S&P500 & Market Direction

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

US Earnings

Monday, February 3 – Palantir Technologies, NXP Semiconductors, IDEXX Laboratories, Tyson Foods, and Clorox.

Tuesday, February 4 – Alphabet, Merck, PepsiCo, Advanced Micro Devices, and Amgen.

Wednesday, February 5 – Novo Nordisk, Walt Disney, Qualcomm, Arm Holdings, and Uber Technologies.

Thursday, February 6 – Eli Lilly, Linde, Honeywell International, ConocoPhillips, Neurocrine Biosciences, and Bristol-Myers Squibb.

February 7 – Fortive, Cboe Global Markets, Banco Bradesco, and Kimco Realty.

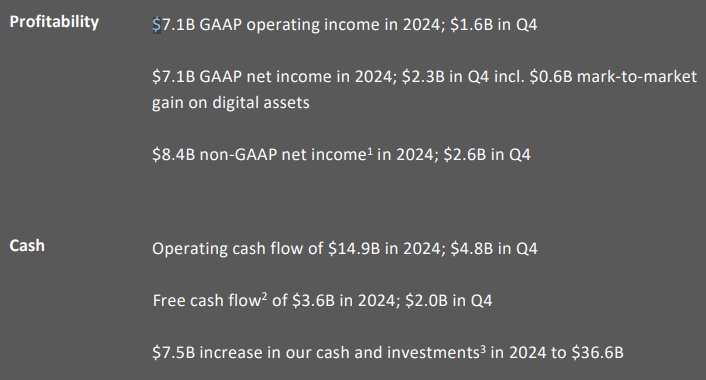

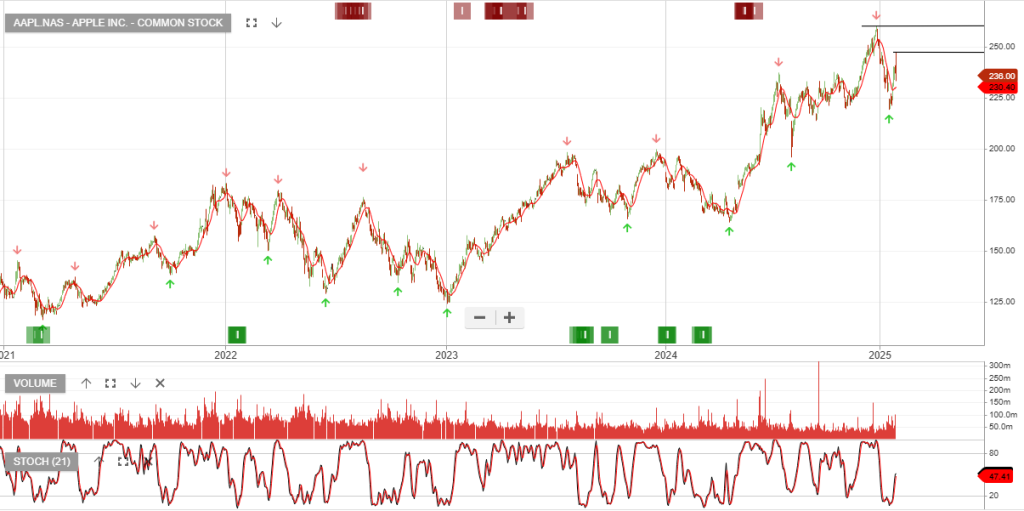

Apple Inc: Q1 Earnings

Apple Inc. – Common is under Algo Engine sell conditions.

Q1 2025 earnings: $124.3 billion in total revenue, YoY a 3.95% increase. Products increased by 1.56% YoY to $97.96 billion, while services grew by 13.94% YoY to $26.34 billion.

Apple increased its gross profit by 6.23% YoY to $58.28 billion. On the bottom line, AAPL generated $36.33 billion of net income, a YoY increase of 7.12%, and EPS increased by 13.73% or $2.41 per share.

Microsoft Earnings: Dec Quarter

Microsoft Corporation – Common

Microsoft’s revenue grew 12.3% year over year in the fiscal second quarter, which ended on Dec. 31. Net income of $24.11 billion was up from $21.87 billion in the same quarter a year ago.

Magnificent 7

The Magnificent 7 will be in focus, with results from Apple, Tesla, Microsoft, and Meta due out soon.

Beyond Big Tech

This week, key earnings reports from Comcast and Intel will show if the turnaround is underway.

Aerospace and Defense

RTX topped Q4 estimates, Reporting 9% revenue growth to $21.6 billion and a19% increase in earnings EPS to $1.54 (adjusted).

Lockheed Martin fell after missing earnings. Revenue eased to $18.62 billion, marking three quarters of declining sales growth and earnings of $2.22 per share.

Lockheed Martin guided 2025 earnings between $27 and $27.30 per share. The company forecasts net sales range from $73.75 billion to $74.75 billion.

Caterpillar Reports Earnings

Industrial giant Caterpillar reports fourth-quarter 2024 results on Jan. 30, before the opening bell. Revenues are estimated at $16.64 billion, suggesting a 2.5% year-over-year decline.

US Earnings

Monday, January 27 – AT&T, Brown & Brown, Nucor, W. R. Berkley, and Ryanair Holdings.

Tuesday, January 28 – Boeing, SAP, RTX, Stryker, and Lockheed Martin.

Wednesday, January 29 – Microsoft, Meta Platforms, Tesla, ASML Holding, and T-Mobile US.

Thursday, January 30 – Apple, Visa, Mastercard, Blackstone, and Thermo Fisher Scientific.

Friday, January 31 – Exxon Mobil, AbbVie, Aon, Colgate-Palmolive, and Charter Communications.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.