Intel

INTC:NAS has rallied following the breakout above the $31 resistance. Several analysts have upgraded their price targets, and commentary has generally turned bullish. The trailing stop loss should be lifted to $32.50.

INTC:NAS has rallied following the breakout above the $31 resistance. Several analysts have upgraded their price targets, and commentary has generally turned bullish. The trailing stop loss should be lifted to $32.50.

MU:NAS was added to our model portfolio in March 2023 at $56 and is now up 134%. We recommend watching for the next Algo Engine buy signal.

Micron reported 50% sequential data center revenue growth in Q3, driven by AI demand. The company is well-positioned to benefit from the CHIPS Act and plans to expand its manufacturing.

Thursday, July 11 – Delta Air Lines, PepsiCo, and Conagra Brands.

Friday, July 12 – Citigroup, JPMorgan Chase, Bank of New York Mellon, and Wells Fargo.

RTX:NYS is rated a buy with a stop loss at $93.00

GEHC:NAS is rated a buy with a stop loss at $74.51

IHI:ARC is rated a buy with a stop loss at $54.17

OKTA:NAS is rated a buy with a stop loss at $85.80

AMD:NAS is rated a buy with a stop loss at $153.64

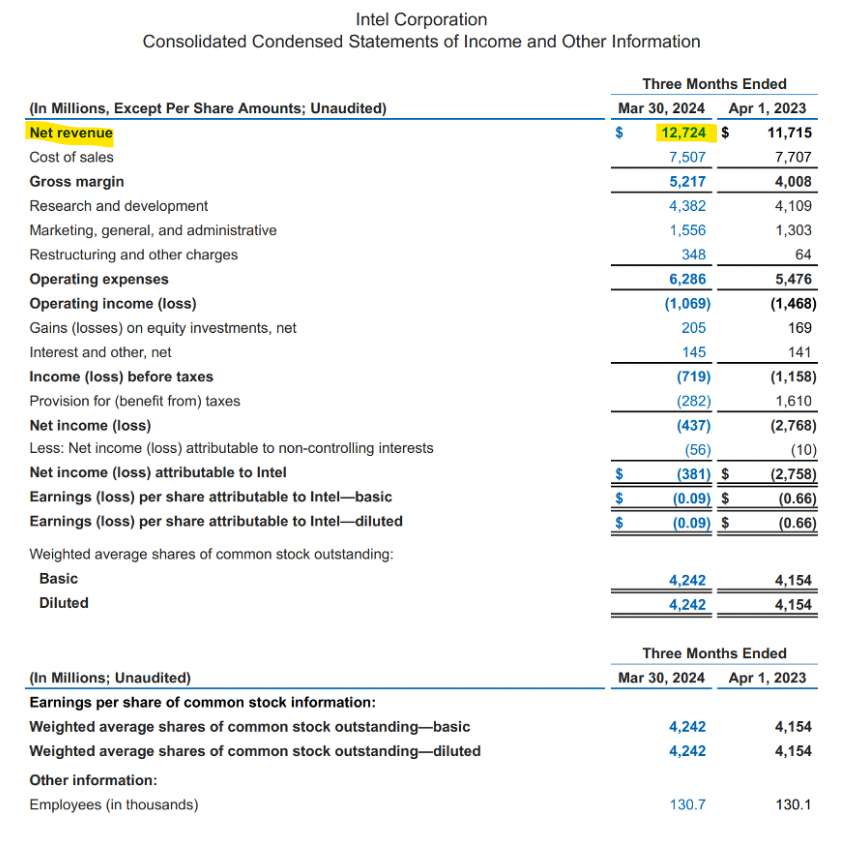

Revenue increased from $11.7b in Q1/23 to $12.7b in Q1/24, resulting in 8.6% year-over-year growth.

Intel is now reporting in two major segments – Intel Foundry and Intel Products.

The chart pattern shows support at $30.00

The long-term chart suggests investors should accumulate the stock within the $25 – $35 range and look for a multi-year recovery starting in 2025.

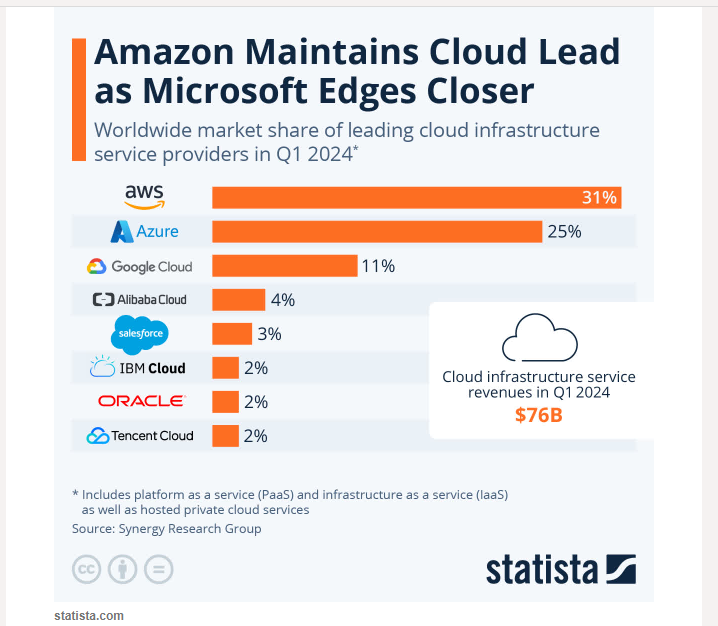

Alibaba Group Holding Limited American Depositary Shares each representing eight Ordinary Alibaba’s investments in cloud & AI sets up the company for significant future gains.

We rate Alibaba a buy with a stop loss at $71.80

Or start a free thirty day trial for our full service, which includes our ASX Research.