Apple

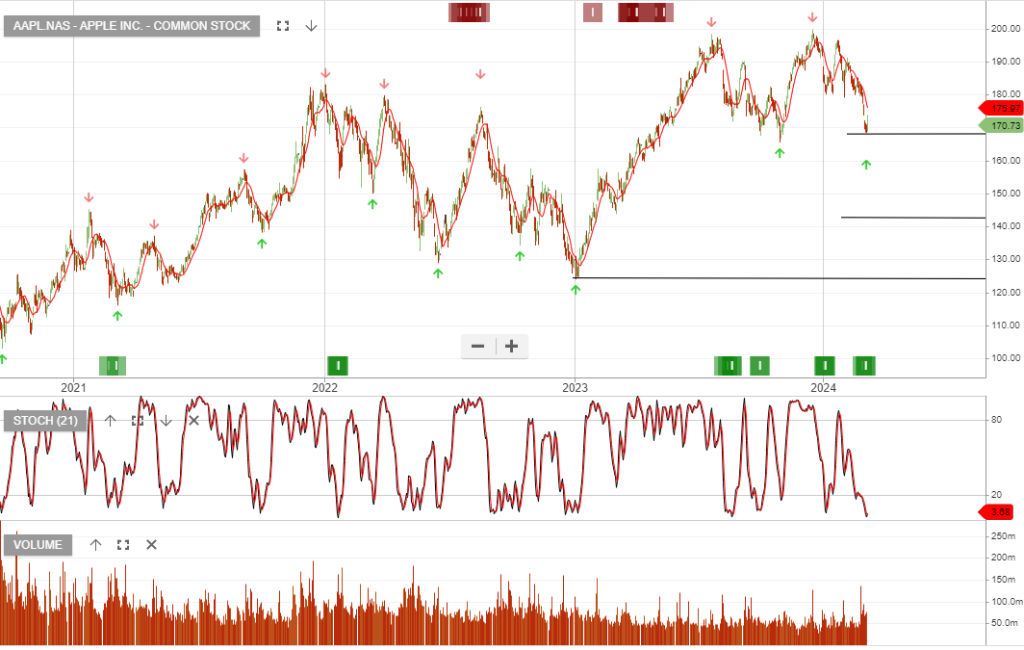

AAPL:NYS is under Algo Engin buy conditions. We see long-term value for investors within the $140 – $170 price range.

AAPL:NYS is under Algo Engin buy conditions. We see long-term value for investors within the $140 – $170 price range.

SHOP:NYS is added to our buy list with a stop loss of $72.64

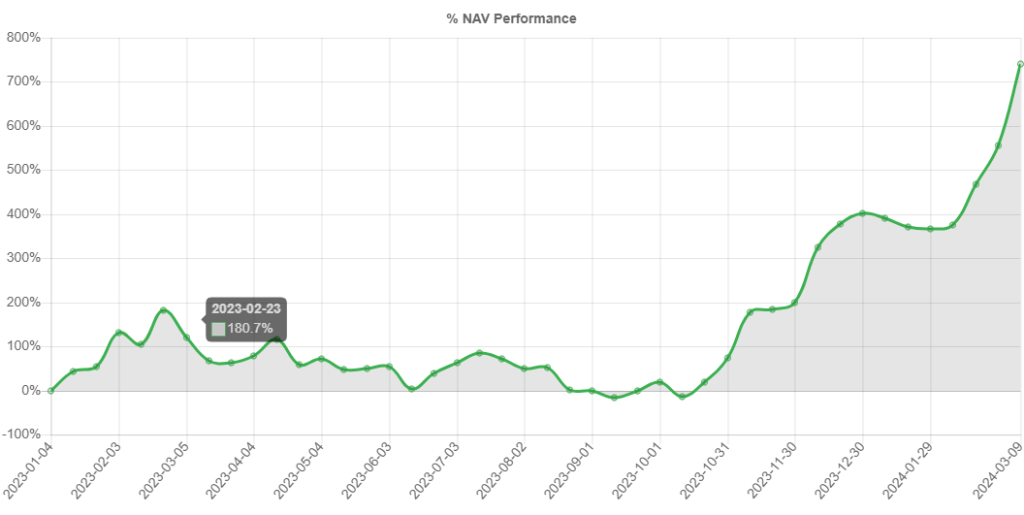

Our crypto algo engine has generated a 740% return since October 2023. The automated trading model focuses on large-cap momentum.

Recent portfolio additions include;

For all enquiries, please call 1300 614 002.

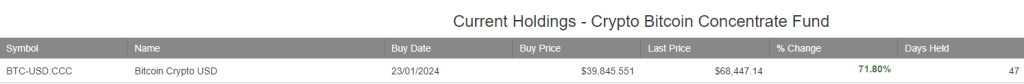

Bitcoin surpassed its November 2021 record high on Tuesday as demand for the token continued to be filed by excitement over spot bitcoin ETFs and the April halving event. Our Algo Engine generated a buy signal in January and the holding is up 71% after 47 days.

The red arrow suggests we’re nearing a short-term peak and traders may look at hedging any long exosure on a downturn in the price momentum.

