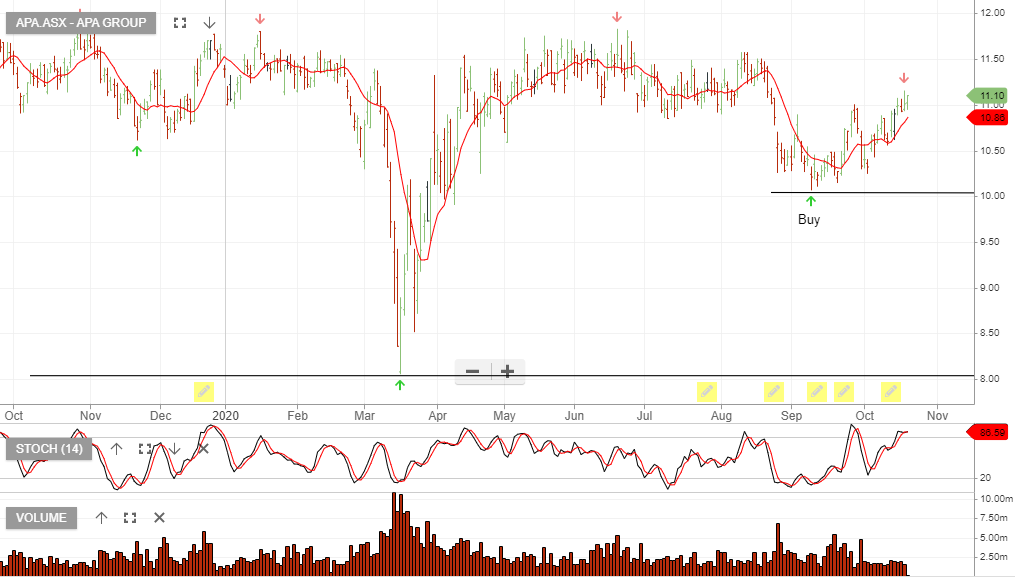

APA – Buy

APA is under Algo Engine buy conditions and we see support building at the recent $10.50 higher low formation.

APA has now rallied to $11.13 and goes ex-div 23c on 30 December.

APA is under Algo Engine buy conditions and we see support building at the recent $10.50 higher low formation.

APA has now rallied to $11.13 and goes ex-div 23c on 30 December.

APA is under Algo Engine buy conditions and we see support building at the recent $10.50 higher low formation.

APA is under Algo Engine buy conditions and we see support building within the $10 to $10.50 price range.

Watch the short-term indicators for a turn higher.

APA is under Algo Engine buy conditions and since finding support at $10, the stock has now rallied 10%.

Our 12 month price target on APA is $12.00

APA is likely to find increased buying support at $10 and trade higher.

Since making the above post on 23 Sept, APA has rallied 8% and the short-term indicators have turned positive.

We continue to see APA as a low-risk opportunity even if the market sentiment was to shift more negative.

APA is likely to find increased buying support at $10 and trade higher.

APA is likely to find increased buying support between the $9.50 and $10.25, supported by 4.5% dividend yield and single-digit earnings growth.

About APA – Our 7,500-kilometre East Coast Grid of interconnected gas transmission pipelines provides the flexibility to move gas around eastern Australia, anywhere from Otway and Longford in the south, to Moomba in the west and Mount Isa and Gladstone in the north. In Western Australia and the Northern Territory, our pipelines stretch thousands of kilometres to supply gas to power major cities, towns and remote mining operations.

Apart from our interconnected natural gas pipelines, we own and operate the Ethane Pipeline which supplies ethane from the Cooper Basin production facility at Moomba, South Australia, to an ethylene plant in Botany, Sydney.

And it’s not just pipelines. We also own and operate the Mondarra Gas Storage and Processing Facility and the Emu Downs Wind Farm in Western Australia, Diamantina and Leichhardt Power Stations in Queensland, the Dandenong LNG Storage Facility in Victoria and the Central Ranges Gas Distribution Network servicing Tamworth in New South Wales.

APA is under Algo Engine buy conditions and provides a defensive yield.

Buy $10.80 – $11.00 price range.

APA is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support at $11.00 and reaffirm our “accumulate” rating.

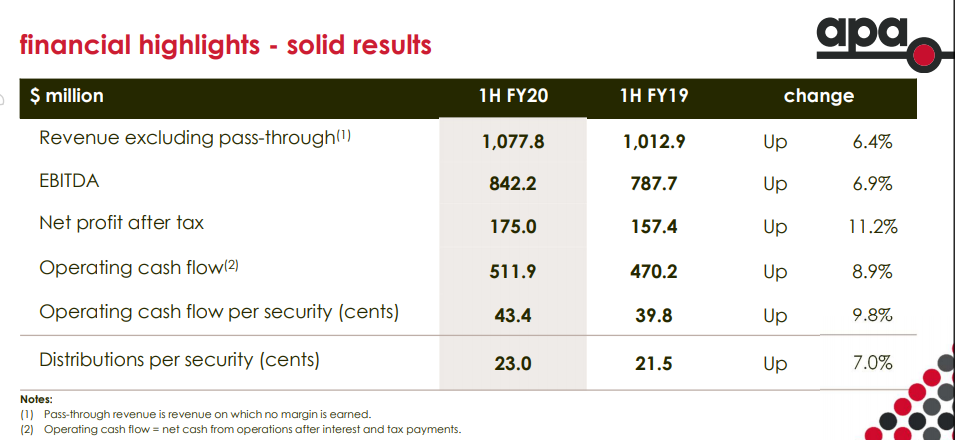

APA 1H20 results.

APA is under Algo Engine buy conditions and is a current holding in ASX 100 model portfolio.

NOTE: APA has now rallied over $1.00 and investors can consider taking profit.

Or start a free thirty day trial for our full service, which includes our ASX Research.