Gold Road

Gold Road Resources is under Algo Engine buy conditions.

Gold Road Resources is under Algo Engine buy conditions.

Paladin Energy is under Algo Engine buy conditions.

Rio Tinto is rated a buy with a stop loss at the $105.11 pivot low.

Fortescue is rated a buy with a stop loss at the $15.88 pivot low.

Mineral Resources is rated a buy with a stop loss at the $29.51 pivot low.

Australia’s Foreign Investment Review Board approved the sale of a 49 per cent interest in the Onslow Iron haul road.

BetaShares Crude Oil Index ETF-Currency Hedged is rated a buy at $4.97

Global X Copper Miners is rated a buy at $11.70

Macquarie Technology Group has been added to our watchlist following the recent Algo Engine buy conditions.

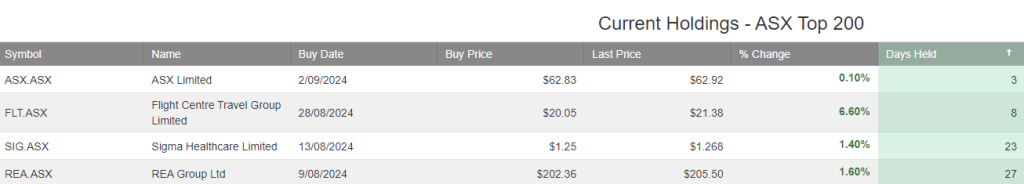

ASX200 Trade Table holdings include…

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Or start a free thirty day trial for our full service, which includes our ASX Research.