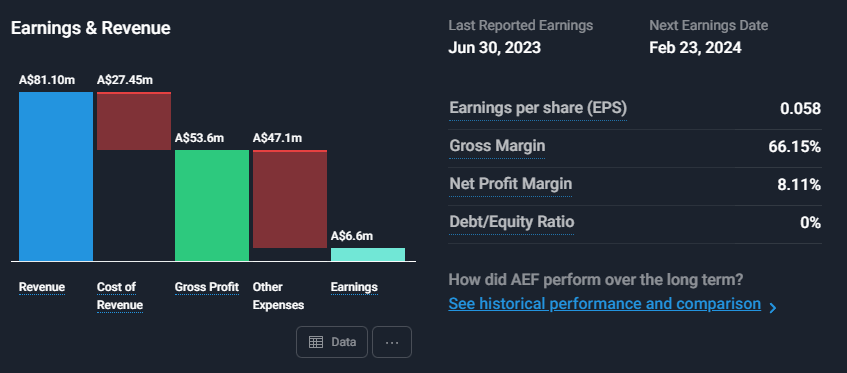

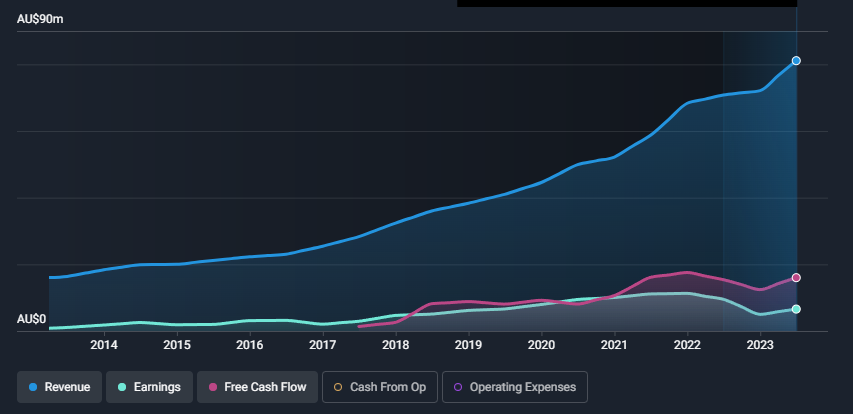

Australian Ethical Investments

Australian Ethical Investment is under Algo Engine buy conditions.

Australian Ethical Investment Ltd is an Australia-based company engaged in the operating segment of Funds Management. The company is involved into acting as the responsible entity for a range of public offer ethically managed investment schemes and to act as the Trustee of the Australian Ethical Retail Superannuation Fund (Super Fund). The products of the company are Super, Managed funds, ETF and Pension.