BXB – EBIT Should’ve Been Over $1 Billion

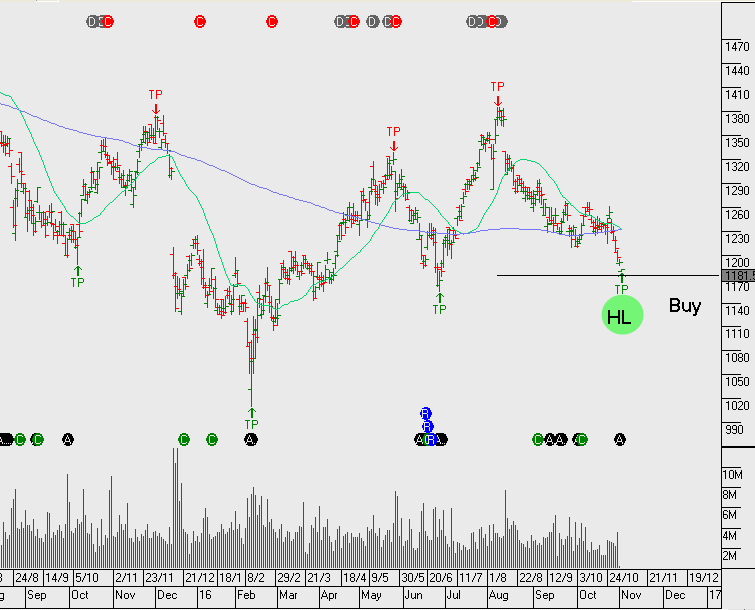

While BXB’s 1H17 result overall was below market expectations, the outlook for flat earnings growth in FY17 was much weaker than expected. FY17F EBIT was down 6% to US$950m.

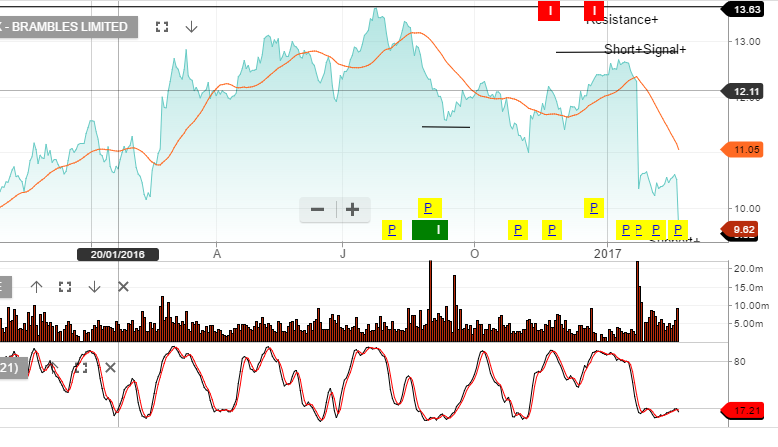

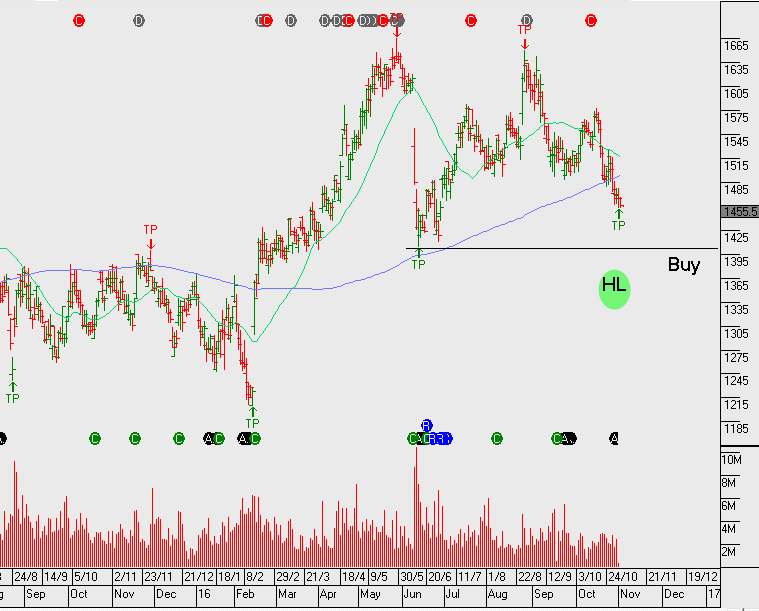

The market was looking for stable EPS growth supporting an EBIT range of $1b – 1.1B over the next 12 to 24 months. The $950 million figure is a substantial miss and the new consolidating share price range for BXB is now $9.25 to $11.00.

Setting the covered call strategy at a more aggressive level will help to drive returns here, we look to lower the call strike and see $10.25 calls as an effective level.