S&P ASX 200 Index up 1.6%

The S&P ASX 200 Index finished the week up 1.6%.

The best performing sector was Health Care, up 4.2% and the the worst performer was the Energy sector, down 0.6%.

The S&P ASX 200 Index finished the week up 1.6%.

The best performing sector was Health Care, up 4.2% and the the worst performer was the Energy sector, down 0.6%.

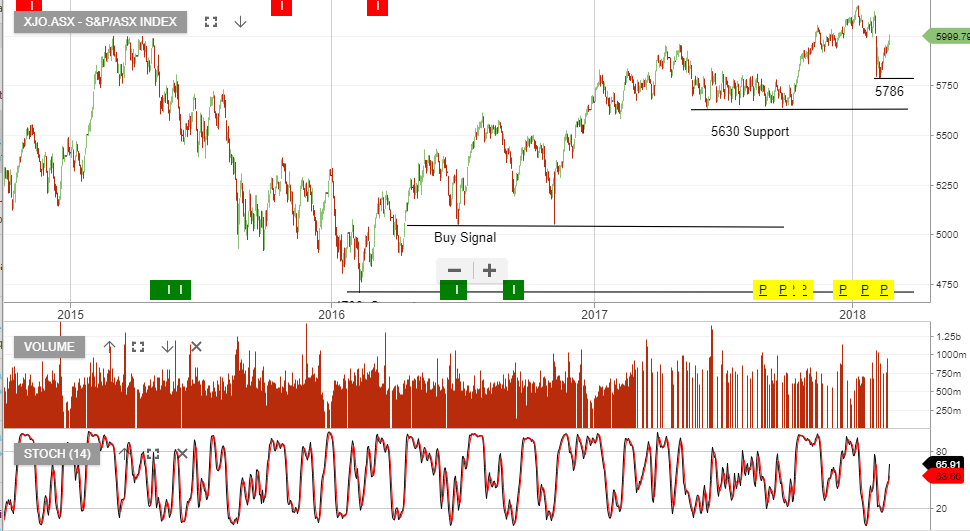

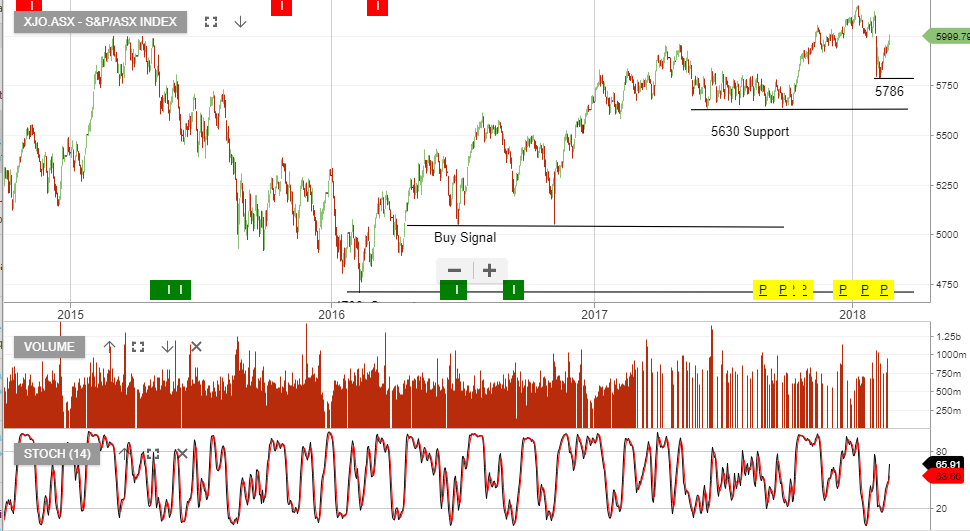

The XJO has formed a “higher low” formation at 5991 and the short-term momentum indicators have turned positive.

With most ASX200 constituents trading on extended multiples, we feel the big four banks will need to find buying support, in order for the index to trade higher.

