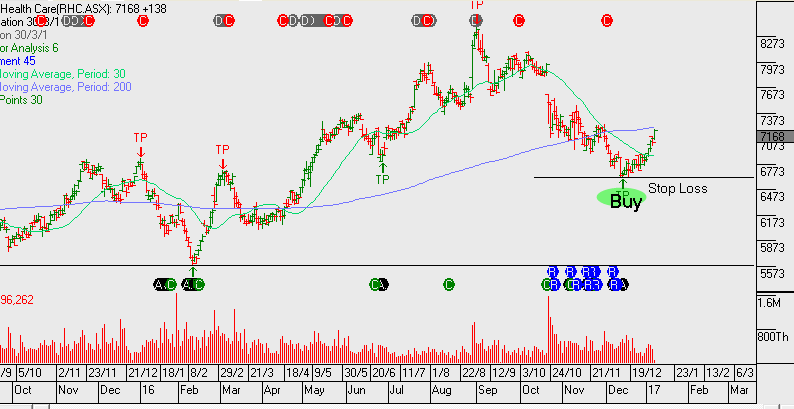

Healthcare Algo Buy Signals

At this point in the market we prefer healthcare names as a sector allocation for new money. Here are the recent buy signals generated by our Algo Engine.

With SHL, CSL and ANN we’ve added covered calls to boost the annualised cash flow to over 10%, whilst still allowing for capital growth if exercised at the strike price of the sold call.