The Investor Signals Islamic Quality portfolio offers direct exposure to our proprietary multi-factor selection process of global companies that pass rules-based screens for adherence to Shariah investment guidelines.

Multi-Factor Selection

Why Investor Signals Islamic Global Quality Portfolio?

1. Seek factor-driven outperformance over the long term in a portfolio of global shariah compliant companies.

2. Proven drivers of high growth returns in the global economy.

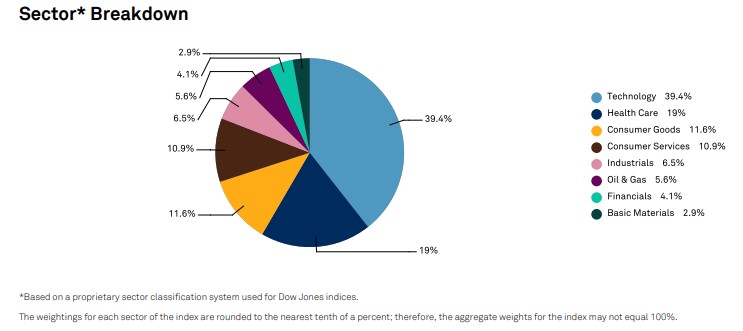

3. Quality (financially healthy firms), Value (inexpensive stocks), Size (Large high-quality balance sheets) and Momentum (trending stocks)

3. Gain cost-efficient access to a rules-based multifactor strategy in a simple managed approach.

Global Leading Sharia Screened Stocks

Plus Global Leading Sharia Screened ETFs

| ETF | Ticker | What It Tracks | Expense Ration |

|---|---|---|---|

| Wahed FTSE USA Shariah ETF | HLAL | FTSE Shariah USA Index | 0.50% |

| Wahed Dow Jones Islamic World ETF | UMMA | Dow Jones Islamic Market International Titans 100 Index | 0.65% |

| Wealthsimple Shariah World Equity Index ETF | WSHR | Dow Jones Islamic Market Developed Markets Quality and Low Volatility Index. | 0.50% |

| SP Funds Dow Jones Global Sukuk ETF | SPSK | Dow Jones Sukuk Total Return Index | 0.65% |

| SP Funds S&P500 Shariah Industry Exclusions ETF | SPUS | S&P 500 Shariah Industry Exclusions Index | 0.49% |

| iShares MSCI World Islamic UCITS ETF | ISWD | MSCI World Islamic Net Total Return Index-USD | 0.60% |

| iShares MSCI Emerging Markets Islamic UCITS ETF | ISDE | MSCI EM Islamic Index | 0.85% |

| Saturna Al-Kawthar Global Focused Equity ETF | AMAP.L | None | 0.75% |

| iShares MSCI USA Islamic UCITS ETF | ISUS | MSCI USA Islamic Net Total Return Index | 0.50% |

| SP Funds S&P Global REIT Shariah ETF | SPRE | S&P Global All Equity REIT Shariah Capped Index | 0.69% |

| Invesco Dow Jones Islamic Global Developed Markets UCITS ETF | IGDA | Dow Jones Islamic Market Developed Markets Index | 0.40% |

Costs: US$2,800 per year. Our allocation models will email you/or your broker instructions on when to add or remove any investment from your managed Islamic portfolio. This means, no new brokerage accounts or added paperwork. Simple, quick, and efficient.

100% Money Back Guarantee. No questions asked, no delays if you’re unhappy with our service after the first 90 days. We refund 100% of your purchase price.

What should you expect: It’s essential to recognize that our model is a medium-term investment strategy and statistically generates an average of 8 rebalancing transactions per annum. Meaning the workload is minimal, transaction costs are low and portfolio tracking and performance is easy to keep on top of.

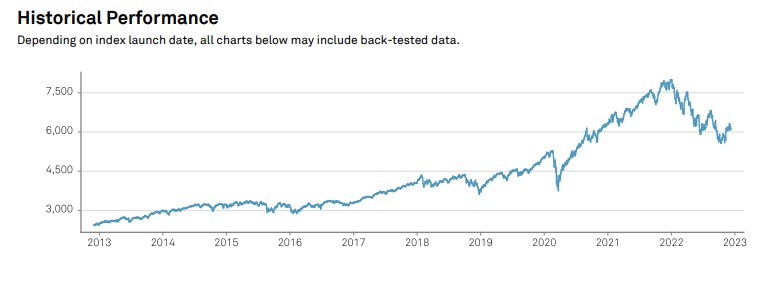

Does it work: The results speak for themselves. Over the last 10 years, our model has turned $100,000 into $1,300,000 million dollars, outperforming the S&P500 by a wide margin. Our multi-factor approach is unique, and our blended models of quality, growth, and momentum work to identify the optimum entry and exit timing around the highest quality Sharia-compliant companies in the world.

Get Started Today

Join today and receive your current portfolio starting point instructions and automatically receive all rebalancing buy/sell instructions going forward.