Super Micro Computers

Super Micro Computer, is rated a buy within the $575 – $625 price range.

Super Micro Computer, is rated a buy within the $575 – $625 price range.

Micron Technology, Inc. – Common is rated a buy within the $80 -$90 price range.

Grab Holdings is under Algo Engine buy conditions. We expect buying support to build near the $3.10 support.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Consensus expectations for S&P 500 companies’ earnings per share for 2024, 2025, and 2026 are $US243, $US279, and $US317.

Based on current PE ratios, the index is trading in line. If the EPS increased to $279 next year, the index would be at 6000 points. The question is, can earnings grow at the forecast rate, or will slowing global GDP begin to drag, and earnings come in at a lower than forecast level in 2025?

For share-term traders, you should be on the long side of the index (once again), with a stop loss at 5493.

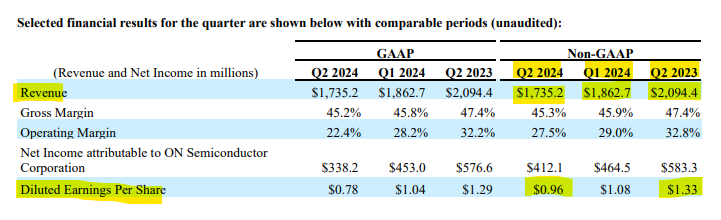

ON Semiconductor Corporation – Common 2Q quarter revenue was $1.73bn, with GAAP diluted earnings per share and non-GAAP diluted earnings per share of $0.78 and $0.96, respectively.

The company returned $650 million of free cash flow over twelve months to shareholders through stock repurchases.

NAS:PLTR remains on track to become a leader in the AI software industry.

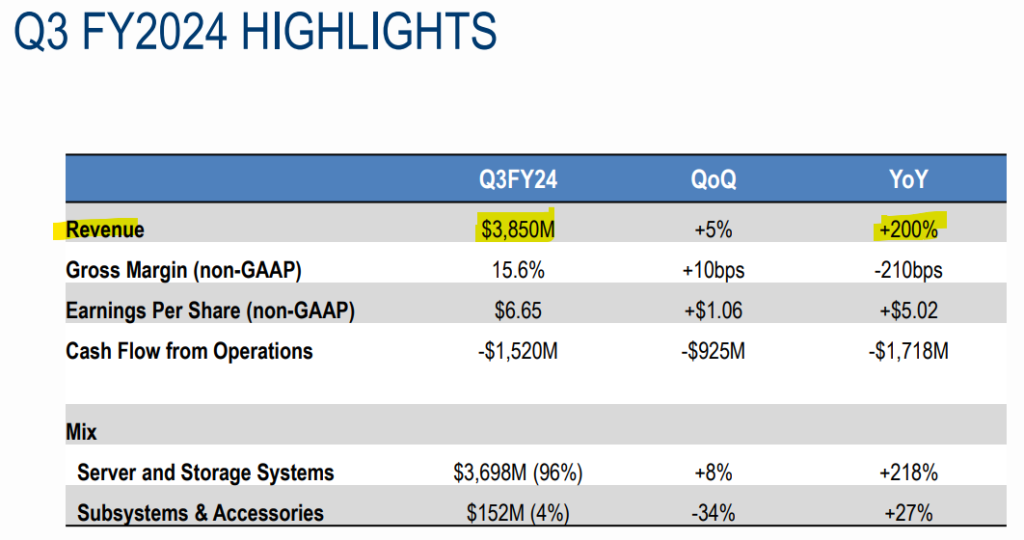

Super Micro Computer, trades on a forward PE of 30x earnings. The June 2024 earnings release is scheduled for 6 Aug.

Super Micro Computer develops and manufactures high-performance server solutions, vital for data centers that power LLMs.

Last quarter results.

