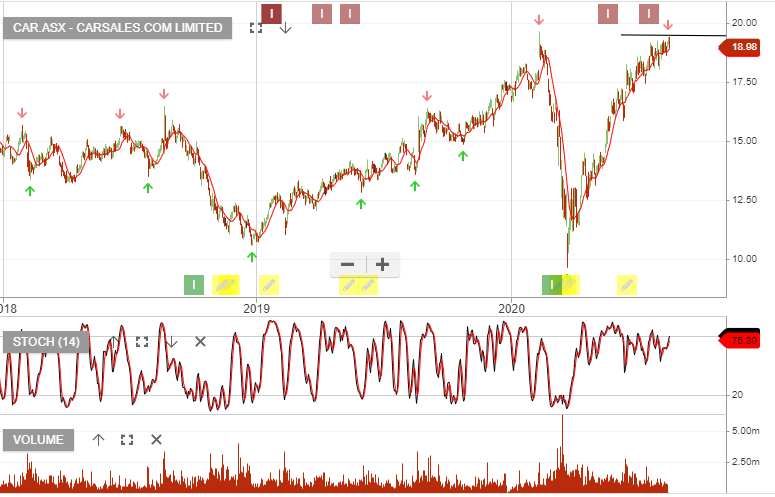

Carsales – Algo Buy

Carsales.Com is under Algo Engine buy conditions and is a current holding in our model portfolio.

Carsales.Com is under Algo Engine buy conditions and is a current holding in our model portfolio.

Carsales.Com is under Algo Engine buy conditions and is a current holding in our model portfolio.

Carsales.Com is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio. The stock is up 14% since being added in December 2020.

1H21 result with adjusted EBITDA of $125 is up 16% on the same time last year. With the stock trading on 30+PE, the short-term upside is limited.

Forward yield into FY22 now stands at 2.6%, which is supported by 10%+ EPS growth.

Carsales.Com is under Algo Engine buy conditions and is a current holding in our model portfolio.

Since being added on 11 Dec the stock is now up 5.5%.

Carsales.Com is under Algo Engine buy conditions and now been added to our ASX 100 model portfolio.

Carsales.Com is under Algo Engine buy conditions and is now a new holding in our ASX 100 model portfolio.

Carsales.Com is now under Algo Engine sell conditions which reflects the short-term overbought conditions.

Carsales.Com is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see value emerging and suggest buying at market and running a stop loss at $9.50.

Carsales.Com is under Algo Engine buy conditions and we suggest members add the stock to their watch lists and look for support to develop within the $11.00 to $12:00 price range.

Carsales.Com is under Algo Engine buy conditions and we see support building near the $15.50 price level.

Buy CAR at $15.50

Or start a free thirty day trial for our full service, which includes our ASX Research.