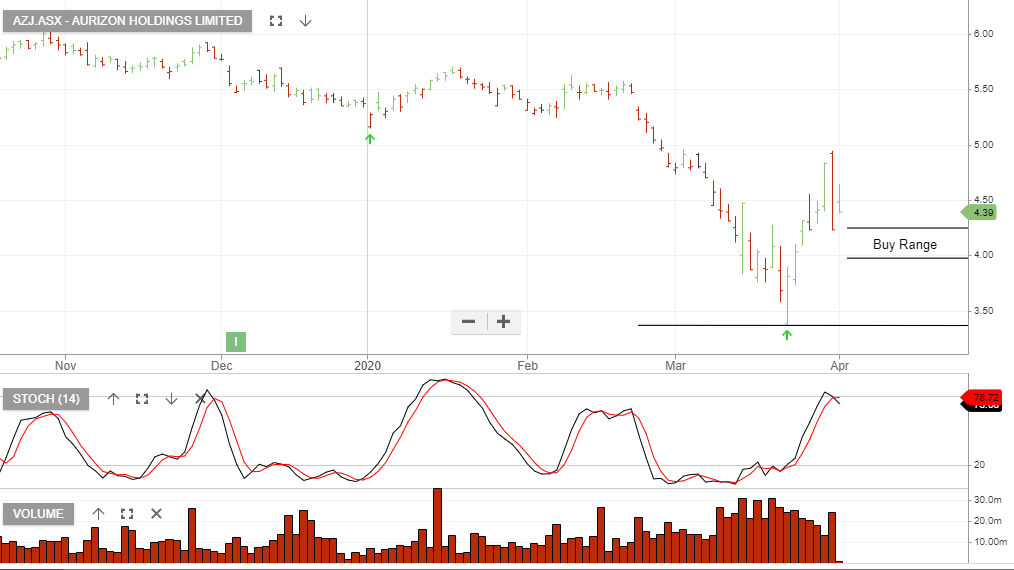

AZJ – Buy Signal

Aurizon Holdings is under Algo Engine buy signals.

Aurizon reported underlying earnings before interest taxation depreciation and amortisation (EBITDA) of $1.48 billion and told investors to expect underlying EBITDA of between $1.42 billion-$1.5 billion in fiscal 2022.