A2 Milk Company

The A2 Milk Company is now under Algo Engine buy conditions. We are watching for buying support to build near the $18.75 level.

Watch the short-term momentum indicators for a turn higher.

The A2 Milk Company is now under Algo Engine buy conditions. We are watching for buying support to build near the $18.75 level.

Watch the short-term momentum indicators for a turn higher.

The A2 Milk Company is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

2H19 earnings growth was 39% and FY19 revenue was up 40%. The market was disappointed in the FY20 guidance and consensus earnings growth expectations have come down to 20%.

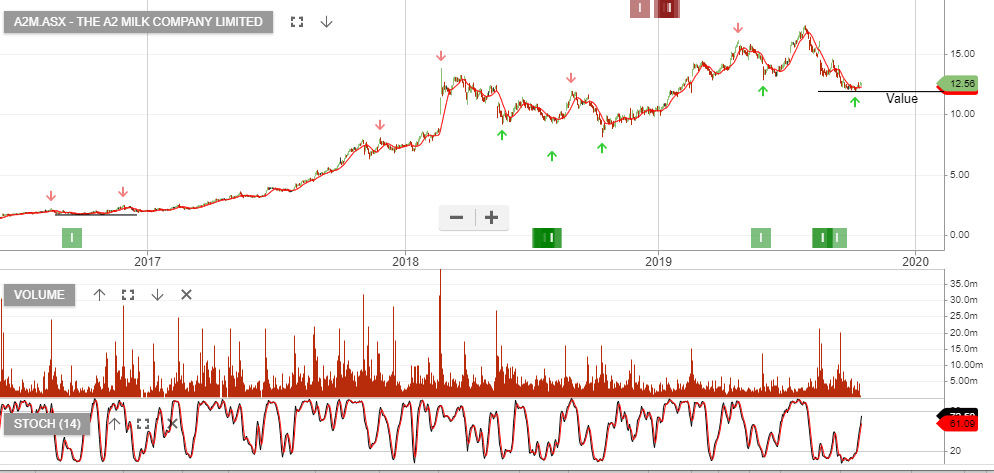

We look to accumulate A2M near the $12.50 price level.

The A2 Milk Company is under Algo Engine sell conditions and resistance is likely to build around the $13.50 level.

A quick look at the fundamentals puts into perspective the lofty expectations that are currently priced into the stock. 2018 EBIT was $280mn and no dividend was paid out. By 2020 the EBIT needs to double to $560mn to support the forecast 2.3% yield.

We’re skeptical of these consensus growth targets.

Our ALGO engine triggered a buy signal in A2 Milk at $9.81 on July 20th.

Since then, a broker note has lifted the company to an “outperform” rating with a 12-month price target of $12.40.

The report focuses on the fresh milk delivery partnership between A2M and Fonterra in New Zealand, and the opportunity to replicate that model in other countries.

As a result, the broker note estimates growth in EBIT to rise from $274 million to $523 million over the next two years.

A2 Milk

A2 Milk

Our ALGO engine triggered a buy signal in A2 Milk into yesterday’s ASX close at $9.81.

This “higher low” pattern is referenced to the intra-day low of $9.19 on May 23rd.

Despite falling formula prices in China, recent broker notes from both UBS and Goldman’s have positive ratings, citing robust net earnings results through 2020.

It’s worth noting that A2M is a high growth, low yielding stock and investors should apply a stop loss below the $9.10 level.

A2 Milk

Shares of A2 milk have opened over 15% lower to $9.80 after reporting lower guidance in their trading update and full year outlook.

The company reported that they expected total revenue near the NZ 920 million mark. This materially below the NZ 950 million the company was shooting for earlier this year.

Technically, we see scope for A2M shares to fill the price gap from February and find support near $9.00.

A2 Milk

A2 Milk

Or start a free thirty day trial for our full service, which includes our ASX Research.