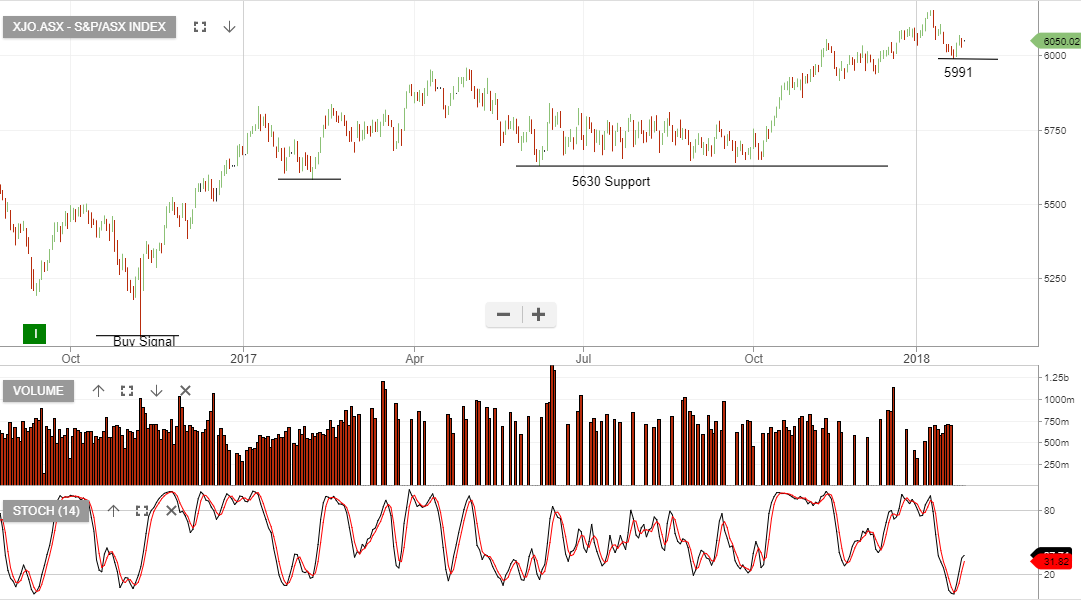

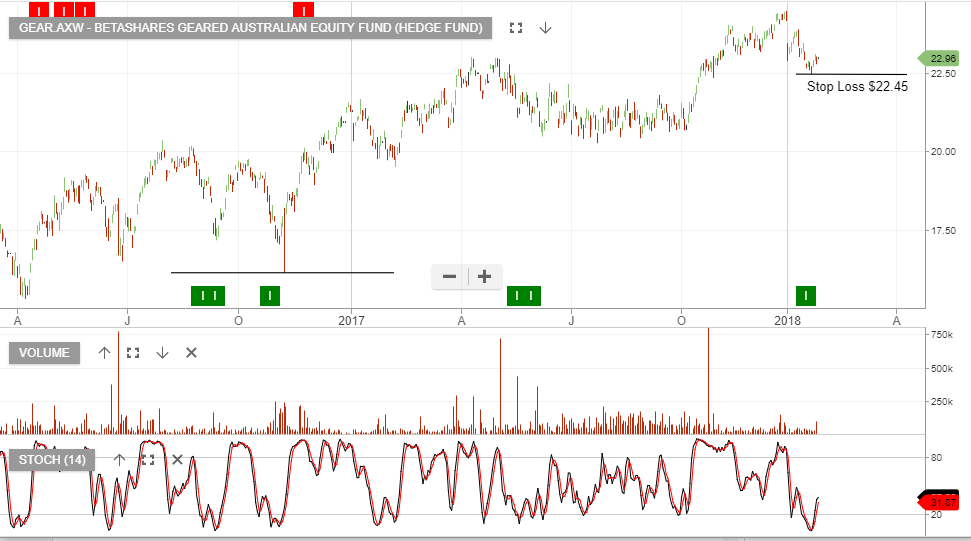

Any move higher from the 5991 low will likely be moderate and index investors can consider the GEAR ETF to gain additional leverage.

Our Algo Engine triggered a buy signal in the GEAR ETF on 17th January at $22.66.

Stop-Loss orders are recommended at $22.45.

XJO

GEAR (ETF)

By the time the ASX starts trading on Monday, the results of the first round of the French Presidential election should be confirmed.

At 4pm Sydney time today, French citizens will begin casting their ballots in what has been one of the most contentious elections in its history, and where the future direction of the European Union could be in the balance.

From a market volatility perspective, the most positive result would be a large turnout for centrist Emmanuel Macron against any of the other three leading candidates.

The worst case scenario for the markets would be if Mr Macron doesn’t get enough votes to qualify for the second round of voting scheduled for May 7th.

Current polling shows that the most likely outcome will be Mr Macron running against the anti-EU candidate, Marine Le Pen, in the second round of voting.

In this case, the market reaction will be determined by the size of the margin between these two candidates.

