BHP Firms On Capital Return

BHP announced the return of the full US$10.4 billion proceeds from the sale of the mining giant’s US shale assets.

The funds will be returned to shareholders almost immediately through a combination of an off-market buyback in Nov/Dec 18 (US$5.2 billion) and a special dividend of US$5.2 billion payable in January 2019.

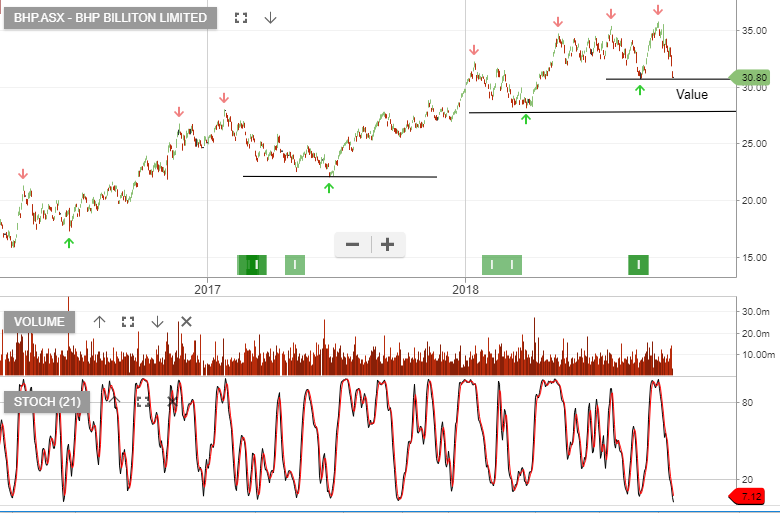

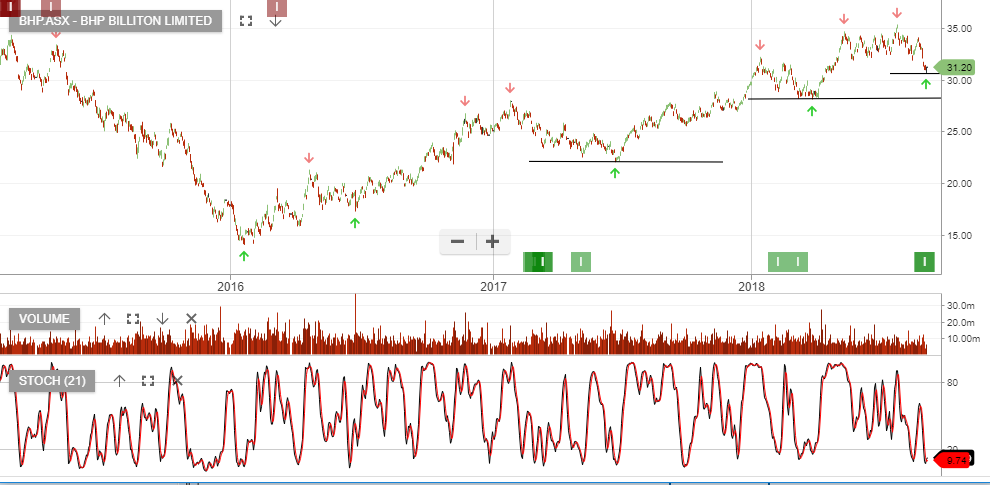

BHP has been under an ALGO buy signal since September 11th at $31.20 and we see the next chart resistance level at $35.40.

BHP