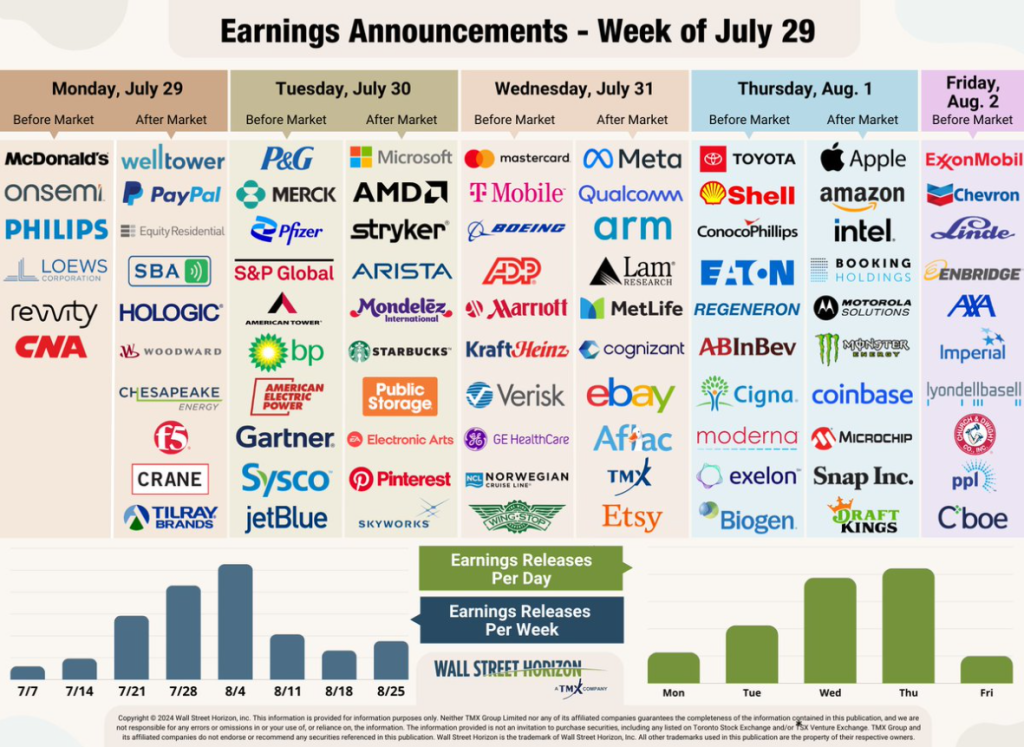

Week 3.

Monday, July 29 – McDonald’s, ON Semiconductor, and Welltower.

Tuesday, July 30 – Microsoft, Procter & Gamble, Merck, Advanced Micro Devices, Pfizer, Starbucks, and S&P Global.

Wednesday, July 31 – Meta Platforms, Mastercard, Qualcomm, Western Digital Corporation, Arm Holdings, Boeing, eBay, Altria, Marriott International.

Thursday, August 1 – Amazon, Apple, Intel, Block, DoorDash, Cigna, ConocoPhillips, Anheuser-Busch InBev, Roblox, and DraftKings.

Friday, August 2 – Church & Dwight, Chevron, and Exxon Mobil.

Week 2.

Monday, July 22 – Verizon Communications and NXP Semiconductors.

Tuesday, July 23 – Alphabet, Tesla, Visa, The Coca-Cola Company, Texas Instruments, Philip Morris International, United Parcel Service, Lockheed Martin, General Motors, and Comcast.

Wednesday, July 24 – International Business Machines, AT&T, Chipotle Mexican Grill, General Dynamics, and Ford Motor.

Thursday, July 25 – AbbVie, Northrop Grumman, Union Pacific, and AstraZeneca.

Friday, July 26 – Bristol Myers Squibb, Colgate-Palmolive, and Charter Communications.

Week 2.

Monday, July 15 – Goldman Sachs and BlackRock.

Tuesday, July 16 – UnitedHealth, Bank of America, Progressive, Morgan Stanley, PNC Financial, and J.B. Hunt Transport.

Wednesday, July 17 – Johnson & Johnson, U.S. Bancorp, Kinder Morgan, United Airlines, and Ally Financial.

Thursday, July 18 – Netflix, Abbott Laboratories, Blackstone, Domino’s Pizza, and Taiwan Semiconductor Manufacturing.

Friday, July 19 – American Express, Halliburton, and Traveler.

Week 1

Thursday, July 11 – Delta Air Lines, PepsiCo, and Conagra Brands.

Friday, July 12 – Citigroup, JPMorgan Chase, Bank of New York Mellon, and Wells Fargo.

International Business Machines Corporation Common earned $1.99 per share in the June quarter, as revenue rose 1.9% year-over-year to come in at $15.77B. The company also expects revenue for the full year to be up mid-single digits.

Or start a free thirty day trial for our full service, which includes our ASX Research.