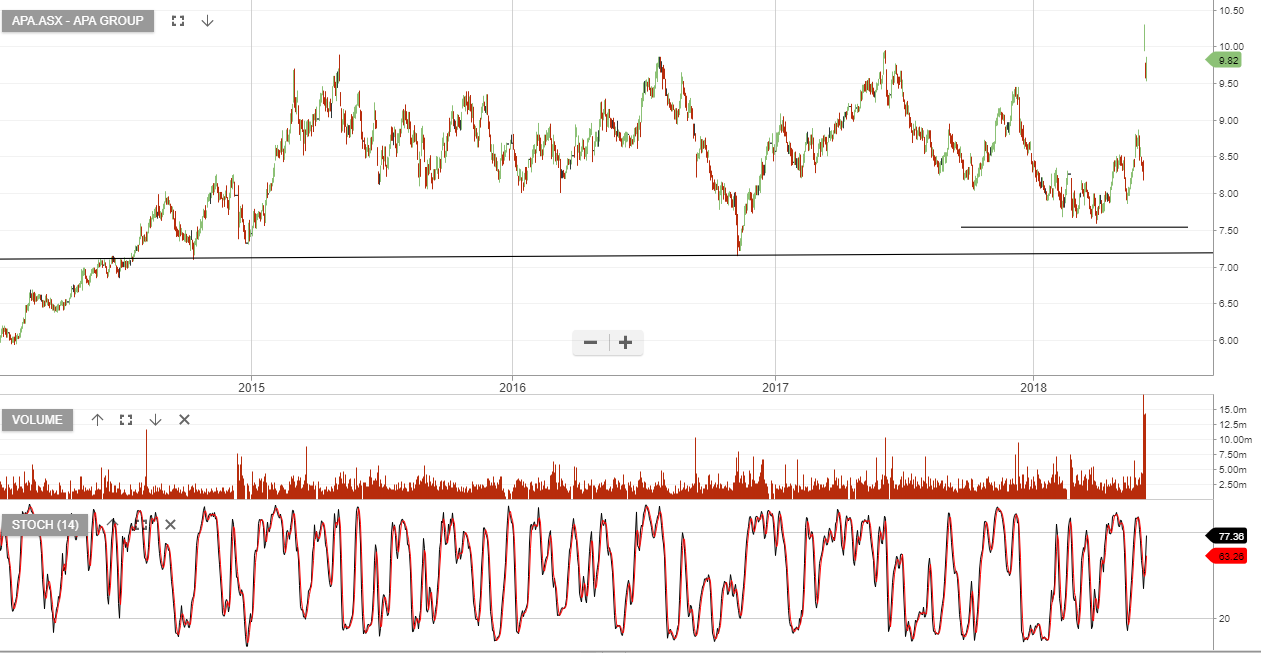

APA Group – FY18

APA’s FY18 operating results were ahead of market consensus with underlying profit growth of 6%.

FY19 forecasts suggest low single digit growth with EBITDA guidance in the range of $1.55b to $1.57b.

The ACCC is expected to release a Statement on, or before the 13th September, expressing its preliminary concerns about the take-over by CKI, (offer price$11 per share).

Further price retracement back towards $9.00 creates another buy opportunity here with APA. The stock now trades on a forward yield of 4.5%