Alumina

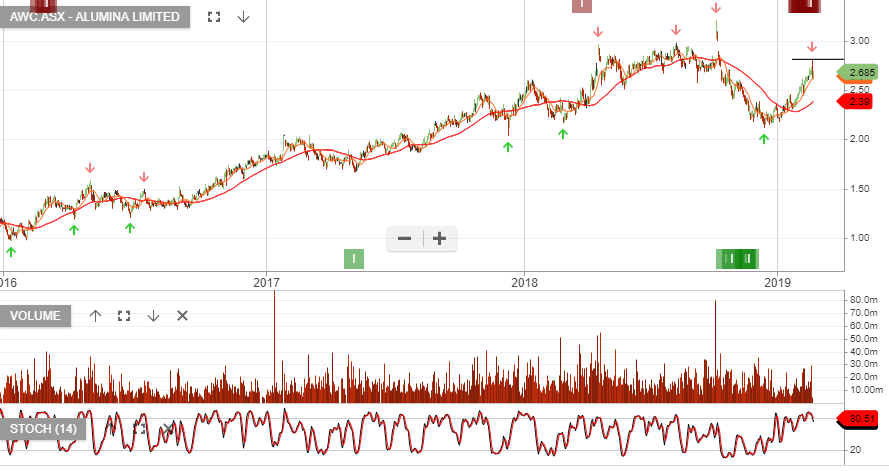

Alumina is under Algo Engine buy conditions.

Alumina is under Algo Engine buy conditions.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Alumina is now under algo engine sell conditions and has reached our price target of $2.00.

Aluminium prices have increased 35% from lows of less than US$1,500/t in mid-2020 to ~US$2,000 currently.

AWC – take profit.

Alumina is under Algo Engine buy conditions and is a current holding in our ASX 100 model.

We recently focused on adding AWC to portfolios at $1.50 per share and have become somewhat concerned regarding the implications of the ATO back tax issues the company now faces.

Taking a closer look at 1H20 earnings, underlying NPAT was above consensus at $US88.

China’s recovery continues to support pricing momentum and AWC has lagged the alumina price rebound. Over the next 1 – 2 years, China is expected to have a metallurgical alumina deficit.

With the above in mind, we expect the $1.50 support level to hold but suggest a stop-loss on a break below.

The stock remains under review although we acknowledge the bullish outlook among institutional analysts.

FY21 dividend yield is 2.2%.

Alumina is under Algo Engine buy conditions and we flagged the recent entry off the $1.55 support.

The stock has now rallied 15% and is trading at $1.81 today.

Alumina has run into issues with the Australian Tax Office following a review of transfer pricing arrangements with the AWAC JV.

The claim relates to a 20 year period and the ATO is claiming an additional tax of $200M plus interest. Other penalties may also be due and will be further communicated to the JV next month.

We forecast FY21 EBIT to increase to $350m, supporting a forward yield of 6%.

Alumina is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support building and note the short-term momentum indicators are now trending higher.

Alumina is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support building at $1.38 and suggest traders watch the short-term momentum indicators and stay “long” AWC whilst the indicators trend higher.

Stop loss on a break below $1.38.

Since making the above post, AWC has rallied as buying support increases.

Alumina is now under Algo Engine sell conditions and we expect the share price to struggle below the $2.80 level.

Alumina prices are likely to weaken over the next 12 months which will weigh on the cash receipts from the AWAC joint venture.

2018 net profit after tax was reported at US$690m. AWC declared a total dividend for the year of US$0.227, which was ahead of market expectations.

Stay short AWC with a stop loss above the $2.80 resistance.

Or start a free thirty day trial for our full service, which includes our ASX Research.