CIM – An Important Price Range

CIMIC is likely to deliver 10%+ EPS growth over the 2 to 3 years.

The industry backdrop remains supportive and we encourage our readers to set an alert for a retracement in CIM back below $48.00.

Cimic

CIMIC is likely to deliver 10%+ EPS growth over the 2 to 3 years.

The industry backdrop remains supportive and we encourage our readers to set an alert for a retracement in CIM back below $48.00.

Cimic

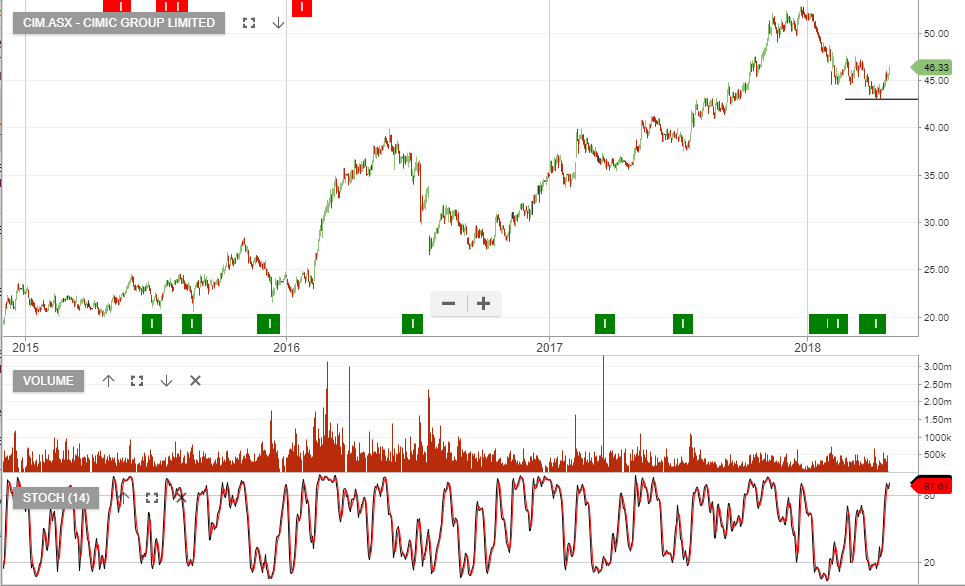

From our Monday “opportunities in review” webinar, CIMIC was a high conviction buy idea heading into earnings season.

The strong share price reaction to last week’s 1H profit announcement sent CIMIC shares 20% higher.

The result came in ahead of analysts forecast with revenue growth and profit growth of more than 10%.

1H Revenue +11% to $6.9 billion, EBITDA of $794 million +11% and NPAT $363 million +12% and on the same time last year.

Whilst the stock price now looks full value based on a forward yield of 3.3%, we continue to like the longer-term fundamentals.

Cimic Group

Shares of CIMIC Group have spiked over 10% higher to reach a 5-month high of $47.50 in early trade.

The company’s H1 2018 results showed an increase of FY 18/19 earnings in the 3% range and a 10% increase in revenue growth specifically in their construction business.

Our ALGO engine triggered a buy signal in CIM at $41.15 on March 9th and the stock was added to our ASX Top 100 portfolio on June 27th at $35.00.

We see the next resistance level in the $48.75 range. CIM goes ex-dividend for 70 cents on September 12th.

Cimic Group

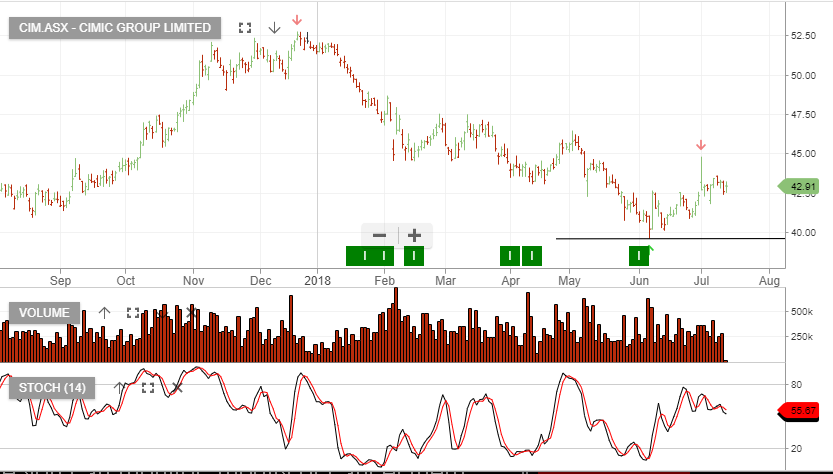

Our Algo Engine generated a buy signal recently in CIMIC and we’re encouraged by the buying support which developed around the $40.50 level.

We continue to have a favorable outlook on the fundamental earnings backdrop for CIMIC and we expect next Thursday’s earnings announcement to further support the share price.

CIMIC goes ex-div $0.60 on the 12th September.

Shares of Cimic Group continue to build on last week’s gains in the lead up to next week’s Half-yearly earnings report.

Since posting an intra-day low of $39.60 on June 6th, the share price has risen over 9%.

Our ALGO engine triggered a buy signal on June 1st at $40.73 and CIM is part of our ASX Top 100 Model Portfolio.

Next week’s report is expected to show NPAT at $341 million and a 62.4 cent DPS.

Daily price charts point to a medium-term target near $46.40.

Cimic Group

Shares of Cimic Group have started the week over 4% higher and have reached a 2-month high of $44.75 in early trade.

Investors are reacting to the recent news that CIM was awarded a 4-year, $480 million contract by QCoal to continue mining services operations at QCoal’s Bowen Basin Mines.

Our ALGO engine triggered a buy signal for CIM on June 1st at $40.73 and the stock has been part of our ASX Top 100 portfolio since June of 2016.

From a technical perspective, we see solid support near $42.50 with an initial upside target at $47.50.

Cimic Group

Our Algo Engine triggered a buy signal in CIMIC at $40.62. We suggest accumulating the stock within the $4.1.50 to $42.50 range.

CIMIC went ex-dividend $0.75 on the 13th of June.

The next share price catalyst will be the half year profit results due to be announced on the 2nd of July. The market is looking for NPAT to be around $350 million.

CIMIC

Shares of Cimic are down over 2% to $40.85 in early trade as the company goes ex-dividend today.

This drop is a few cents deeper than than the 75 cent dividend that will be paid to shareholders on July 4th.

CIM was added to our ASX Top 100 portfolio in June of 2016 at $35.00.

CIM has been a steady performer in client portfolios over the last two years and we will look to add to long positions on a pull back into the $40.20 area.

Cimic

Our Algo Engine triggered a recent buy signal in CIMIC and we’ve been highlighting the buying support at $44.50.

The upside price range is $48 to $51.

CIMIC goes ex-div $0.75 on the 13th June.

CIM

CIM

Our Algo Engine triggered a buy signal in CIMIC Group and with the stock price finding support at $44, we recommend investors add long exposure. Our upside price target is $48 – $50.

Or start a free thirty day trial for our full service, which includes our ASX Research.