CleanTech ETF

ProShares S&P Kensho Cleantech has been added to my watchlist and I’ll discuss the reasons why in the next webinar.

ProShares S&P Kensho Cleantech has been added to my watchlist and I’ll discuss the reasons why in the next webinar.

Crude Oil futures are trading at $73.50 after the U.S. warned Houthi militants against attacks in the Red Sea and OPEC pledged unity to support market stability.

We remain buyers of oil-related trades.

QBE Insurance Group was added to the ASX200 Trade Table on the 19/12.

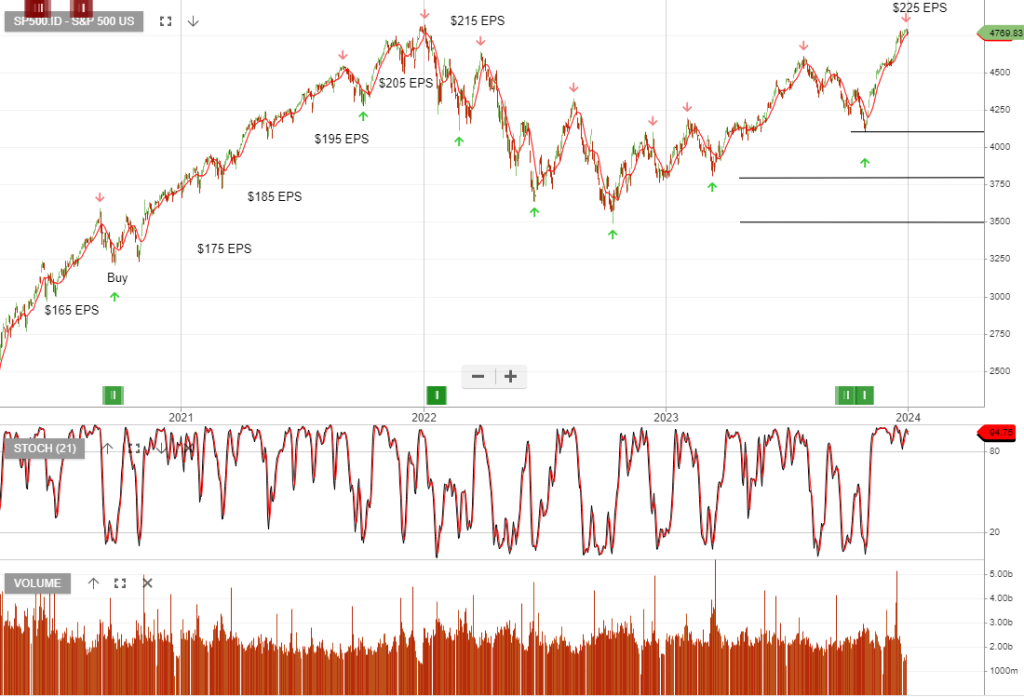

The S&P500 futures are trading below the 10-day average, following last Thursday’s pre-alert red arrow. Place the stop loss on a reversal above 4828.

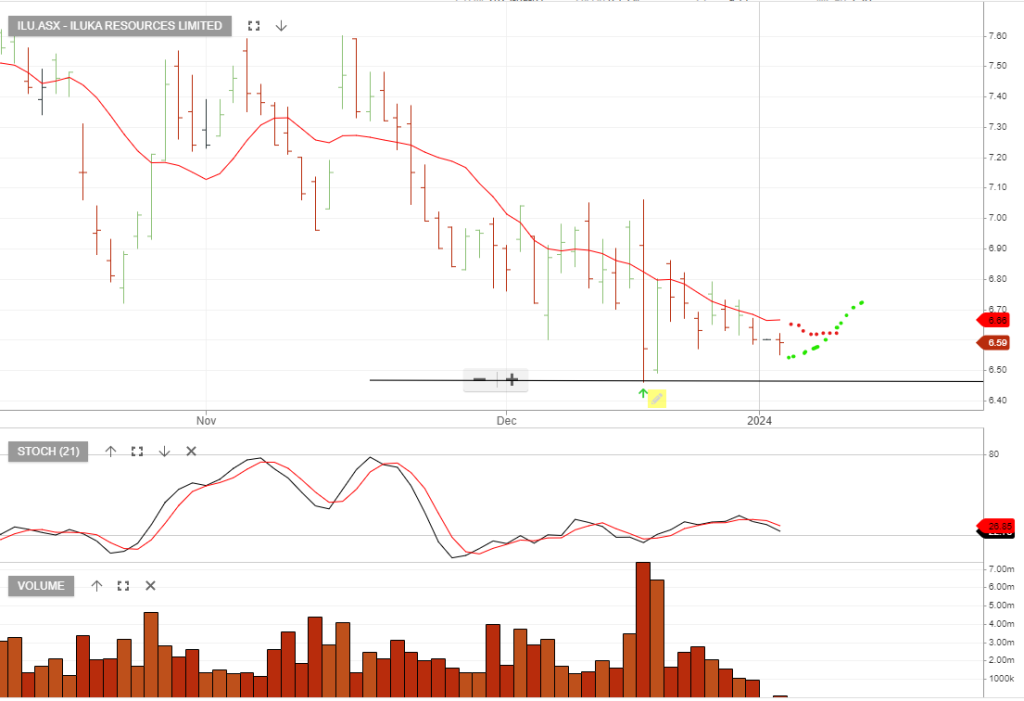

Iluka Resources is added to our watchlist and we’ll revisit this one later in the week.

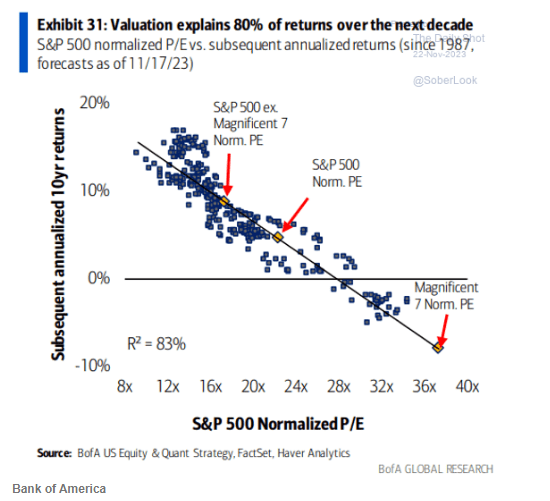

The biggest contributors to the S&P 500’s banner year have been the usual suspects, currently dubbed the Magnificent Seven, which are Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla. This group is up 75% in 2023, while the remaining 493 companies in the S&P 500 are about 12% higher.

S&P500 PE valuation excluding the magnificent 7 is trading at the long-term average of 16x, suggesting that most of the market is at fair value.

Crude Oil futures are trading at $71.50

Boss Energy is producing uranium, and therefore can take advantage of the current high price. Uranium prices have doubled in 2023 and are now trading at 15-year highs of US$87/lb.

Or start a free thirty day trial for our full service, which includes our ASX Research.