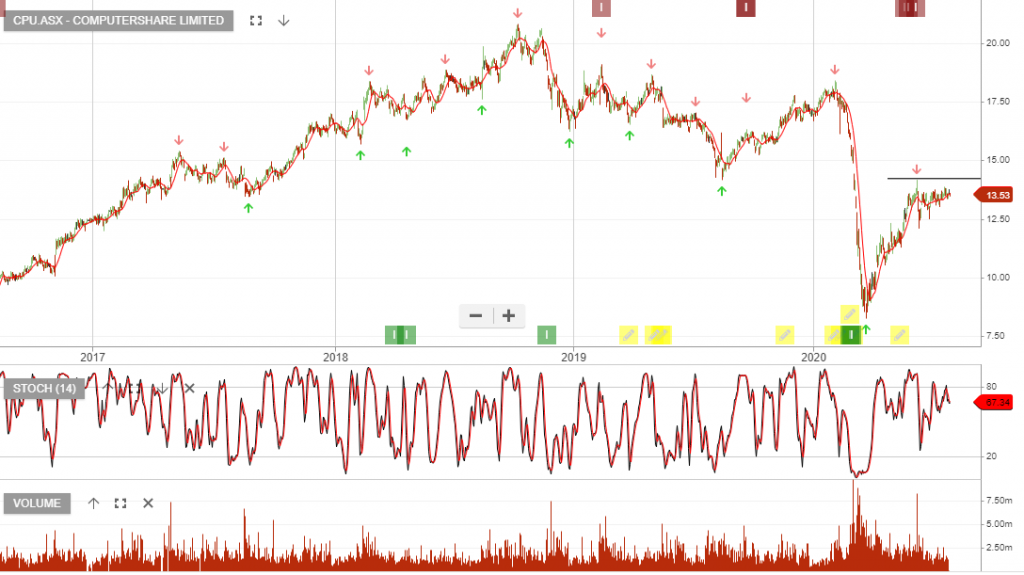

Short Trade: CPU

Computershare is a short trade from our ASX 50 Pivot Table.

Computershare – 1H21

Computershare is under Algo Engine buy conditions and we’re somewhat pleased to see the 1H21 earnings down less than originally forecast.

A fall of 8% on the same time last year is still hardly inspiring and we, therefore, remain concerned about the lack of growth drivers for the business.

CPU remains under review.

Computershare – Algo Review

Computershare is under Algo Engine buy conditions following the signal on 21 Sept 2020 with an entry price of $11.95.

We now see CPU trading at $13.00 and draw your attention to the higher low, and the positive short-term indicator trends.

Buying momentum is building above the $12.80 support level. Apply a stop loss on a break below $12.50.

.

and we see price support

Computershare

Computershare FY20 earnings are in-line with guidance, down 20% on the same time last year.

What’s now concerning is FY21 guidance has been downgraded and management is now forecasting a further 10% decline next year.

We remain negative on the CPU outlook and retain our “short” exposure.

Computershare – Sell

Computershare is under Algo Engine sell conditions and we see increasing selling pressure due to a weak earnings outlook.

Risks remain elevated coming into the next earnings release.

Computershare

Computershare is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see buying support at $11.00.

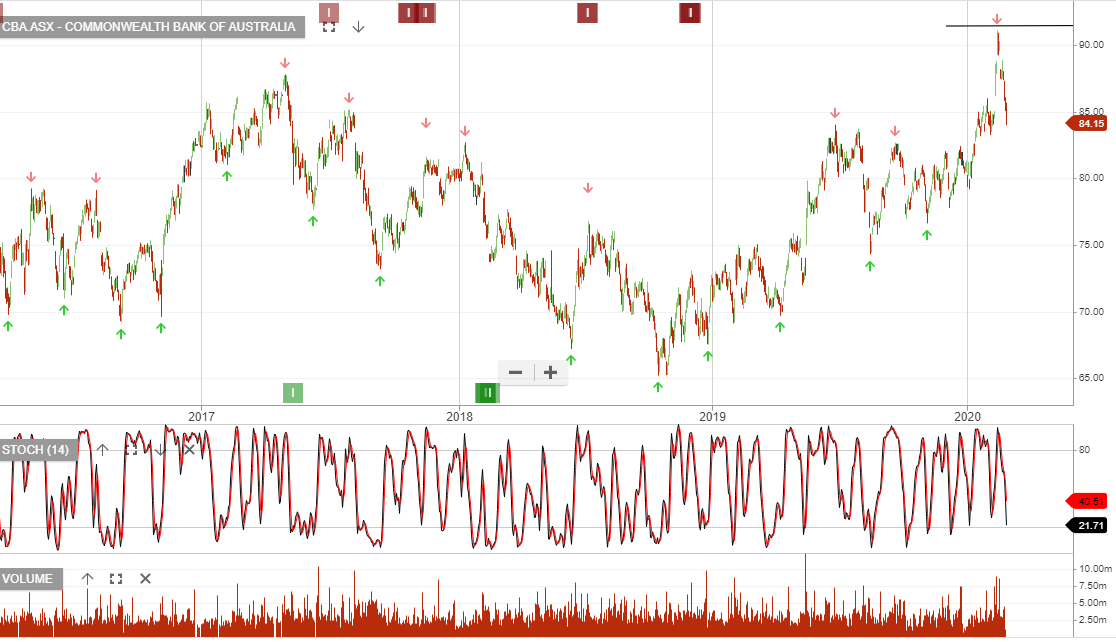

CBA & CPU – Time to Cover the Shorts

Our short positions in Commonwealth Bank of and Computershare have now switched to Algo Engine buy conditions and we can see approaching support levels in the charts.

CPU at $14 – cover short exposure

CBA at $77 – cover the short exposure.

Short “High Conviction” Ideas Revisited

Over the past month, we’ve focused on a handful of short positions. Commonwealth Bank of, Computershare, Perpetual, Platinum Asset Management and IRESS.

We continue to see weakness across these names.

Computershare – Earnings Downgrade

Computershare has been on our “high conviction” shortlist for the past few months and today’s 1H20 earnings result helps to support our bearish case.

EPS fell 17% on the same time last year. Lower margin income, weaker corporate actions and pressure in the UK mortgage business all weighed on earnings.

We’re skeptical of the company’s reassurance that 2H earnings will improve.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.