CBA – Algo Sell Signal

Commonwealth Bank of is under Algo Engine sell conditions. We remain concerned about the declining profitability in retail banking.

Commonwealth Bank of is under Algo Engine sell conditions. We remain concerned about the declining profitability in retail banking.

Commonwealth Bank of is under Algo Engine sell conditions. We remain concerned about the declining profitability in retail banking.

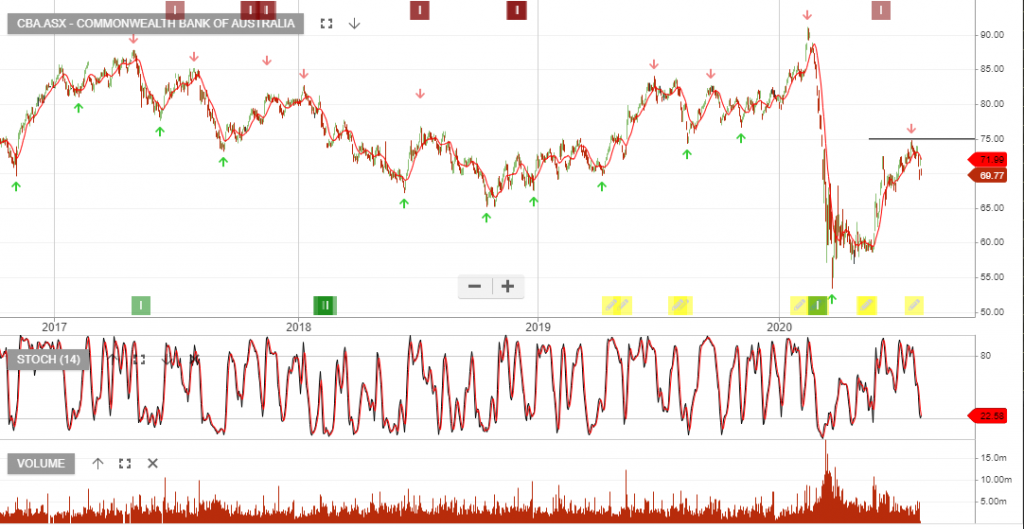

Commonwealth Bank of remains under Algo Engine sell conditions.

1Q21 earnings of $1.8bn were down 16% on the same time last year. CBA’s operational performance in 1Q21 does not justify the premium it is trading on versus peers.

Our preferred exposure to banks is through the BetaShares Global Banks

Commonwealth Bank of remains under Algo Engine sell conditions and the only Australian Bank in our model is Westpac.

CBA trades almost 20x forward earnings which is a 30%+ premium to the other major banks.

Our deep value recovery play is the BNKS ETF which captures a broader global exposure.

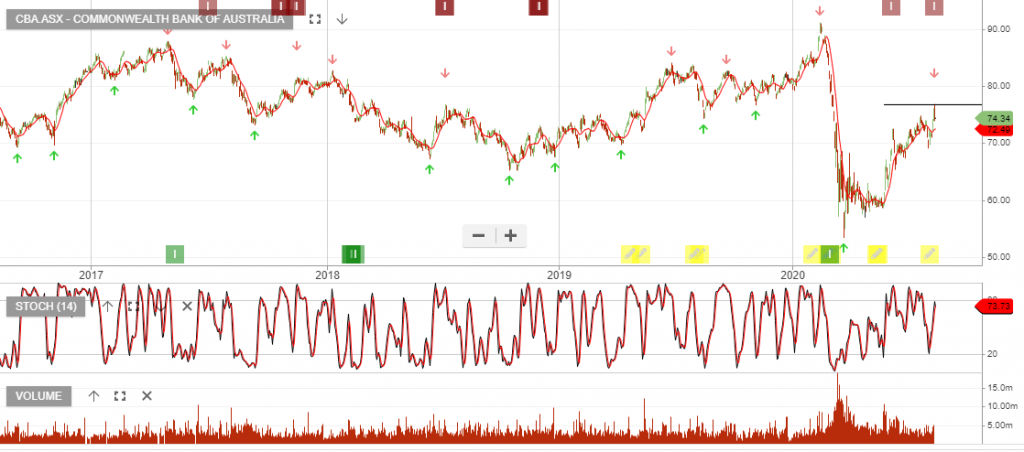

Commonwealth Bank of remains under Algo Engine sell conditions and we see resistance building near the $74 price level.

CBA reports FY20 earnings on 12 August, at which time the market will focus on CBA’s dividend and any capital management commentary. Consensus expectations are for earnings to be $7.8bn, (down 10% on 2019 numbers), and the 2H20 dividend to be cut by 50%.

We remain on the short side of the CBA trade.

