CSL – Buy

CSL is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

CSL is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

CSL is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

CSL is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Buy CSL

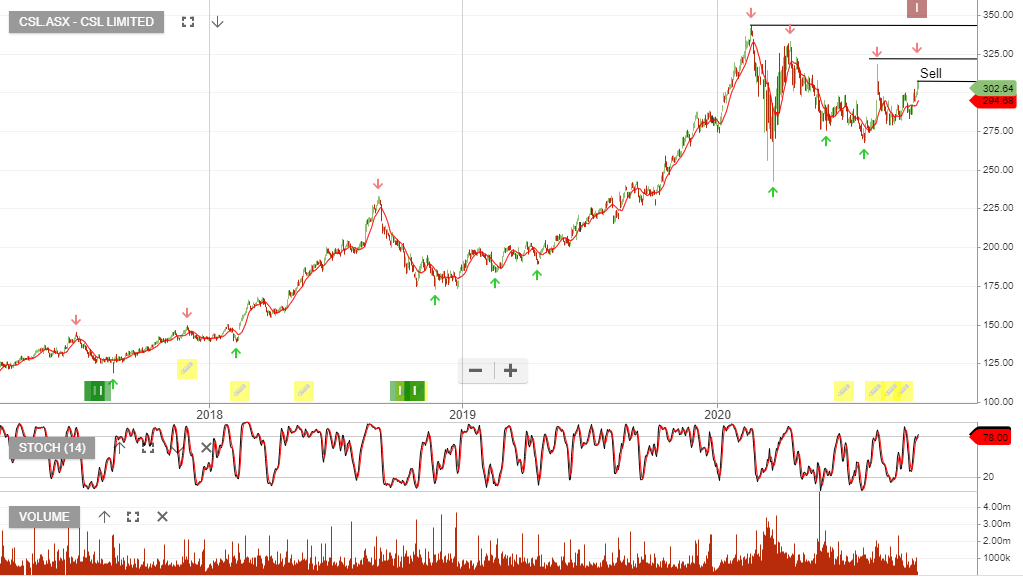

CSL has now shifted to sell conditions after being in our model portfolios since May 2015. With dividends, the stock has increased by 250%.

CSL has raised its full year profit guidance to between 3% – 8%, despite warnings of higher plasma costs. The lower end of guidance had previously been zero.

Full-year FY21 is now expected to be between $2.2bn and $2.26bn. We continue to see reliable earnings growth for CSL, however, the 40x multiple may prove to be too rich in the short-term.

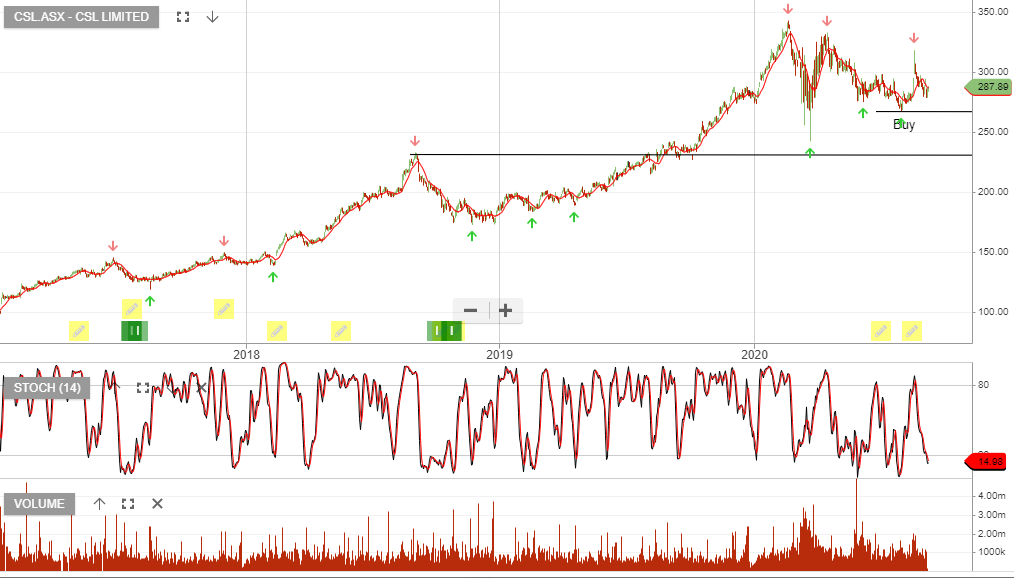

Buy CSL

CSL is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

CSL & the Australian Government signed a Heads of Agreement to supply 51mn doses of the University of Queensland’s COVID-19 vaccine.

CSL & AstraZeneca also signed a Heads of Agreement for manufacture & distribution of 30mn doses of AZN’s COVID-19 vaccine (AZD1222).

We expect EPS to increase by 8 – 10% in FY21 and FY22. This supports a forward dividend yield of 1.1%.

Buy CSL within the $265 – $280 support range.

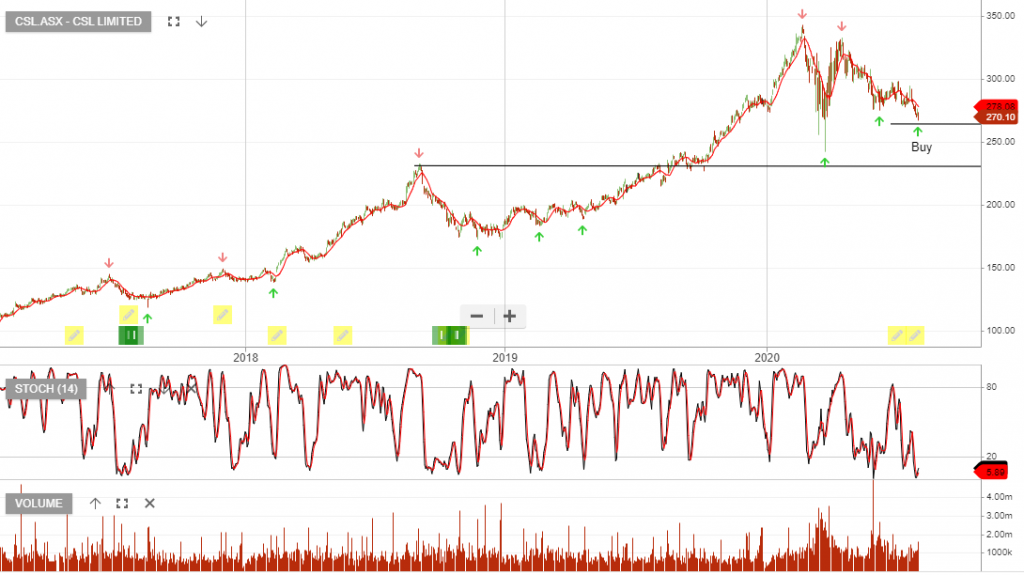

CSL is under Algo Engine buy conditions and remains one of the best-performing stocks in our ASX model portfolios.

The technical indicators show the recent higher low formation with support at $270.

CSL is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

CSL is one of the best performing stocks within the ASX20, ASX50 and ASX100 model portfolios.

Since being added in May 2015 the share price is up 113% including dividends.

The recent retracement in the share price provides another opportunity for investors to add CSL to their portfolios.

CSL

Or start a free thirty day trial for our full service, which includes our ASX Research.