FMG Continues To Look Attractive

Shares of FMG have posted as 6-week high at $4.75 as the Iron Ore miner reaffirmed FY18 shipments of 170 million metric tons.

It’s worth noting the Q4 is typically FMG’s strongest quarter for shipments.

This should continue this year as the company broadens its customer base to include low-grade ore users like India.

We still prefer the long side of FMG and have a medium-term price target of $5.35.

Fortescue Metals Group

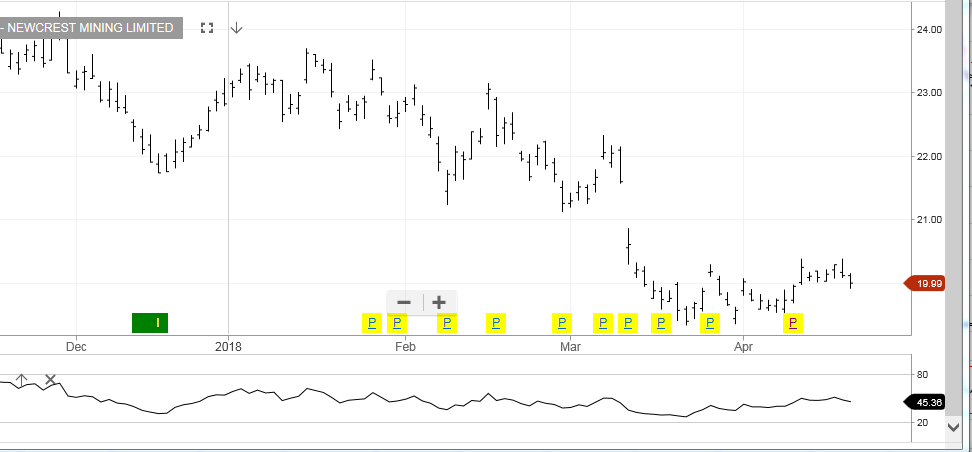

Newcrest Mining

Newcrest Mining Fortescue Metals Group

Fortescue Metals Group Oz Minerals

Oz Minerals

Fortescue Metals Group

Fortescue Metals Group

Fortesque Metals Group

Fortesque Metals Group

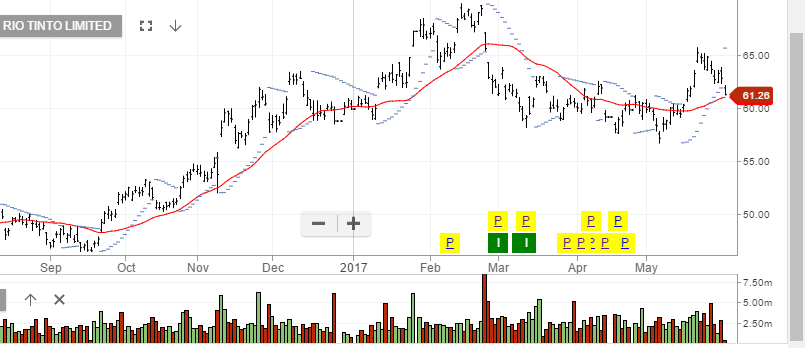

Rio Tinto

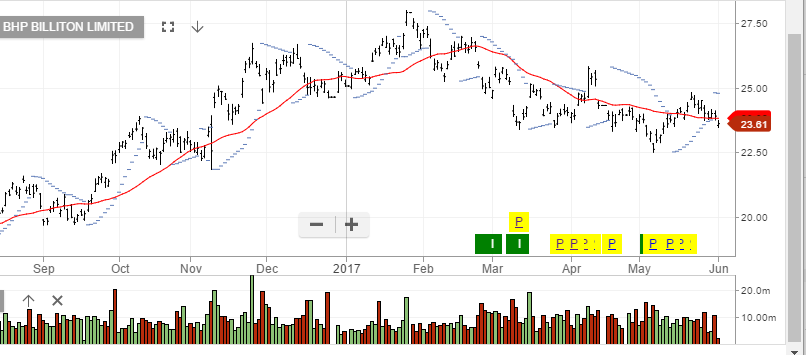

Rio Tinto BHP

BHP