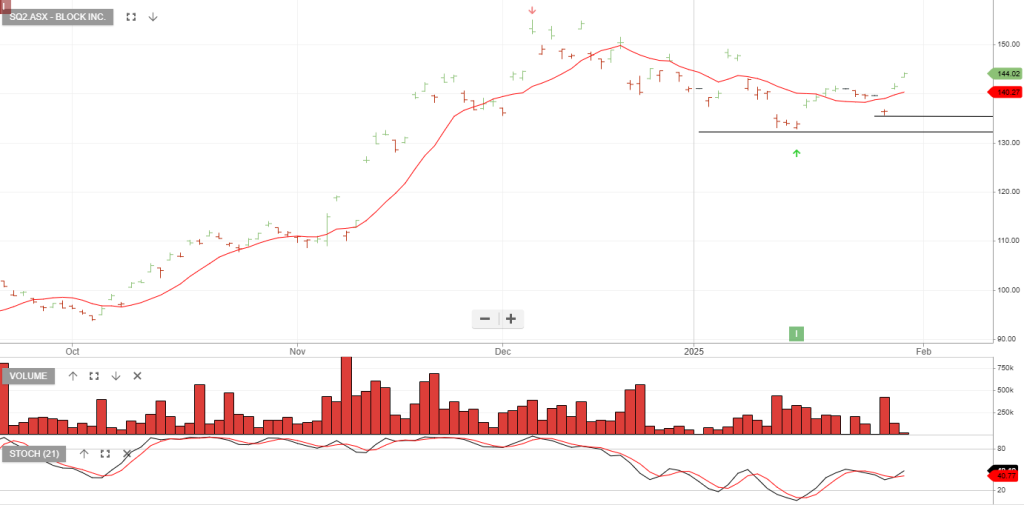

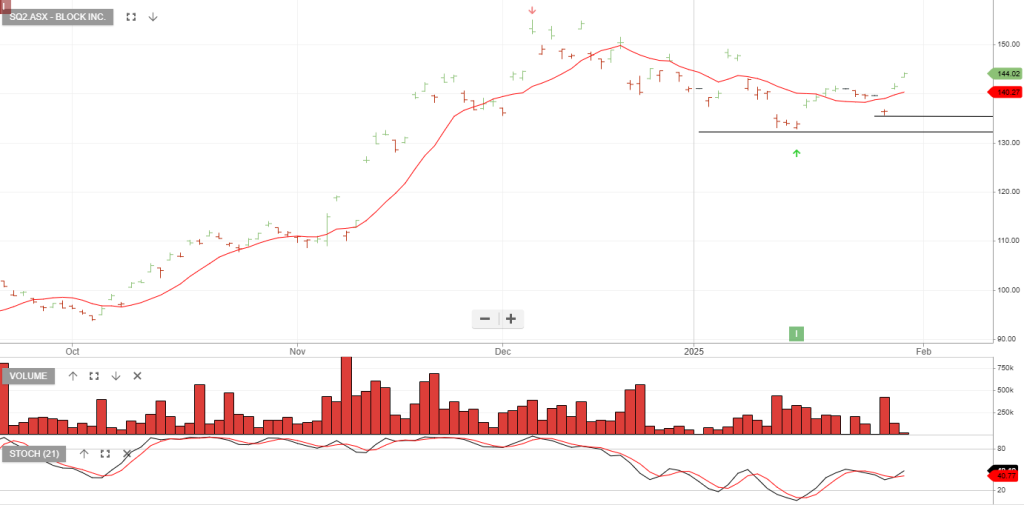

Block Inc

Block is under Algo Engine buy conditions.

Block is under Algo Engine buy conditions.

Endeavour Group is breaking out and a momenteum trade with a stop loss at $4.15, should be considered.

The Magnificent 7 will be in focus, with results from Apple, Tesla, Microsoft, and Meta due out soon.

This week, key earnings reports from Comcast and Intel will show if the turnaround is underway.

