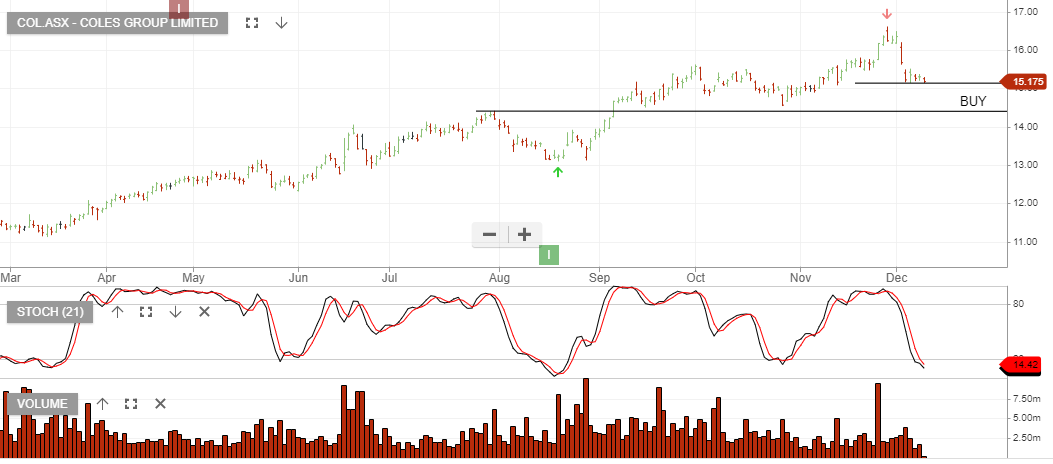

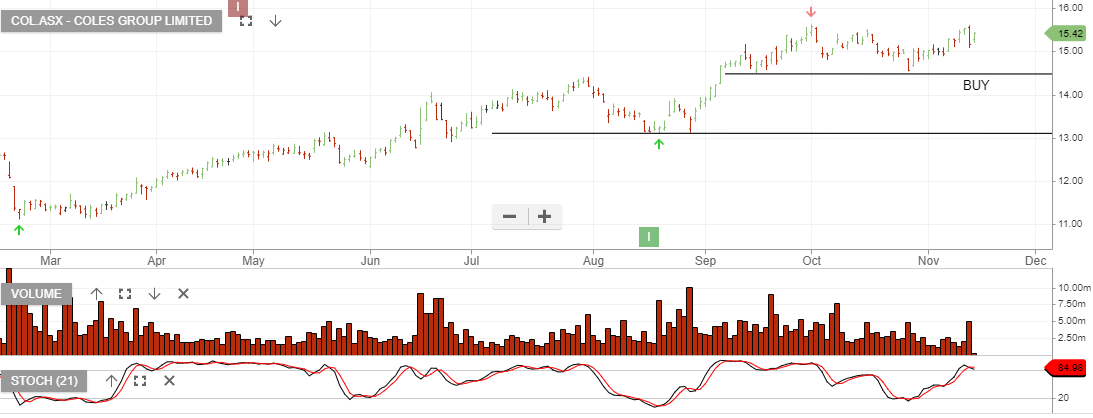

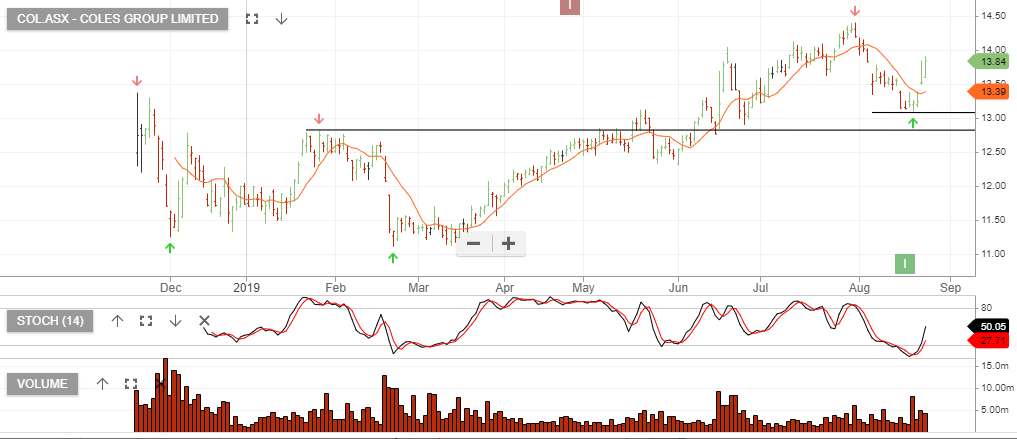

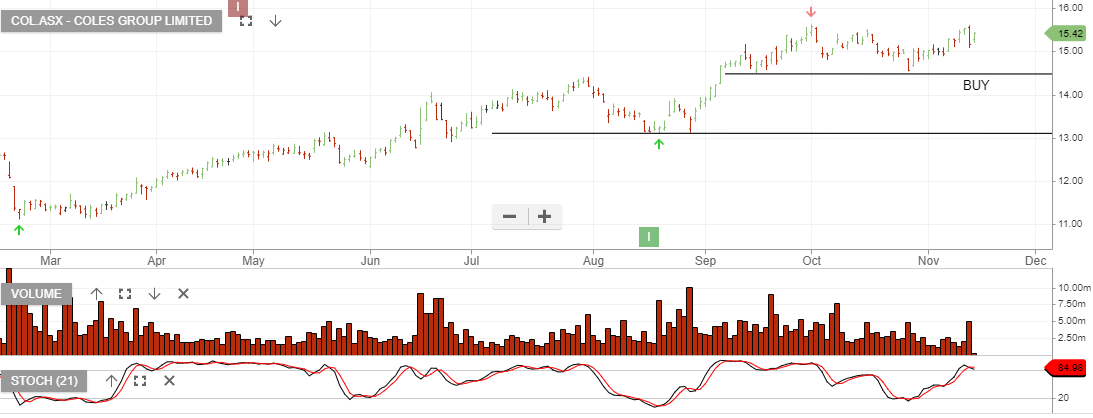

Coles Group is under Algo Engine buy conditions and is a current holding in the ASX 100 model portfolio.

1Q sales results are tracking in line with guidance and we continue to see a relatively flat revenue and profit growth outlook for the Coles business.

FY20 revenue $39bn, EBIT $1.2bn and reported profit forecast is around $830mn. This places the stock on a forward yield of 3.2%, which looks like full value.

Adding an out-of-the-money covered call will help boost the cash flow returns to almost 10% per annum. For more detail on the strategy, please call our office on 1300 614 002.

laches

laches