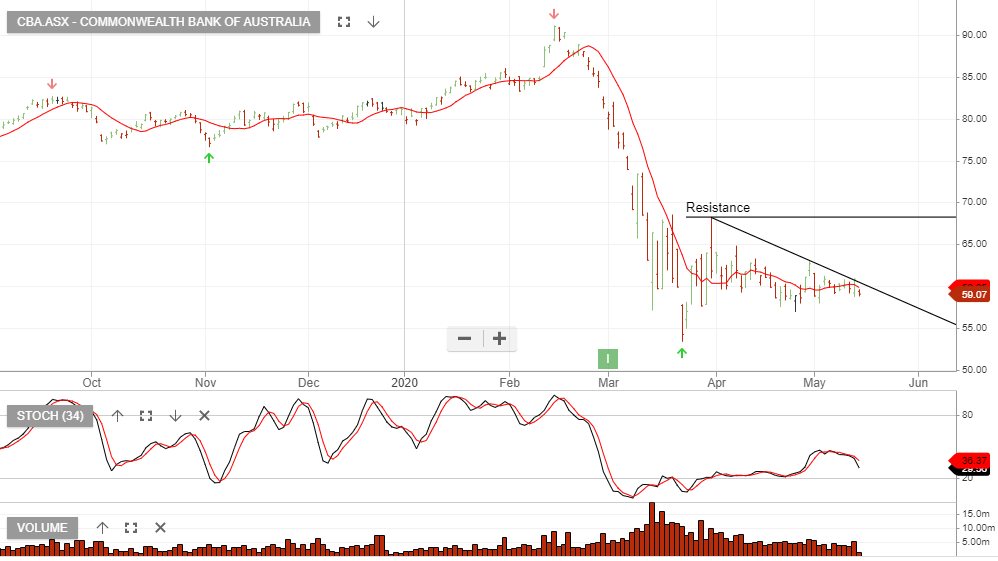

We remain cautious on the banks and feel the trough in the share price may be two to three months out from now, at which point a good long-term buy opportunity will be in place.

Short term we continue to watch CBA track below the downsloping resistance.

Commonwealth Bank of Australia – unaudited cash profit fell 23% in the three months ended March 31 to $1.3 billion from $1.7 billion in the year-earlier.

CBA has provisioned $1.5 billion for COVID-19 provisions.

The below graph provides a picture of the trend that short-term traders may be interested in.

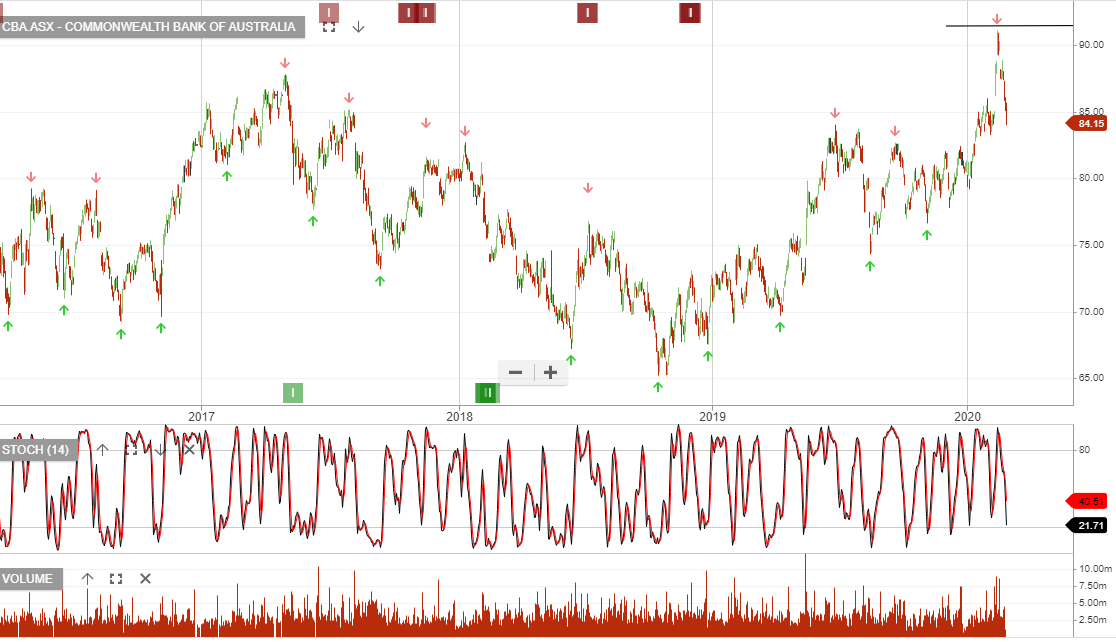

Our short positions in Commonwealth Bank of and Computershare have now switched to Algo Engine buy conditions and we can see approaching support levels in the charts.

CPU at $14 – cover short exposure

CBA at $77 – cover the short exposure.

Over the past month, we’ve focused on a handful of short positions. Commonwealth Bank of, Computershare, Perpetual, Platinum Asset Management and IRESS.

We continue to see weakness across these names.

Commonwealth Bank is priced for a strong result on February 12, so the potential for disappointment is high. The stock remains under Algo Engine sell conditions and despite the prospect of a $2.5bn on market share buy-back, we remain on the short side of the stock.

CBA has re-rated to a P/E multiple of 17x and a dividend yield of 5%.

Or start a free thirty day trial for our full service, which includes our ASX Research.