RTX topped Q4 estimates, Reporting 9% revenue growth to $21.6 billion and a19% increase in earnings EPS to $1.54 (adjusted).

Lockheed Martin fell after missing earnings. Revenue eased to $18.62 billion, marking three quarters of declining sales growth and earnings of $2.22 per share.

Lockheed Martin guided 2025 earnings between $27 and $27.30 per share. The company forecasts net sales range from $73.75 billion to $74.75 billion.

Industrial giant Caterpillar reports fourth-quarter 2024 results on Jan. 30, before the opening bell. Revenues are estimated at $16.64 billion, suggesting a 2.5% year-over-year decline.

Monday, January 27 – AT&T, Brown & Brown, Nucor, W. R. Berkley, and Ryanair Holdings.

Tuesday, January 28 – Boeing, SAP, RTX, Stryker, and Lockheed Martin.

Wednesday, January 29 – Microsoft, Meta Platforms, Tesla, ASML Holding, and T-Mobile US.

Thursday, January 30 – Apple, Visa, Mastercard, Blackstone, and Thermo Fisher Scientific.

Friday, January 31 – Exxon Mobil, AbbVie, Aon, Colgate-Palmolive, and Charter Communications.

CSL is rated a buy with the stop loss at $268.75

Alcoa has recently been added to our ASX 200 investor model portfolio.

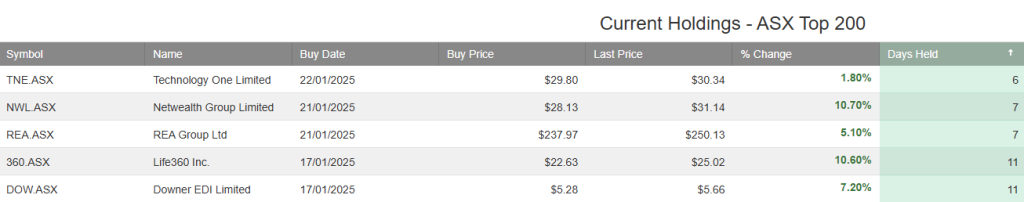

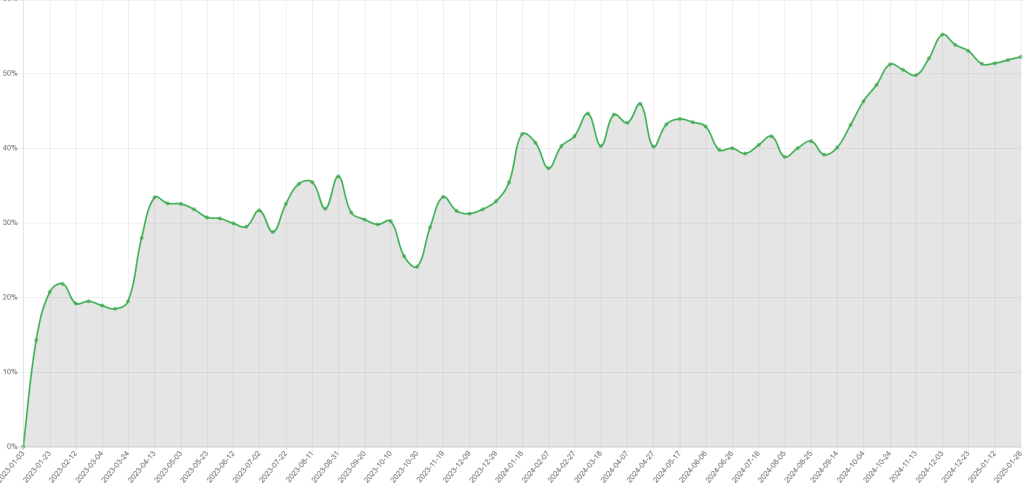

Our ASX200 Trade Table isup 50% over the last 2 years. The table below shows the current holdings.

Or start a free thirty day trial for our full service, which includes our ASX Research.