Fortescue Metals – Buy

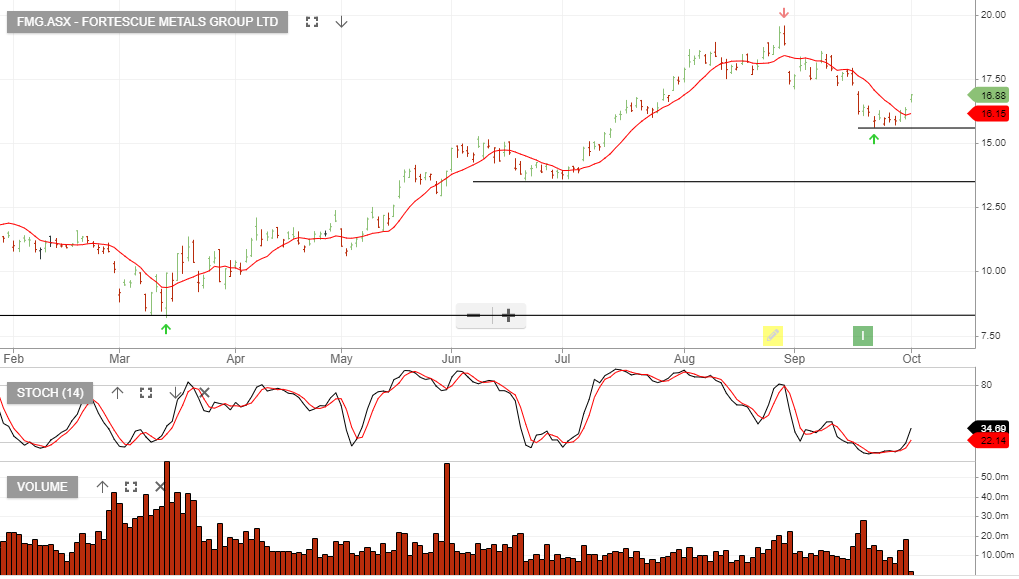

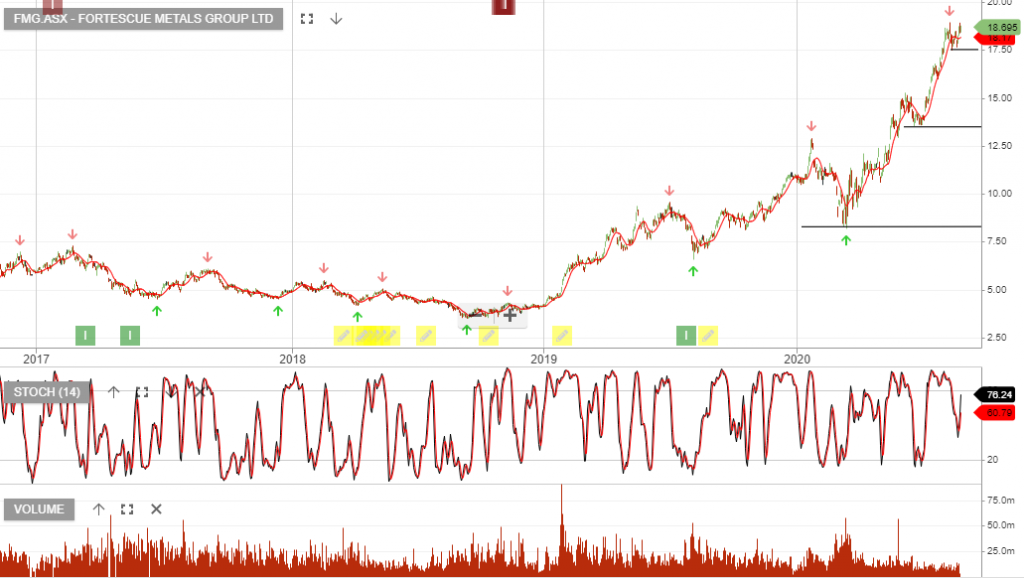

Fortescue Metals Group has been in our model portfolio following the buy signal at $8.30 on 26 July 2019. More recently, we’ve seen another entry opportunity flagged by the Algo Engine at the $15.50 higher low formation.

