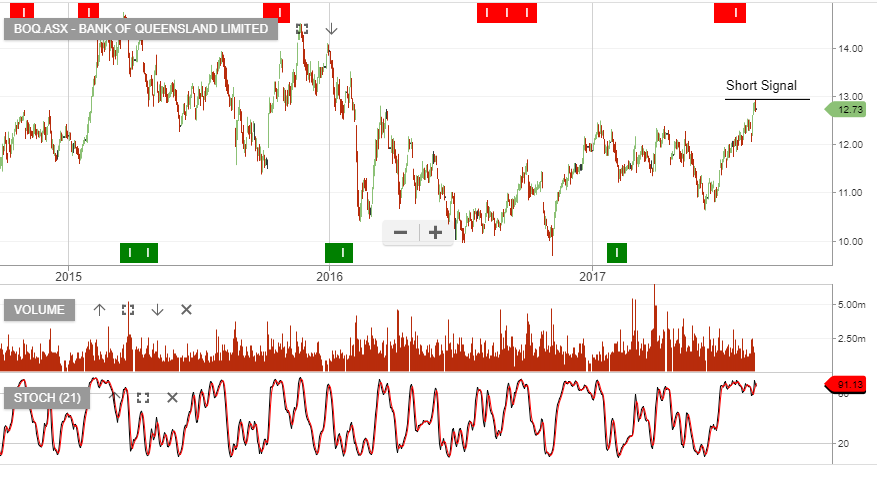

BOQ Shares Reverse Lower

Shares of BOQ have given back all of yesterday’s gains as CEO Jon Sutton warned of industry headwinds, regulatory uncertainty and increased scrutiny of banking fees.

Mr Sutton also pledged to improve its complaint resolution protocol after the Financial Ombudsman Service said the bank had topped the list as Australia’s worst offender for disputes for home loan customers for the fourth consecutive year.

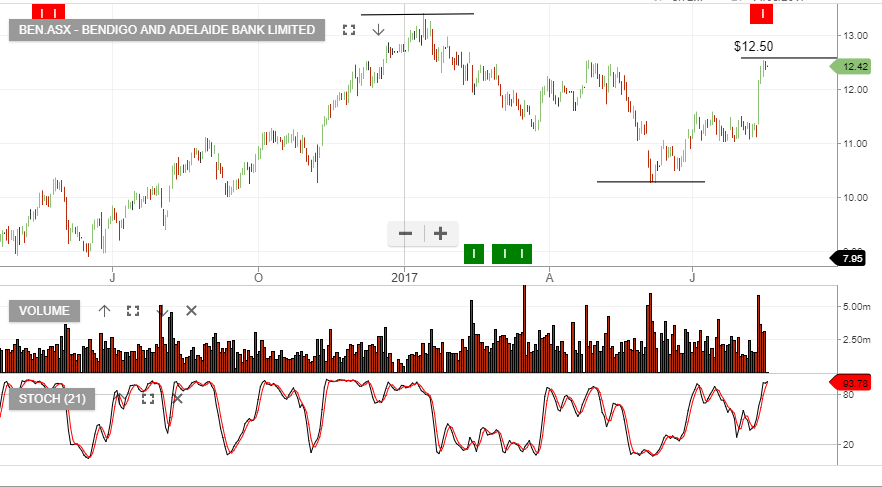

BOQ shares are currently down 1.75% at $12.83. Technically, we see the next area of support near the $12.25 area.

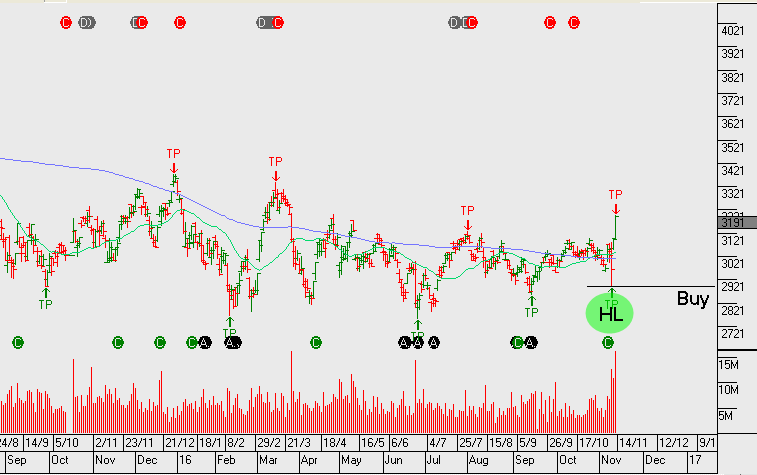

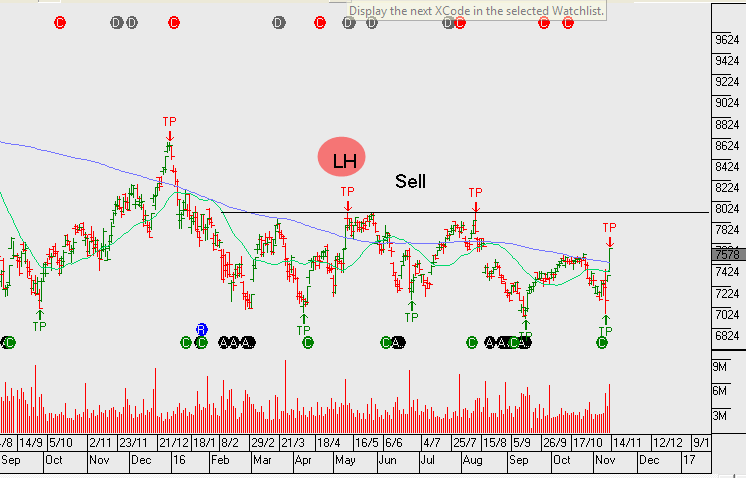

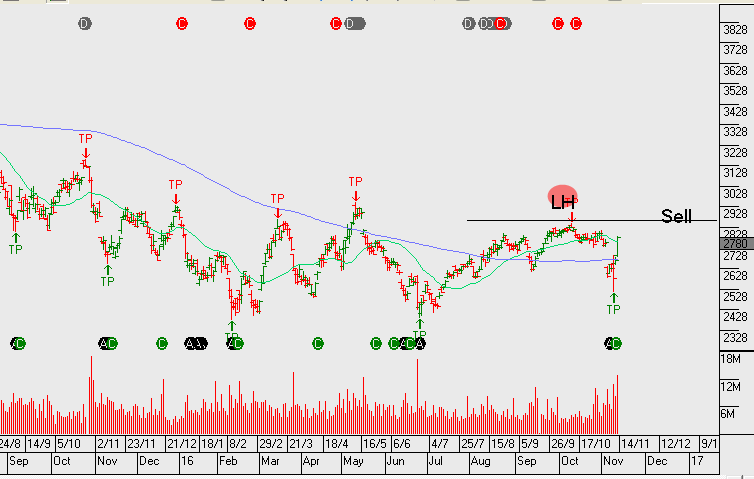

Bank of Queensland

Bank of Queensland

Bank of Queensland

XJO

XJO BOQ

BOQ Bendigo

Bendigo