When share prices are expected to remain flat, the covered write can be used to generate income, while also providing some protection against an unexpected fall in the market. The strategy consists of writing a call option against shares you hold in the underlying stock.

| When to use the covered write | |

|---|---|

| Market outlook | neutral |

| Volatility outlook | steady/falling |

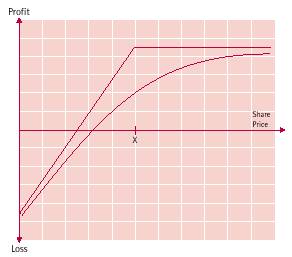

Payoff diagram

| The covered write | |

|---|---|

| Construction | long stock, short call X |

| Point of entry | market usually around X, but can vary |

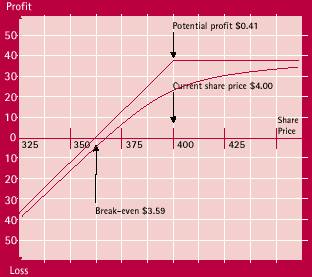

| Breakeven at expiry | share price at time of writing option less premium received |

| Maximum profit at expiry | time value component of option premium plus the difference between strike price and share price if option is out-of-the-money when written |

| Maximum loss at expiry | share price at time of writing option less premium received |

| Time decay | helps |

| Margins to be paid? | no (if underlying stock lodged as collateral) |

| Synthetic equivalent | short put X |

Profits and losses

The maximum profit possible from the at-the-money covered write is the premium earned for writing the option. This will be earned if at expiry the share price is at, or above the share price of the call option sold.

The potential loss with this strategy is unlimited, since the investor holds the stock. Any fall in the share price will result in unrealised losses. However, since the short call will be worthless at expiry if the share price falls below the exercise price of the option, the premium earned on the sale of the option serves to provide some protection from the decline in value of the shares.

Although an unexpectedly strong rise in the share price will not result in a physical loss, there is an ‘opportunity cost’. This is because the investor will only receive the option premium and must forgo the increased value of the shares as they will be obliged to sell their shares at the exercise price of the option they have written.

Other considerations

- Strike price: when choosing which option to sell, the trader must balance the income to be earned against the possibility that the option will be exercised. Writing in-the-money calls will generate the most income and provide the greatest protection in the event of a market downturn.

However the possibility that the option will be exercised is high. Writing at-the-money options will earn the investor the most time value. The choice of strike price will largely depend on whether the investor’s view is neutral leaning to bullish, or neutral leaning to bearish. - Exercise: the writer of a call option must always remember that the option can be exercised at any time. As a result, the investor must be content to lose the stock at that price.

- The buy and write: the buy and write is the simultaneous writing of calls and purchase of the same number of shares over which the options will be written. It represents a method of purchasing stock at levels below the current market price.

- Covered writing can also be done with stock bought on margin.

Follow-up action

If the share price remains flat and volatility remains steady or falls, the position may be left open in order to take advantage of time decay.

If the share price unexpectedly strengthens, the trader may consider closing out the position and possibly rolling up to the next strike price. If expiry is approaching and the trader is concerned about unwanted exercise, the position could be closed out and rolled into the next expiry date, thereby avoiding exercise and potentially increasing the income flow.

Points to remember

- Do not use the covered write if you are concerned about being exercised.

- Be sure that you are happy with the price you will obtain for your shares if you are exercised.

- Given the possibility the options will be exercised, be sure that the premium received is adequate compensation.

Example

XYZ shares have had a run up to $4.00 over the last six months. You believe that the market is quietening down and the stock will remain at these levels over the next three months. In order to gain some income during this time you decide to write call options over your existing holdings. It is now September. You sell 1 December $4.00 Call @ $0.41.

Disclaimer

The information contained in this webpage is for educational purposes only and does not constitute financial product advice

https://www.asx.com.au/products/equity-options/covered-write-options-trading-strategy.htm