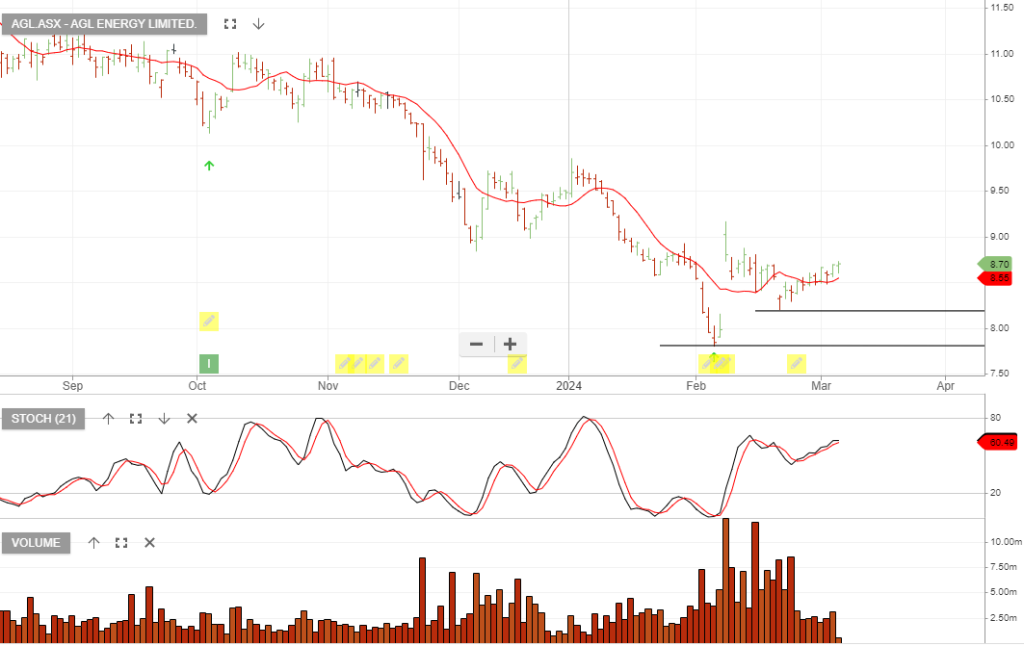

AGL Energy

AGL Energy trade setup with stop loss at $10.25

AGL Energy trade setup with stop loss at $10.25

AGL Energy is under Algo Engine buy conditions.

AGL reported a stronger-than-expected HY25 result with A$1.07 bn EBITDA, up 13%.

AGL Energy is rated a buy with the stop loss at $8.20

AGL Energy is now above the 10-day average following strong earnings results with both electricity and gas portfolio margins exceeding expectations.

FY24 guidance narrowed to the upper end with underlying EBITDA now $2,025m-2,175m (from $1,875m to $2,175m).

AGL Energy is a high-risk counter-trend trade. Watch for the price action to cross above the 10-day average.

AGL Energy is a under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

AGL announced FY19 underlying NPAT of $1,040m and lowered FY20 guidance to be A$780-860m. The forecast is below already adjusted market estimates and we’ve seen the share price trade lower as a result.

With the stock at $19 there is value supported by a 5% dividend yield. This trade is an example where investors should look to add a covered call option to enhance the yield to 10% per annum.

For more information on the option strategy, please call our office on 1300 614 002.

AGL Energy is now under Algo Engine buy conditions, following the recent sell-off from $23 down to $20.50.

We recommend buying AGL and selling an out of the money call option to enhance the income return.

AGL goes ex-div $0.63 on the 22nd August.

For more information on the option strategy, please call our office on 1300 614 002.

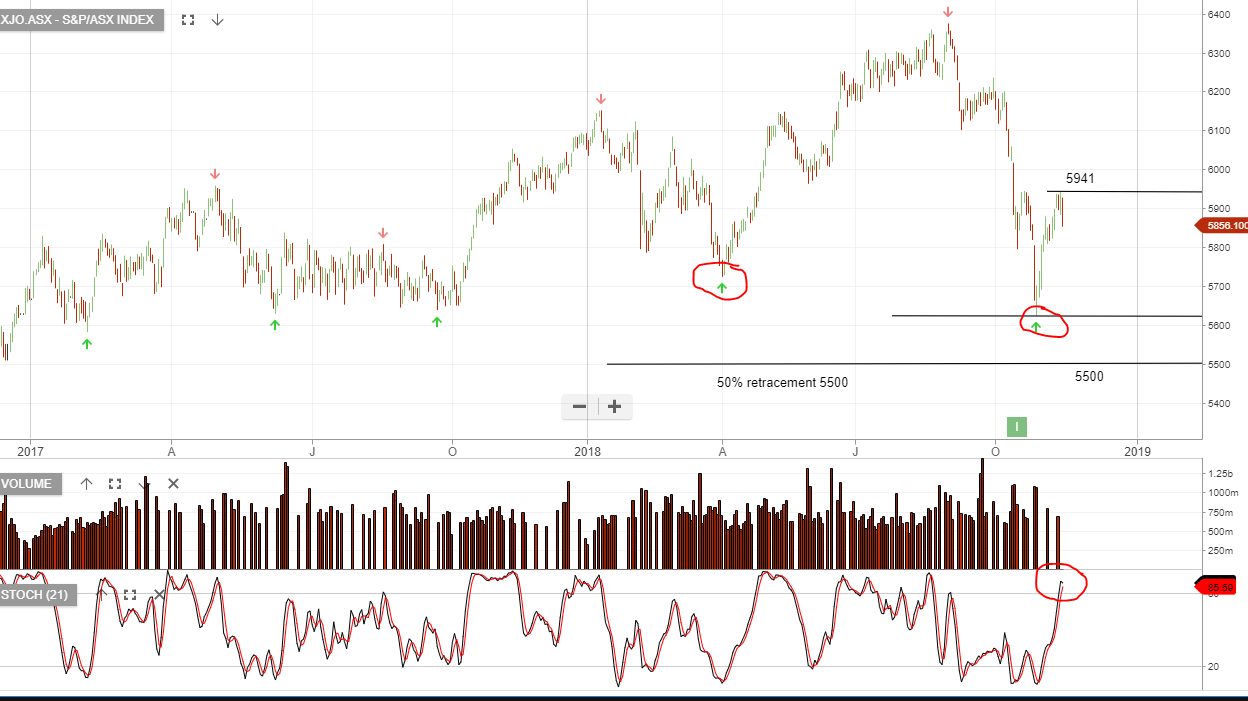

The XJO has formed a “lower high” pattern within the existing Algo Engine buy signal structure.

The market has rallied 6% from the recent buy signal but we’re now mindful of the recent break of the “higher low” structure, as circled on the chart below.

5941 is resistance for the XJO and whilst the market remains below this level, some caution is required.

Names that remain supported within today’s broad market sell off include, AGL, CTX, GPT, WES, SCG, TCL, HSO & WOW. We remain cautious on the banks and select resource names .

XJO

AGL is a current holding within the ASX Top 50 and 100 model portfolios.

With the share price trading at $19.50, we consider a pessimistic view is now priced in.

We suggest buying AGL and looking to sell covered call options to enhance the cash flow.

Or start a free thirty day trial for our full service, which includes our ASX Research.