Fortescue Metals Group has been in our model portfolio following the buy signal at $8.30 on 26 July 2019. More recently, we’ve seen another entry opportunity flagged by the Algo Engine at the $15.50 higher low formation.

Fortescue Metals Group has been in our model portfolio following the buy signal at $8.30 on 26 July 2019. More recently, we’ve seen another entry opportunity flagged by the Algo Engine at the $15.50 higher low formation.

FMG has rallied from the higher low and the short-term indicators continue to trend higher.

Fortescue Metals Group has been in our model portfolio following the buy signal at $8.30 on 26 July 2019. More recently, we’ve seen another entry opportunity flagged by the Algo Engine at the $15.50 higher low formation.

FMG has rallied from the higher low and the short-term indicators continue to trend higher.

Fortescue Metals Group is under Algo Engine buy conditions. Buying support is likely to build at $15.50.

Fortescue Metals Group is under Algo Engine buy conditions. Buying support is likely to build at $15.50.

Fortescue Metals Group is under Algo Engine buy conditions. Buying support is likely to build at $15.50.

Fortescue Metals Group has been in our ASX model portfolios since July 2019 with multiple buy signals since. We are again presented with another reminder of the opportunity to accumulate FMG.

Fortescue Metals Group is under Algo Engine buy conditions and is among the best-performing holdings within our ASX 100 model portfolio.

FY20 revenue was up 27% to $13bn and EBIT was in line with consensus at US$8.3bn, up 38% on the same time last year.

Forward dividend yield is 4.8%, plus any special dividends announced in FY21.

Fortescue Metals Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

The FY19 earnings result was solid with underlying EBITDA US$6b, the strong result helped to drive down net debt to US$2.1b which reflects a gearing ratio of 16%.

A final dividend of A$0.24 was declared, lifting the full-year payment to

A$1.14, translating to a yield of 16%.

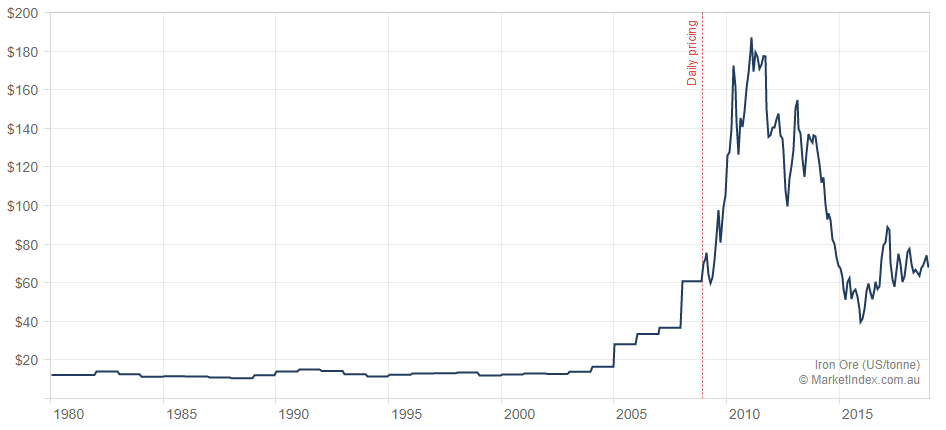

Volatility in spot iron-ore prices continues to be a key driver of the share price. Iron ore futures are now trading at their lowest price in more than six months.

Note: RIO at $83 is now on our watchlists and we suggest tracking the short-term indicators for a reversal higher.

FMG

RIO

Spot iron ore prices have rallied in the past days on the news of a second catastrophic tailings dam failure at a Vale-owned mine in Brazil.

Exceptions of reduced supply impacting the market, has driven up short term spot prices. Although, Iron Ores prices have been on a steady climb since the November low.

Long-term Iron Ore price chart.

We remain cautious of a potential pullback in RIO, BHP and FMG following the run up in prices and Algo Engine sell conditions.

Our preference continues to be in the energy names with OSH and WPL our core exposures.

Or start a free thirty day trial for our full service, which includes our ASX Research.