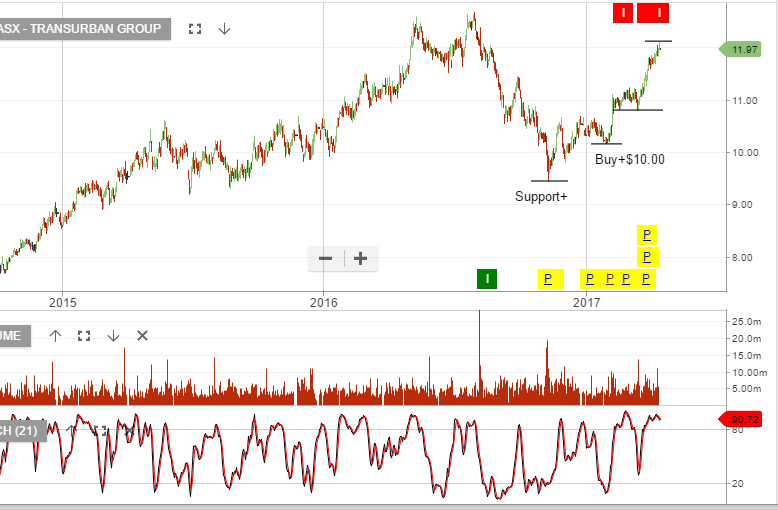

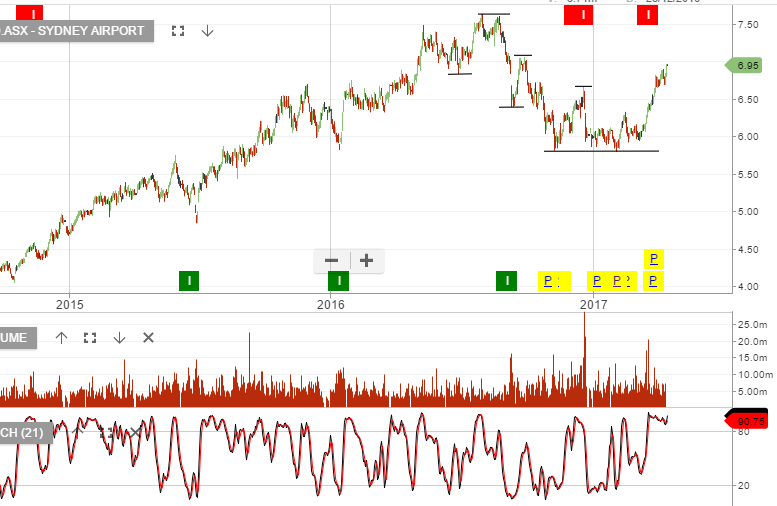

With bond yields moving lower in the US, we’ve seen strong buying interest in domestic yield sensitive names.

The rally is nearing the peak and taking profit or selling tight covered calls is advised. History shows yields compressing below 4% will act as resistance for further share price advances.

The price of West Texas Intermediate (WTI) crude oil dropped over $2.00, or 3.8%, to $51.90 in New York trade as Iraqi exports posted a record high for the month of December.

This is the biggest daily drop in over five weeks as investors are now concerned about Iraqi compliance with the OPEC production cuts agreed to on November 30th in Vienna.

Crude Oil posted its biggest gain since 2009 last year, largely based on the agreement from OPEC and 11 other countries to curb output starting January 1st.

Non-compliance has been a recurring theme in previous OPEC agreements, and the Iraqi export data may be the first sign of a crack in the most recent production accord.

The close below $52.00 in the front month WTI contract is the first trade below the 30-day moving average in over a month and suggests further downside extension below $51.50.

On the ASX, Oil Search (OSH) reached a 2 month high of $7.45 yesterday but will likely trade lower today. Technically, we look for initial support at $7.00 with the Pre-OPEC key support level at $6.40.

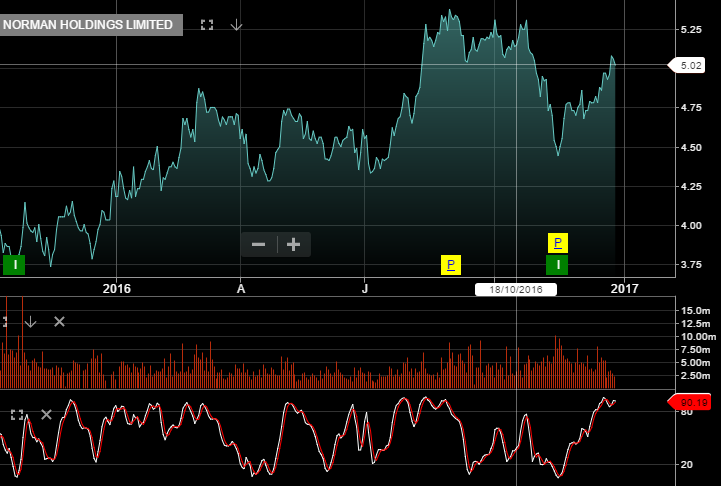

Let’s take a quick look at a few names that should prosper from the Christmas period spending activity. In the US I’ve focused on Amazon and FedEx as two relevant examples and domestically, I’ve looked at Harvey Norman and JB HI-FI.

We had buy signals from the algo engine on these names and our preference was the long position in HVN, which has now rallied 10% from the November low.

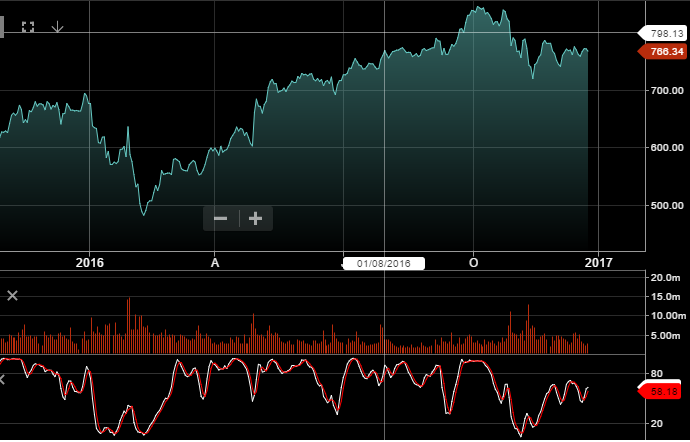

Chart – Amazon

Or start a free thirty day trial for our full service, which includes our ASX Research.