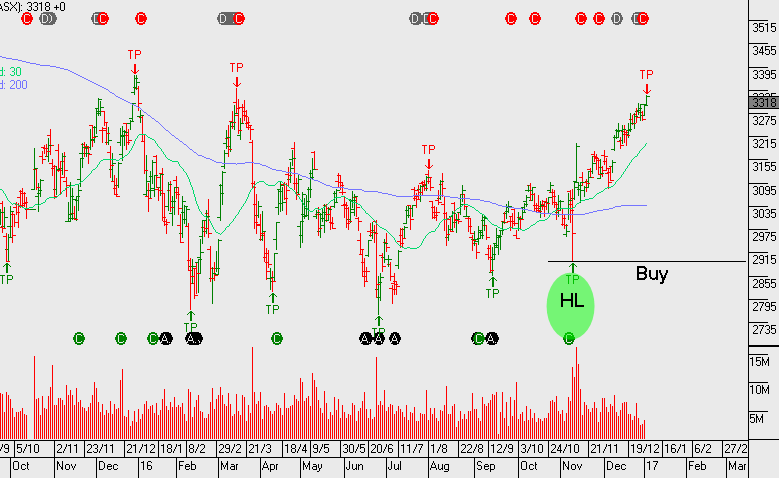

ALGO Buy Signal: ASX

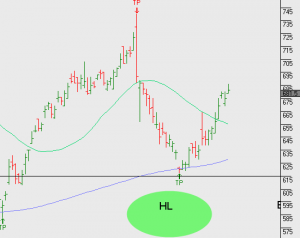

The ALGO engine generated a buy signal for shares of ASX at $49.00.

Many investors were able to write covered calls or exit long positions of ASX around the $52.50 level, last traded in early February.

We are cautious of the general market sentiment , but still like the longer-term growth prospects and a move back at least to the 30-day moving average near $51.10.

A tight stop-loss metric should be employed on long positions of ASX at, or near, the January 2nd low of $49.15.