BHP – 5% plus dividend yield

In FY18, BHP will produce US$46 billion in revenue and generate EBIT of US$16 billion, which will support a dividend yield of 5%+

If we look out into FY19 and assume moderate growth achieved through higher energy prices and disciplined cost control, it’s likely BHP will increase the dividend to US$1.40. This will then place the stock on a forward yield of 5.4%.

BHP goes ex-div US$0.60 on the 7th of September. Adding a $34.01 (Euro) call option into October, boosts the cash flow by a further $1.25 per share.

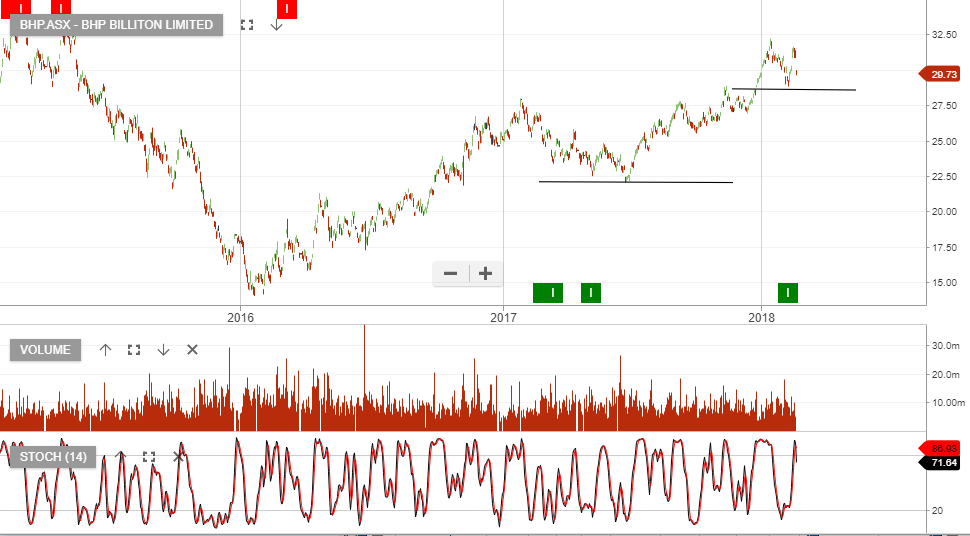

BHP

BHP

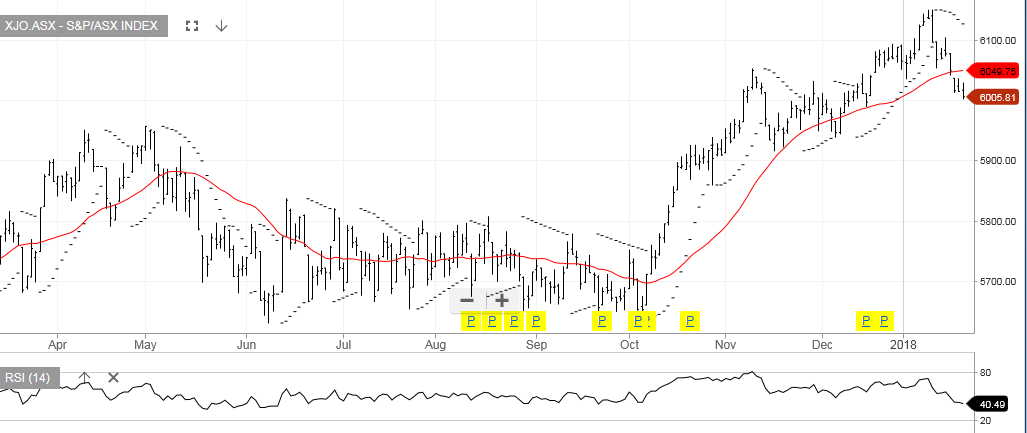

XJO Index

XJO Index