that’s now on our radar. We add this to the list which also includes CIM & A2M.

IAG:ASX is a potential counter-trend recovery trade that’s now on our radar. We add this to the list which also includes CIM & A2M.

Insurance Australia Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see buying support increasing at the $5.50 support level and the short-term momentum indicators have now turned positive.

Insurance Australia Group looks oversold at $6.60. The insurers are out of favour and have been dumped from portfolios.

IAG is a preferred value recovery play within the sector.

Accumulate IAG within the $6.50 – $6.75 range.

Insurance Australia Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

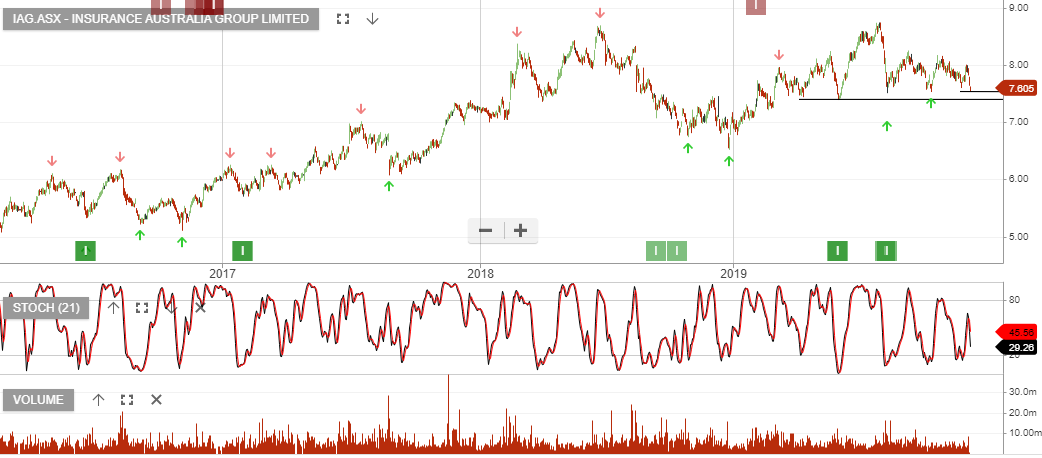

We see price support for IAG at $7.50

Insurance Australia Group is now showing an Algo Engine buy signal and remains a long term holding in our ASX 100 model portfolio.

We see value emerging and consider the $7.50 price range as support and expect buying interest to remain solid.

Look for a move higher into the $8.00+ range and then sell covered call options to enhance the income return.

For more detail on the option strategy, please call our office on 1300 614 002.

Insurance Australia Group has been added into the ASX 100 model portfolio following the recent Algo Engine buy signal.

We see buying support for IAG at $7.50

IAG goes ex dividend on the 21st of August for $0.20. Adding a Dec $8.00 call option will generate an additional $0.30 per share of income.

IAG is under Algo Engine buy conditions and we see support building near $7.10.

The company will report half year earnings on the 6th of February. The market is looking for NPAT to be around $260mn.

We suggest buying IAG and selling an out of the money call option to enhance the return.

IAG goes ex-div 14 cents on the 20th of February.

In our Opportunities in Review webinar series, we’be been suggesting IAG as a buy below $7.00.

A recent broker note estimates that IAG will have a further $600 million to spend on shareholders, which could come in the form of a $300 million special dividend and $300 million share buyback.

Look for a rally to $7.50 and sell covered call options.

IAG

Insurance Australia Group, (IAG) is retracing into a price zone that provides a discounted entry point to begin accumulating the stock.

We see a cluster of support dating back to December of last year on the daily charts and good value between $7.00 and $7.30

IAG

Today’s earnings miss in IAG, along with lower guidance into FY19 has seen a sharp sell-off with price moving back to $7.50.

We see long term value for investors who accumulate the stock within the $7.25 to $7.50 range.

IAG goes ex-div $0.20 on the 6th of September.

Or start a free thirty day trial for our full service, which includes our ASX Research.