Beach Energy

Pepper Money

Tabcorp

Treasury Wine

Crude Oil ETF

BetaShares Crude Oil Index ETF-Currency Hedged is forming a pivot low.

Westpac

Westpac Banking signaled a more-rapid return of ~$4bn of excess capital. 1H24 75¢ ordinary dividend, a 15¢ special dividend, and an additional $1bn added to the buyback.

WBC reported 1H24 cash earnings of $3,342m, in line with consensus.

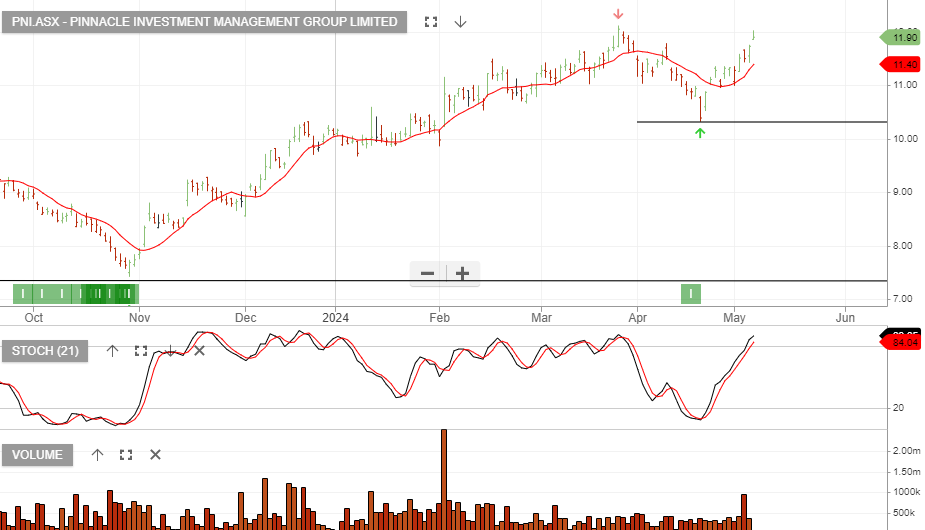

Pinnacle Investment is up 7.2%

Pinnacle Investment Management Group is in the ASX 200 Trade Table, and the position is up 7.2% after a 14-day holding period.

HMC Capital is up 9%

HMC Capital is in the ASX 200 Trade Table, and the position is up 9% after an 8-day holding period.

Pexa is up 17%

Pexa Group is in the ASX 200 Trade Table, and the position is up 17% after a 15-day holding period.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.