Global X Copper Miners has rallied 10%+ since being flagged on the advisory blog.

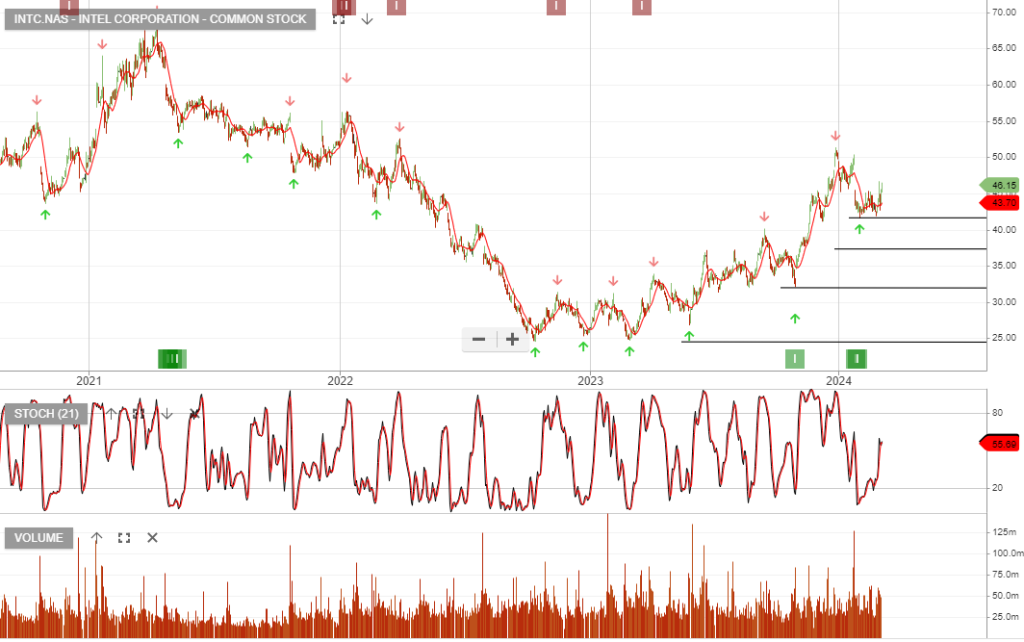

INTC:NAS The U.S. government is expected to invest $3.5B in Intel to make advanced semiconductors for military and intelligence programs. The money is part of the larger $39B Chips and Science Act grant pool aimed at boosting U.S. semiconductor manufacturing.

Santos is rated a buy with the stop loss at $7.12

Qantas Airways is under Algo Engine buy conditions.

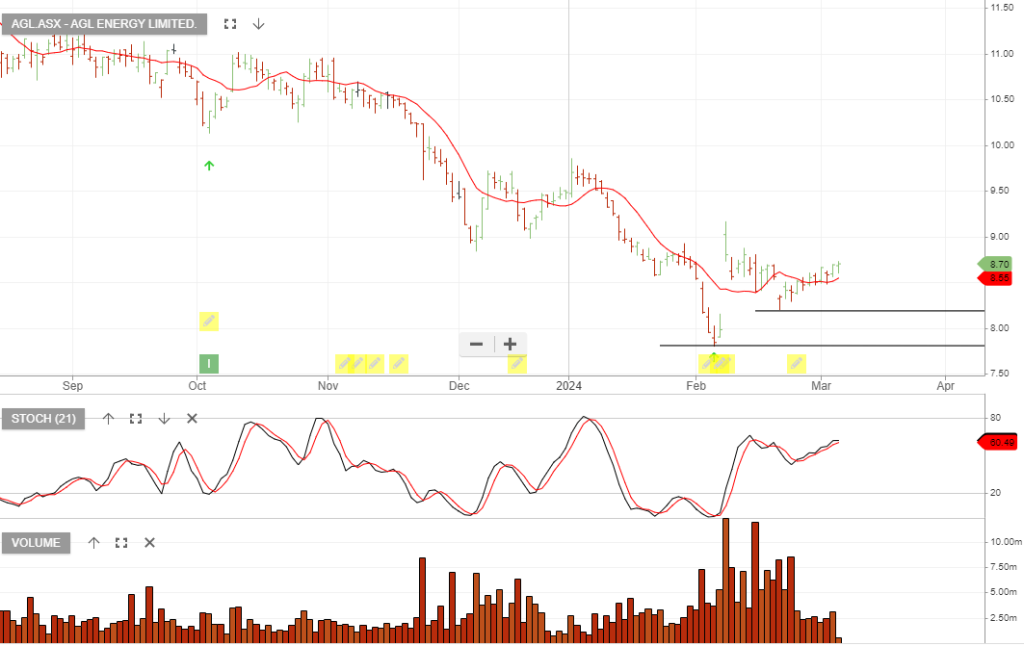

AGL Energy is rated a buy with the stop loss at $8.20

Sonic Healthcare is a counter-trend trade, so the entry point is tricky. I’m drawn to this oppertunity as it’s a high quality business with 5-10% EPS growth potential following the adjustment in post covid revenue runoff.

If you’re jumping into this one, the stop goes at today’s session low.

Or start a free thirty day trial for our full service, which includes our ASX Research.