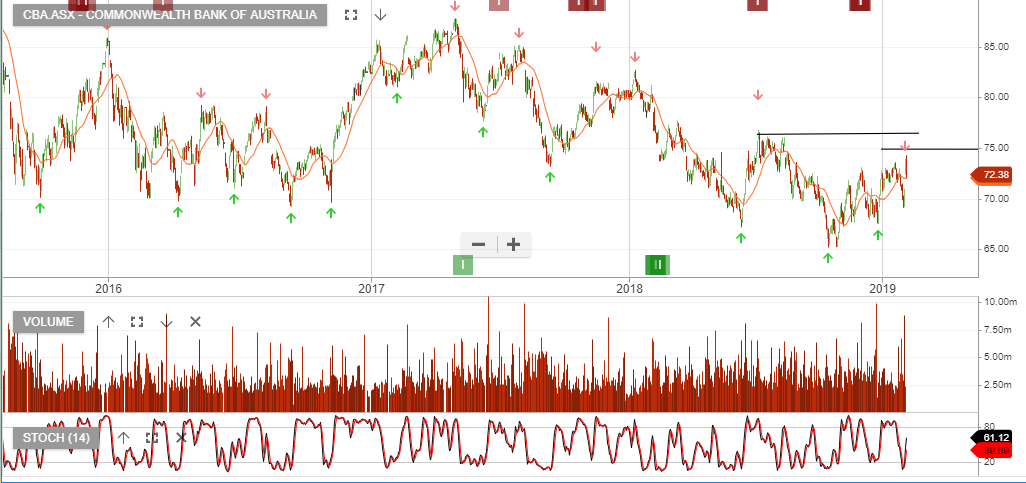

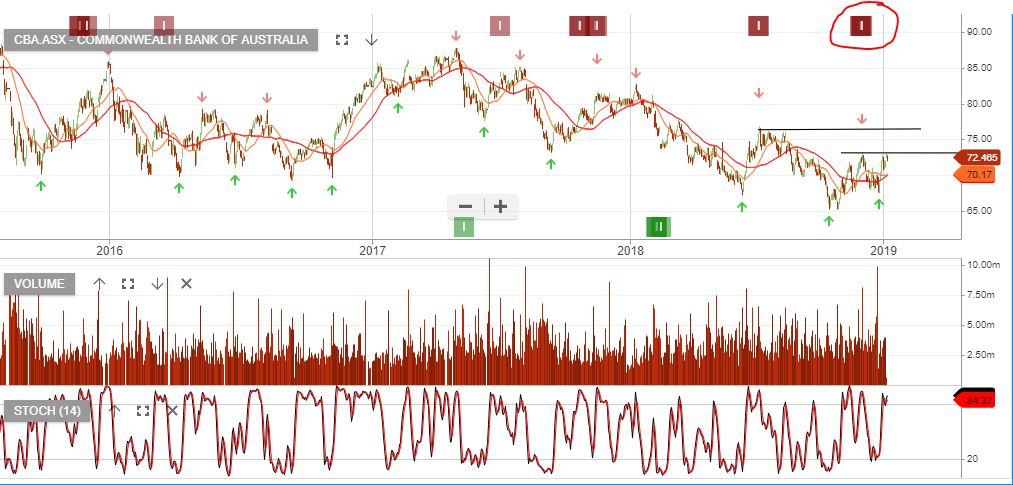

Our Algo Engine triggered sell signals across the domestic banking names back in June.

Since then, on average, the group has sold off approximately 15% and on a 2-year basis, the sector is now down more than 30%.

ANZ announced this week, that its 2H18 cash earnings will be adversely impacted by $711m of after-tax charges related to legal costs and customer remediation from the Royal Commission.

ANZ releases their full-year NPAT on October 31st.

A second sector risk yet to play-out, is the potential for deteriorating credit quality. This risk has been exacerbated over recent years by “add backs”, where short term earnings are improved through lowering the provisions for bad loans.

Looking ahead, CBA chief Matt Comyn will face the royal commission on Thursday morning, followed by WBC’s Brian Hartzer Thursday afternoon and ANZ’s Shayne Elliott on Friday.