Harvey Norman

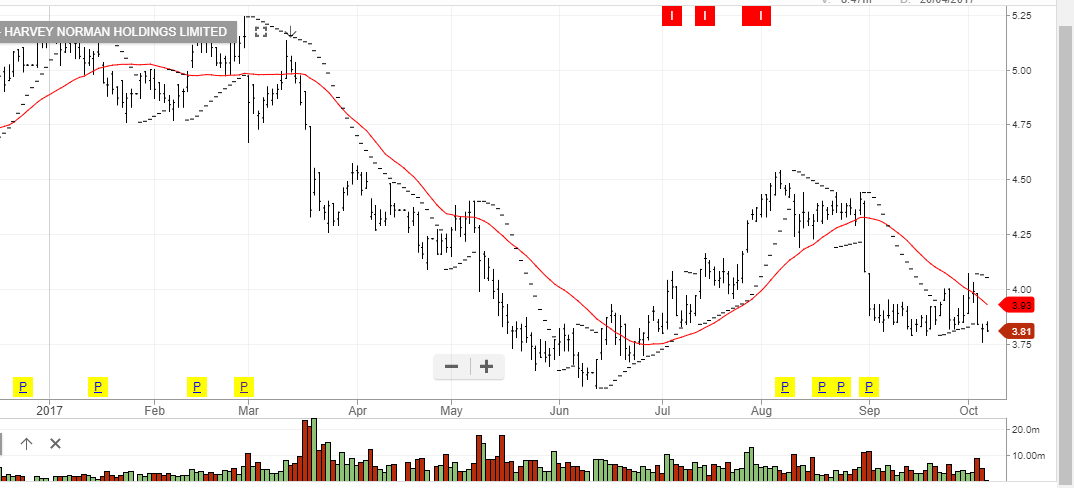

Harvey Norman Holdings buy at the market price with a stop loss at $3.18

Harvey Norman Holdings buy at the market price with a stop loss at $3.18

Harvey Norman Holdings buy at the market price with a stop loss at $3.18

Local economists had expected Australian retail sales to have grown by around 0.3% after a flat report in July.

Instead, retail sales fell by 0.6% in August, and, adding insult to injury, revised the July report to show a 0.2% decline. It is the first back-to-back decline in five years.

Retail names HVN and JBH have both seen their share prices drop over 15% since mid-August and yesterday’s report won’t likely give them a lift.

Over the medium-term, we see scope for HVN to trade back to $3.65 and JBH to slip to $21.70.

