Bluescope 1H22 Earnings

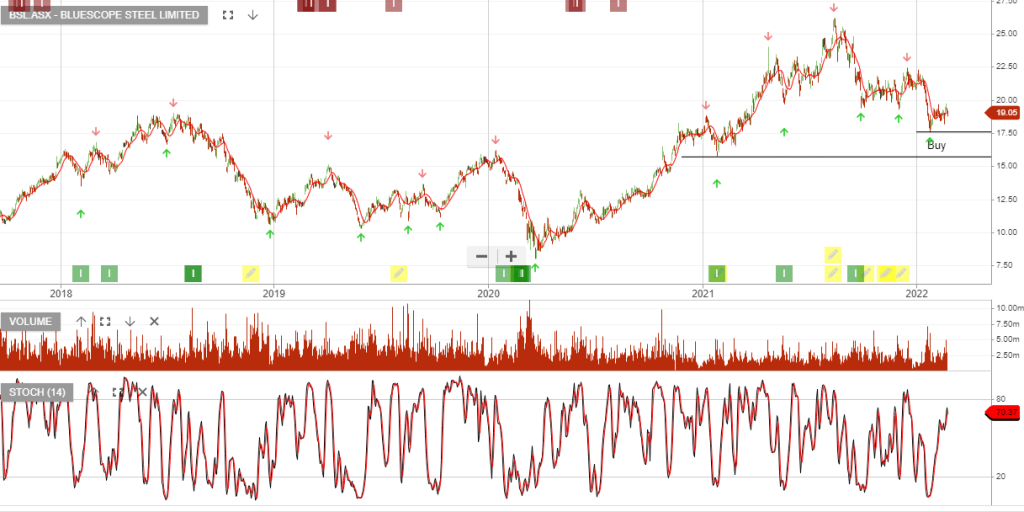

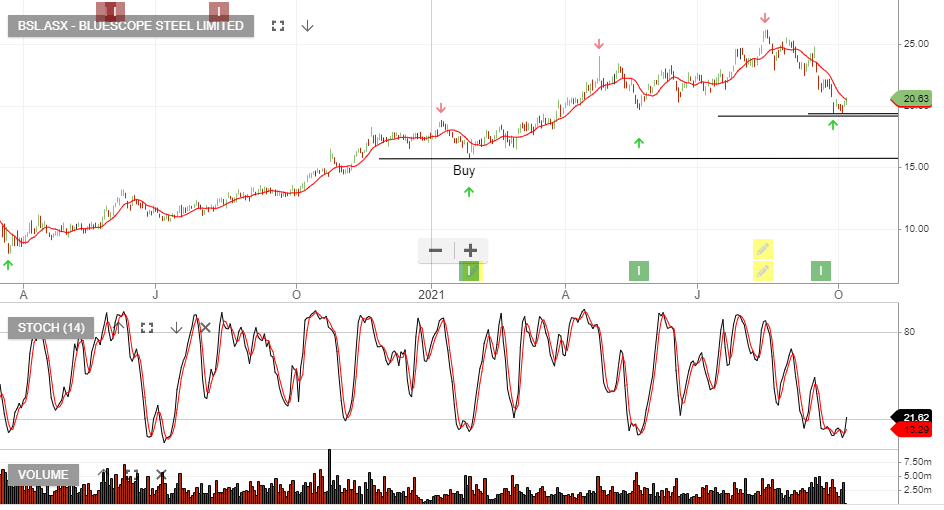

BlueScope Steel is under Algo Engine buy conditions.

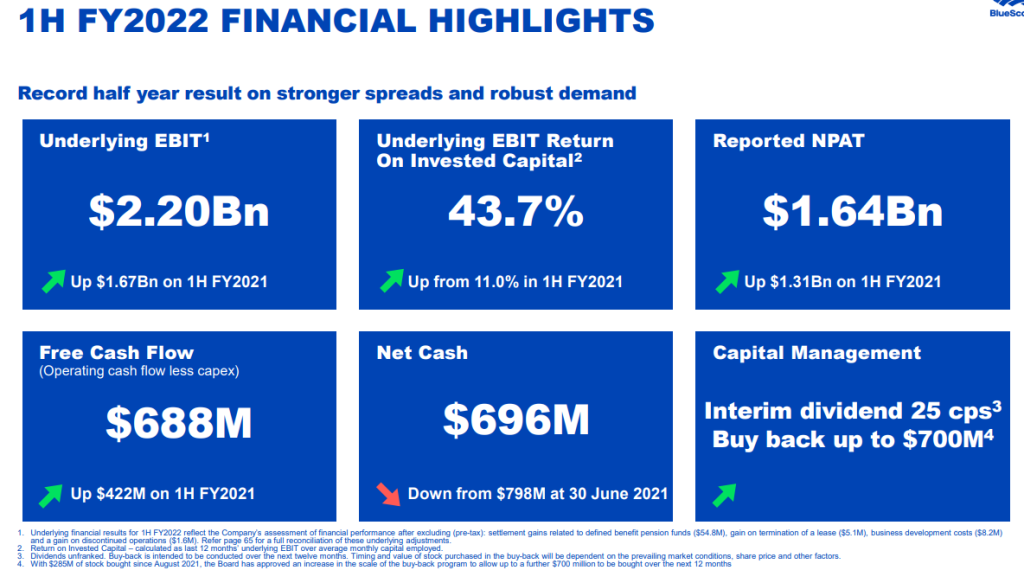

With $285M of stock bought since August 2021, the Board has approved an increase in the scale of the buy-back program to allow up to a further $700 million to be bought over the next 12 months

BlueScope delivers record underlying EBIT of $2.20Bn, increases on-market buy-back; commences feasibility, analysis on blast furnace reline at Port Kembla

1H FY2022 Headlines

Reported NPAT: $1.64Bn

Underlying NPAT: $1.57Bn

Underlying EBIT: $2.20Bn

2H FY2022 GROUP OUTLOOK: Underlying EBIT in 2H FY2022 is expected to be in the range of $1.20 billion to $1.35 billion.