BHP

BHP:ASX is under Algo Engine buy conditions, and the pivot low is in place at $41.93

Fortescue

FMG:ASX is under Algo Engione buy conditions. Buying momentum is increasing, and the pivot low is in place at $23.43

Karron Energy

KAR:ASX is under Algo Engine buy conditions with support now at the higher low level of $1.84.

Inghams Group

ING:ASX is under Algo Engine buy conditions. The pivot low is $3.44 and we expect buying momentum to now increase.

Deep Yellow

Deep Yellow is under Algo Engine buy conditions.

Boss Energy

BOE:ASX acquired a 30% interest in Alta Mesa in early 2024 for US$60m. Positive drilling results are likely to underpin the recent $4.50 support level.

The project remains on track for production in mid-CY24.

Watch Last Night’s Webinar

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

XJO & Market Direction

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

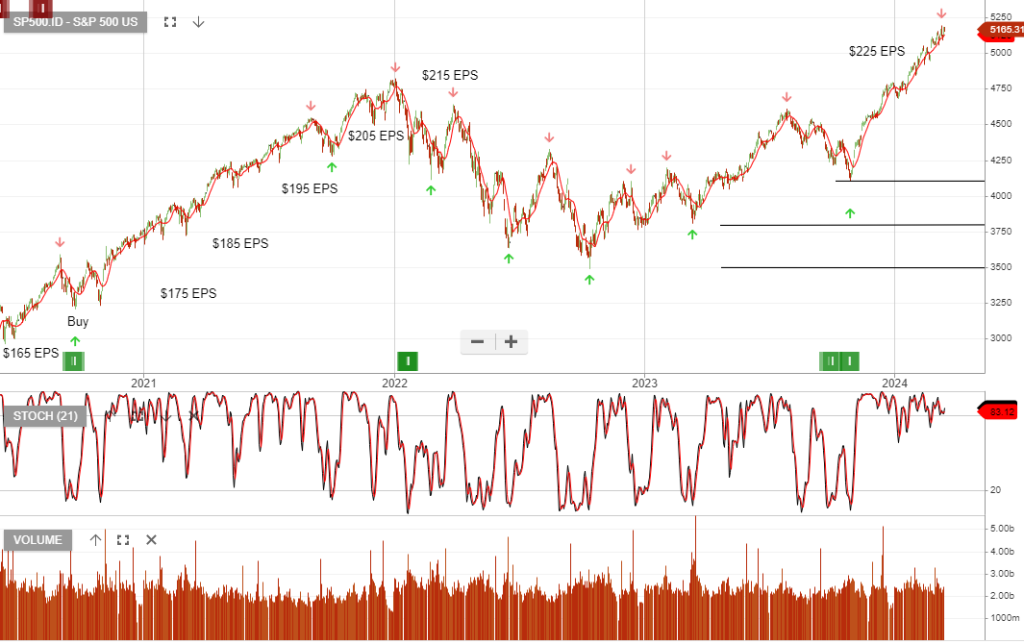

US Share Market: Bull versus Bear

The bullish outlook is supported by…

2024 S&P 500 earnings per share will hit $250, and 2025 EPS will be at $275. A virtuous cycle forming from AI investments will see hyper scalers Microsoft, Amazon, Alphabet, and Meta spend $US180 billion on capex in 2024E, +27% YoY.

The $US38 billion YoY increase in capex represents about 80% of their expected earnings growth YoY.

Semis and networking are the most obvious beneficiaries, but increased power usage and the physical build-out of data centres will lead to more demand for electrification, utilities, commodities, etc. Productivity gains from AI and domestic investments will also provide a significant tailwind.

As big tech enters an investment cycle and the old economy cuts costs/capex, the growth differentials merge between tech and the others to propel the S&P500 much higher.

On the other hand, the bears suggest…

Every technological revolution like this—from the internet to telephones, railroads, or canals—has been accompanied by massive hype and a stock market bubble as investors focus on the technology’s ultimate possibilities, immediately pricing most of its very long-term potential into the current market prices.

Many such revolutions are, in the end, often as transformative as those early investors could see and sometimes even more so – but only after a substantial period of disappointment during which the initial bubble bursts. Thus, as the most remarkable example of the tech bubble, Amazon led the speculative market, rising 21 times from the beginning of 1998 to its 1999 peak, only to decline by an almost inconceivable 92 percent from 2000 to 2002 before inheriting half the retail world!

Are there parallels with the current AI bubble?

Join our Investor Club for a 14-day free trial and access next Monday’s 30-minute live webinar, during which I’ll outline the must-have market playbook.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.