Harvey Norman

JB HiFi

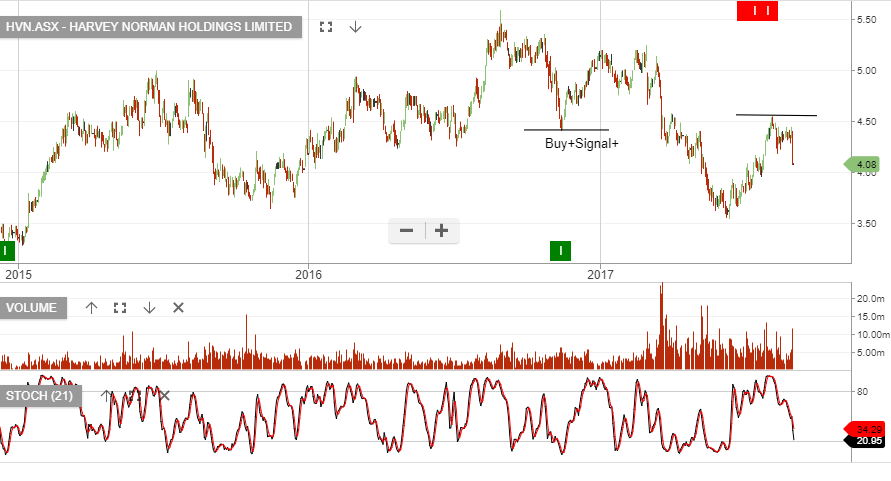

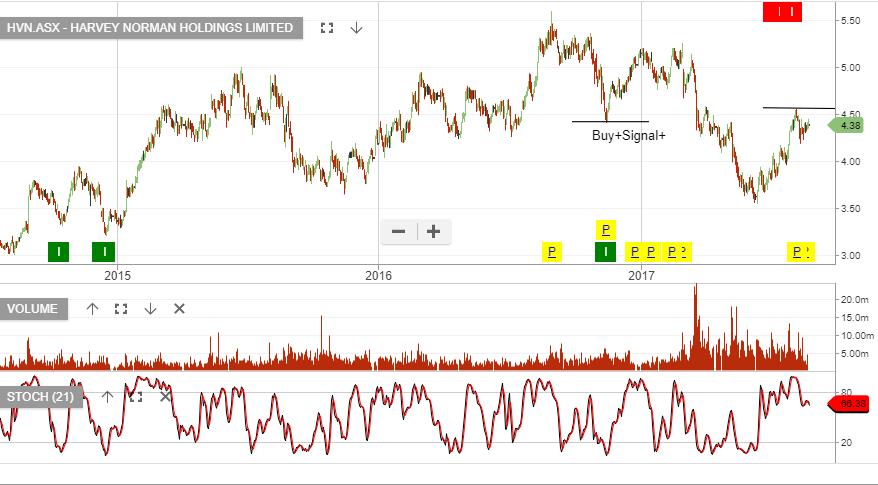

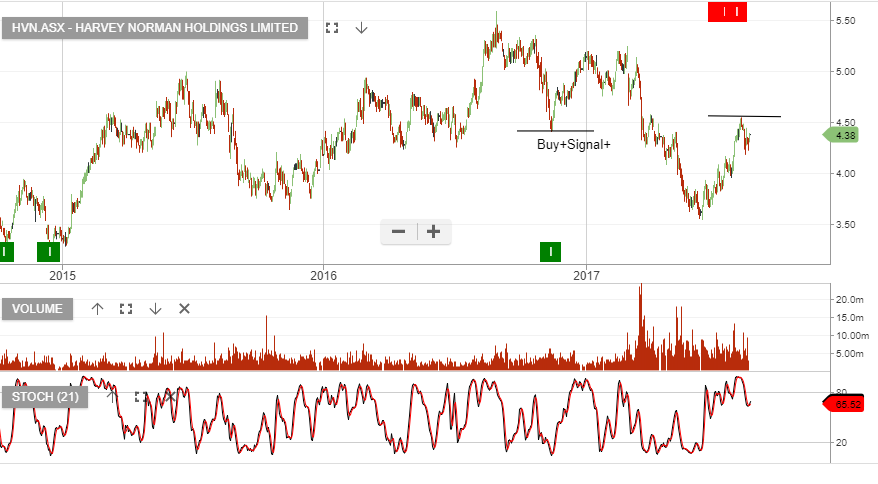

We’ve been highlighting the Algo Engine short signal set-up in Harvey Norman and JB Hi-Fi.

Selling in both names started to picked up yesterday, following the FY17 earnings release by Harvey Norman.

HVN

HVN

We like the short side of the banks and retailers coming into what will likely be a volatile period for equity markets in September & October.

The regional banks, BOQ & BEN look expensive.

Following their profit announcement on the 31st August, HVN should be on your wishlist as a potential short, with a stop losses above recent highs.

A reminder that both HVN and JBH have current Algo Engine short signals.

Selling pressure remains steady in these names and we prefer the short side from current levels.

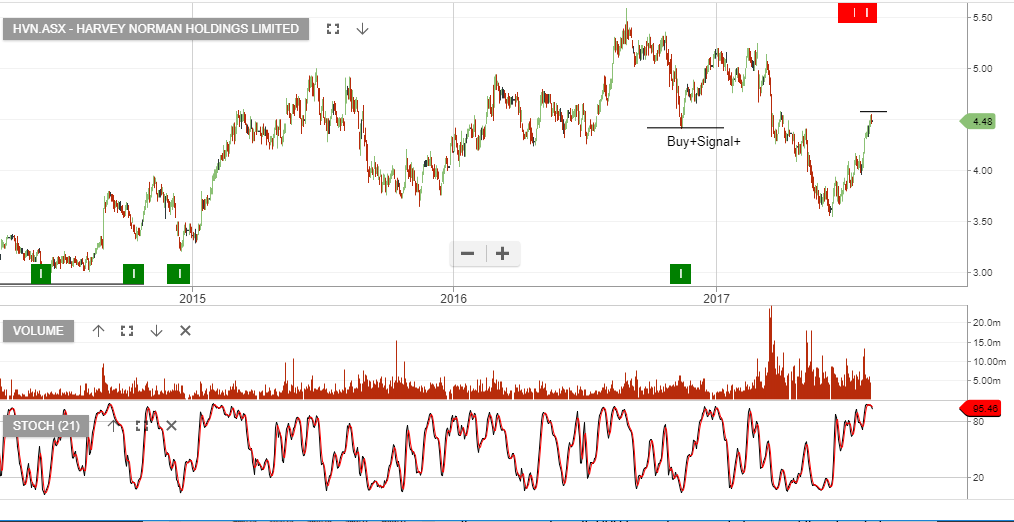

The technical pattern for Harvey Norman started to break-down early this year when the price action traded through the $4.50 support level.

Since then, HVN made a low in June at $3.55 and has now had a counter-trend rally back to $4.50.

Our Algo Engine is now flagging the “lower high” structure and we’ve added HVN to the short trade list with a stop loss above the $4.75 area.

Short term traders may prefer to use the momentum indicators to compliment the entry and stop loss rule.

HVN reports on the the 31st August. The market is looking for NPAT to increase to $377m, (from $337m last year), and DPS up 1 cent to $0.18.

Overly optimistic property revaluations, along with weak consumer trends, concern us and support our bearish view.

Harvey Norman announced a record H1 result after property valuations and strong furniture and appliance sales lifted the company’s net profit by 39% to $257.3 million.

Underlying pre-tax profit rose 20.6% to 290.49 million, which is the highest first-half result in the retailer’s 30-year history.

The company declared an interim dividend of 14 cents (fully franked), which is up 1 cent on the same time last year.

JB Hi-Fi 1H17 earnings results beat expectations driven by strong sales and gross margin expansion.

1H17 underlying NPAT of $125 million represented growth of 32%. Assuming FY17 EPS of $1.87, it places the stock on a forward yield of 4.1%.

Our Algo Engine generated a buy signal in both retail names back in December.

Friday’s US Retail Sales report showed strong demand for automobiles and furniture, providing further evidence that the economy ended the fourth quarter with momentum at the retail level.

The Commerce Department reported that retail sales rose 0.6% in December after increasing by 0.2% in November. Sales were up 4.1% on a year-on-year basis from December 2015 and rose 3.3% for all of 2016 versus 2.3% for all of 2015.

The Core Retail sales figures, which exclude cars, gasoline, building materials and food, rose 0.2% after being flat in November.

The Core Sales data corresponds more closely with the consumer spending component of the GDP and printed below the 0.4% forecast. Despite the smaller gain in Core Retails sales, the consumer spending trend in the US remains solid.

Or start a free thirty day trial for our full service, which includes our ASX Research.