Micron Technology

Micron Technology, Inc. – Common is under Algo Engine buy conditions.

Micron Technology, Inc. – Common is under Algo Engine buy conditions.

Advanced Micro Devices, Inc. – Common is under Algo Engine buy conditions.

NVIDIA Corporation – Common is under Algo Engine buy conditions.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

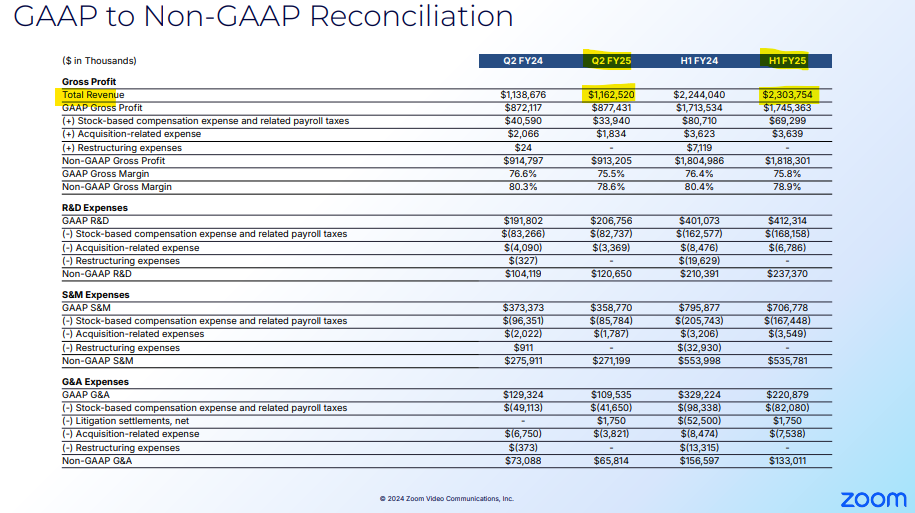

Zoom Video Communications, Inc. – Class A Common surged 17% after delivering better-than-expected 2Q FY2025 results and raising forward guidance.

NVIDIA Corporation – Common is under Algo Engine buy conditions.

The company is expected to report fiscal second-quarter 2025 results on August 28th, and analysts expect another robust quarter for the company. Earnings and revenue are expected to more than double versus a year ago, to $0.65 per share on revenue of $28.7 billion.

SMCI:NAS reported FY24 results with a 109% increase in top-line revenue, at $14.9B vs $7.1B a year before.

FY25 revenue is forecast to be up 90% to $28 billion.

HON:NAS is rated a buy at $190.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Or start a free thirty day trial for our full service, which includes our ASX Research.