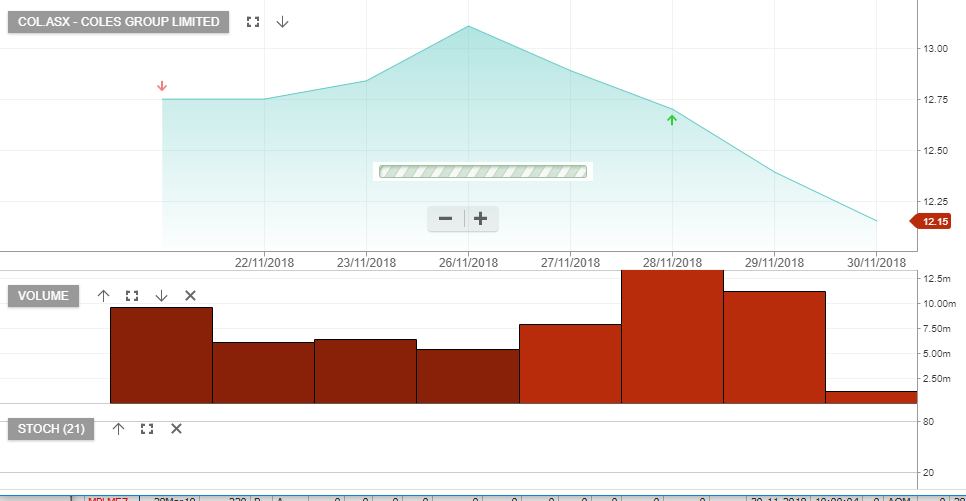

Coles – Algo Buy Signal

Coles Group is under Algo Engine buy conditions and is now a holding in our ASX 100 model portfolio.

FY19 profit fell 9% to $1.43b, which was down from $1.58 the previous year.

The company declared a final dividend of $0.24 and a special dividend of $0.115.

We see support for the share price at $13, underpinned by the extensive cost-cutting program announced in the last quarter. Target cost savings over the next 3 – 5 years exceed $1 billion dollars.