BHP & RIO – Algo Signals

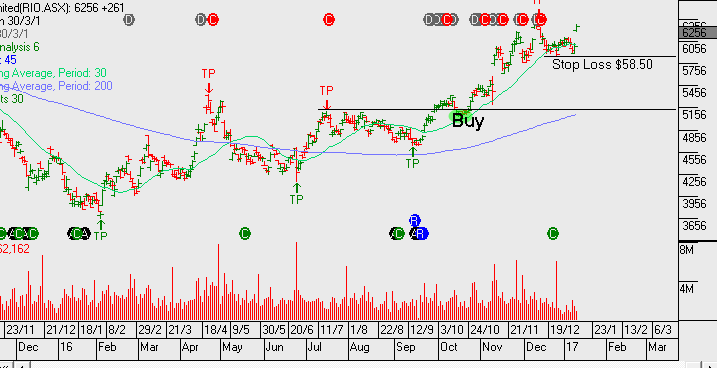

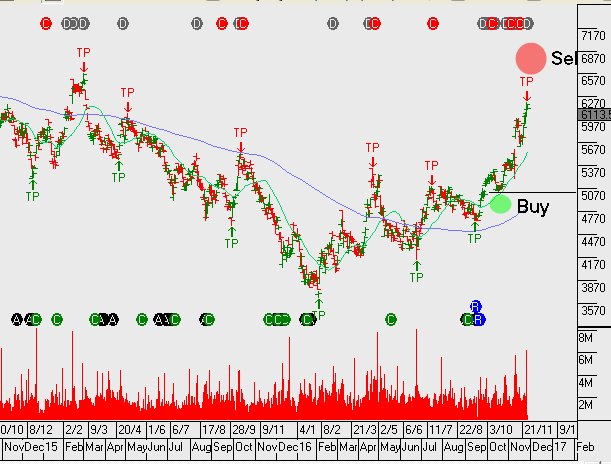

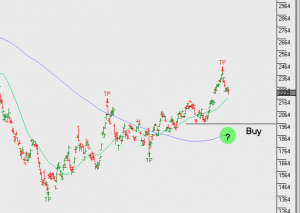

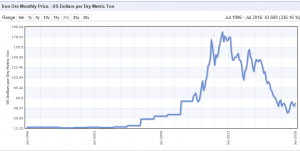

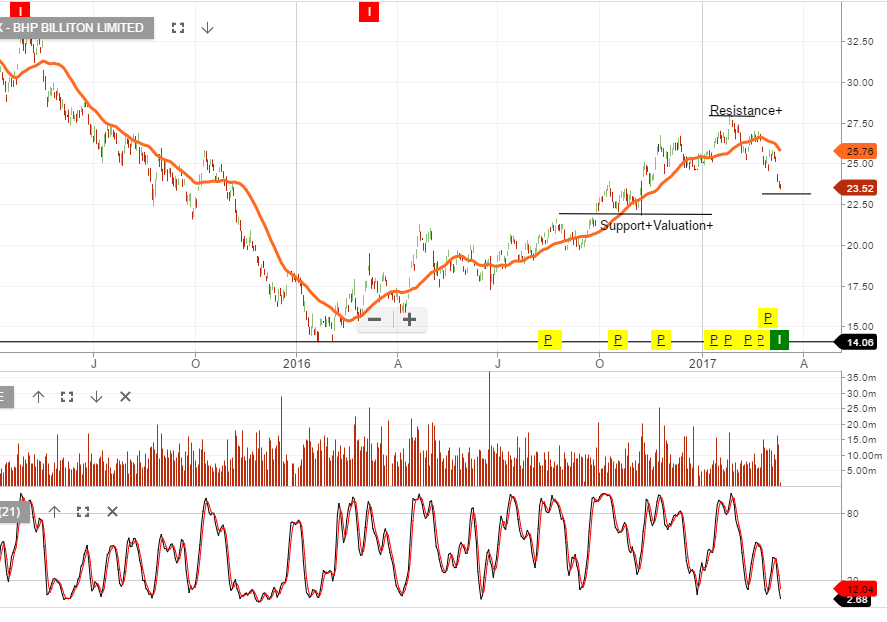

Our Algo Engine is now flagging “higher low” structures in a number of the large cap commodity names; across both metals and energy sector.

In particular, BHP and RIO are now at levels where a technical bounce is likely to occur.

Although, we struggle with the timing of establishing new long positions, given our current valuation concerns at an index level.

We’ll watch the price behaviour in BHP and RIO this week and look for evidence of the short term momentum indicators turning positive.

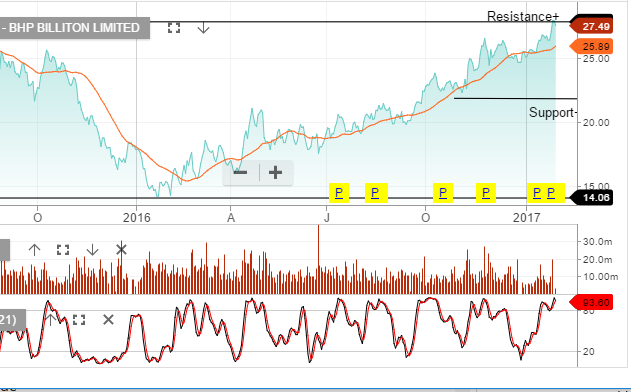

Chart – BHP

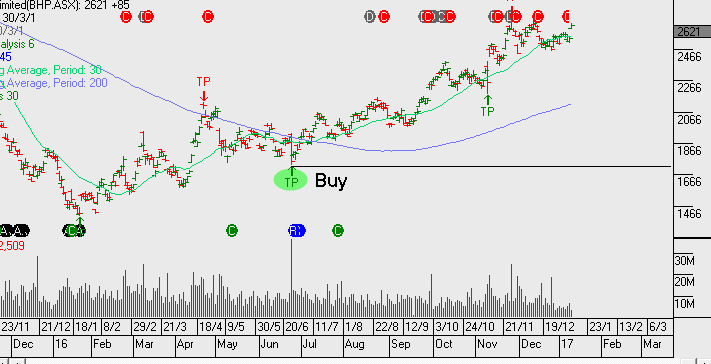

Chart – BHP