ASX – Opportunity Approaches

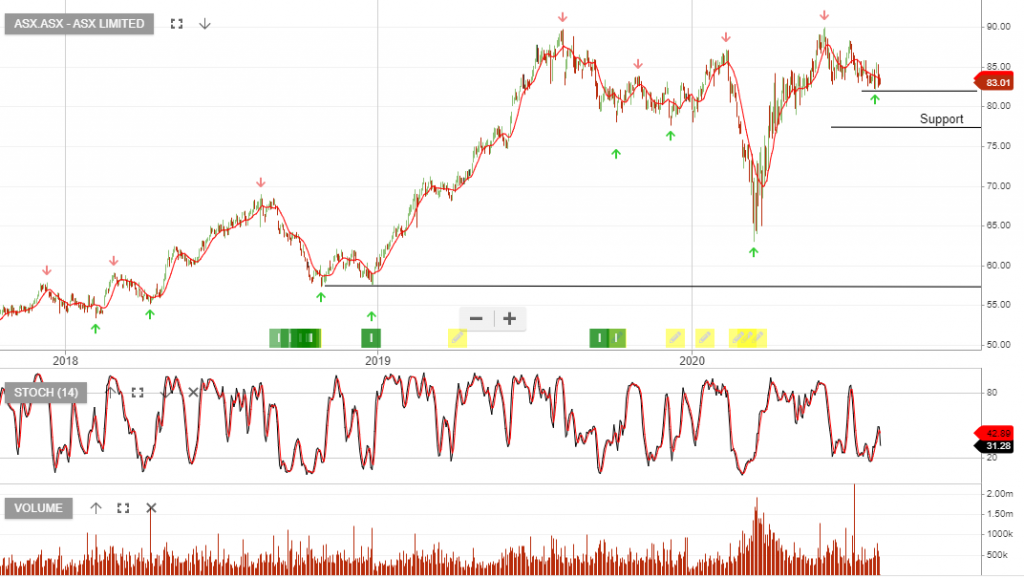

ASX is now under Algo Engine buy conditions and we highlight the expected buying support range of $77 – $82.

ASX is now under Algo Engine buy conditions and we highlight the expected buying support range of $77 – $82.

ASX is under Algo Engine buy conditions.

August cash equity volumes and average daily futures contract volumes were well down on the same time last year, -13% and -19% respectively.

FY21 earnings are likely to be flat at best and with the stock on a forward yield of 2.8%, we see it as “fully valued”. Owning the stock and selling an at the money covered call option is generating 8% cash flow.

We see value in buying ASX on any market weakness.

ASX is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

July trading volumes show cash market: 32.5m, (lower than the 12-month average of 38.4m) and total value traded in July rose to $140.5bn, (July 2019’s $126.8bn).

Derivatives total of 8.6m contracts, down 22% on a year ago and much lower than the past 12-month average.

Volumes are expected to remain below the elevated levels of the past few months.

ASX is a quality business and we look to add to the position at lower price levels.

ASX is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Accumulate within the $64 – $68 price range.

NOTE: It was reported on mainstream media that NYSE volume is up over 50% in March, (based on the same time last year).

It seems reasonable to assume that the ASX will be benefiting from a similar pick up in order flows, across both equities and derivatives.

ASX is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We recommend investors buy ASX and we reaffirm our “high conviction” rating.

