ASX Ltd Has Reached The Buy Target

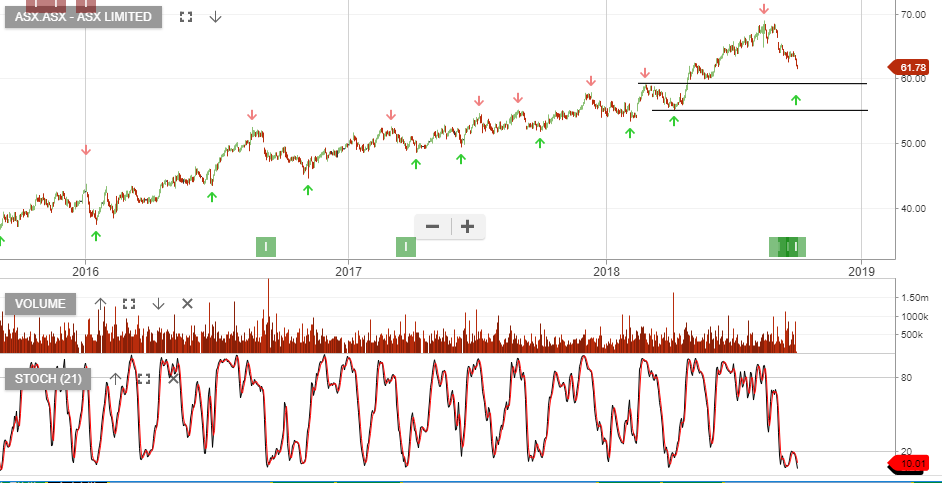

Last week we suggested a buy level for ASX Ltd near $58.00.

With yesterday’s low intraday print at $57.80, that downside buy target has been reached.

Also, with the share price sliding over 15% lower during the last month, internal momentum indicators are now oversold and a reversion higher looks likely.

At $58.00, the stock is on a forward yield of about 4%. We see the first level of resistance near $62.60 and up to $64.00 over the longer-term.

ASX Limited

ASX:ASX

ASX:ASX