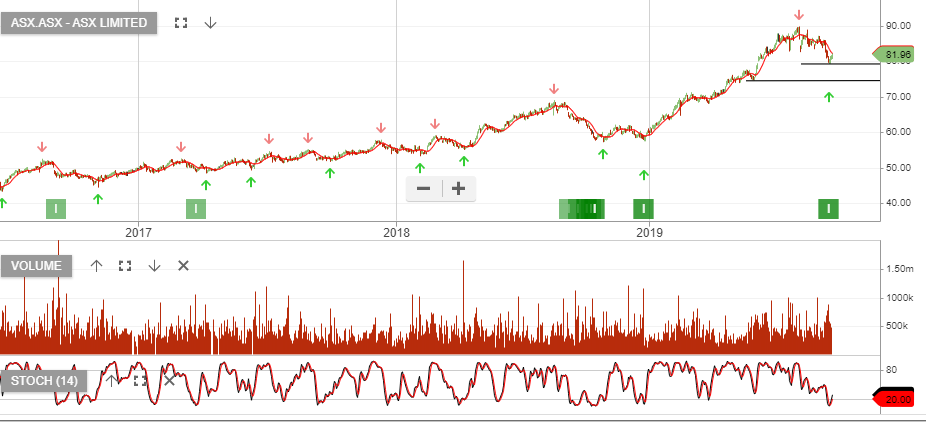

ASX is under Algo Engine buy conditions.

Higher levels of equities and futures trading, along with growing demand for its data services, have lifted ASX Limited’s earnings and revenue over the half year. Net profit 2H19 to December was up 1.8% to $250mn on revenue of $454mn, which was up 7%, EBIT rose 6% to $315.

We expect growth to remain in the 1 – 4% range and we see the stock as a “high conviction” buy on the dip during the current market sell-off.

ASX is building support at $78.50 and is now trading higher coming into the February earnings result.

The market is forecasting 5% EPS growth and an ongoing yield of 3%.

ASX is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support for ASX at $78.00

ASX is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see upside in ASX to $86.00, at which time investors should consider selling out-of-the-money call options to enhance the income return.

ASX goes ex-div $1.14 on 7 March.

For more information on the derivative strategy, please call our office on 1300 614 002.

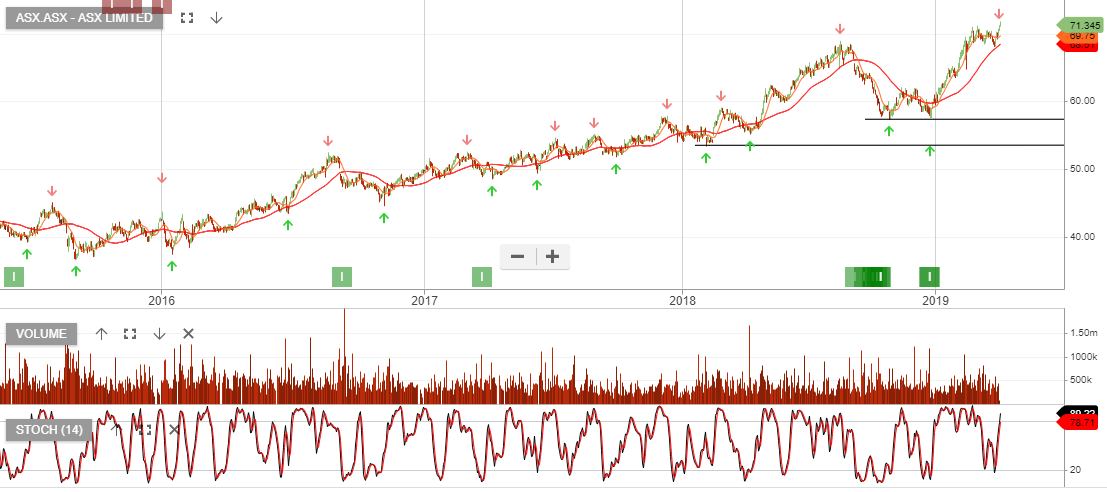

ASX is among the best performing stocks within our ASX 100 model portfolio. The stock remains under current buy conditions and the earnings have been slightly upgraded, following the release of the March quarter trading data.

The upgrades were driven by stronger than expected ASX 24 derivatives activity. Volumes increased 11% on the same time last year, with a record month in March 2019.

Cash equities turnover was up 9% year-over-year.

At 26x earnings and 3.2% yield, the stock looks expensive but it does offer a relatively safe harbour.

Or start a free thirty day trial for our full service, which includes our ASX Research.