US Earnings

Monday, December 18 –

Tuesday, December 19 – FedEx & Accenture.

Wednesday, December 20 – Micron Technology

Thursday, December 21 – Paychex, Carnival, and Nike.

Monday, December 18 –

Tuesday, December 19 – FedEx & Accenture.

Wednesday, December 20 – Micron Technology

Thursday, December 21 – Paychex, Carnival, and Nike.

Monday, December 11 – Oracle.

Tuesday, December 12 – Johnson Controls International.

Wednesday, December 13 – Adobe.

Thursday, December 14 – Costco.

Friday, December 15 –

S&P 500 earnings are forecast to grow 2-5 percent next year with EPS of $US225. This supports a price target of 4500 points for the index.

Crude Oil futures are trading $69.50

We’re bullish on value names as the gap in performance between growth and value widens. For example, the Russell 3000 Growth is up 34% this year, while the Russell 3000 Value is flat. This is one of the largest gaps in recorded history.

Small-cap value is among the most compelling investment opportunities in 2024.

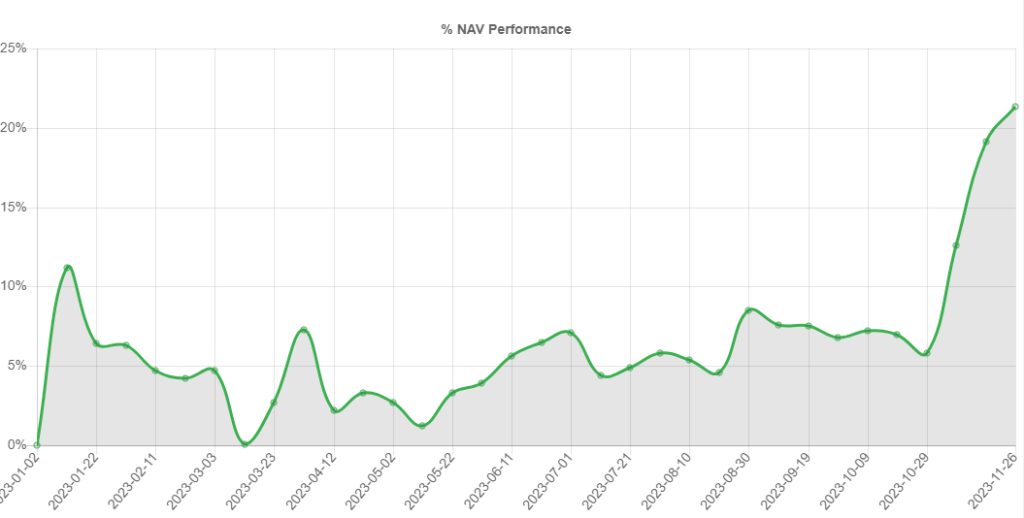

NASDAQ Trade Table is up 21.3% YTD.

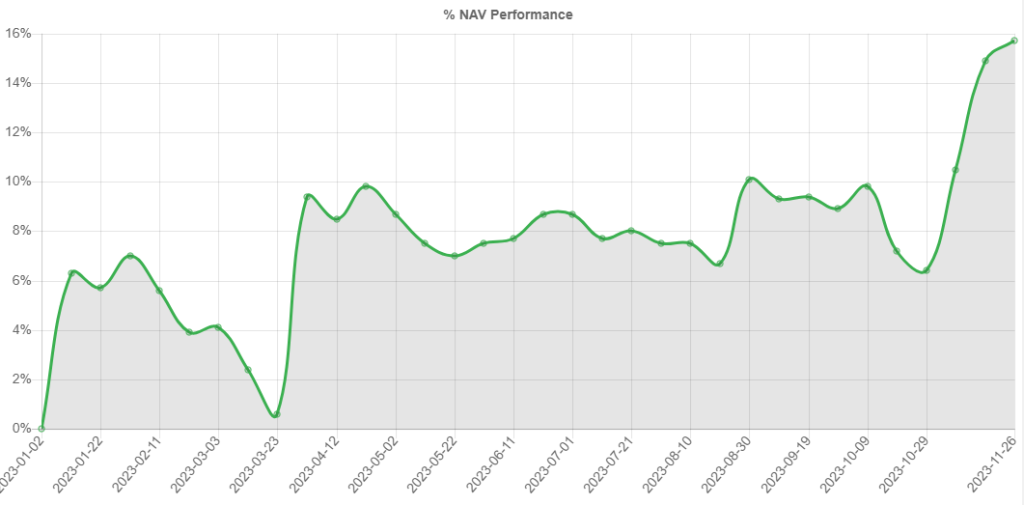

S&P 100 Trade Table is up 15.7% YTD

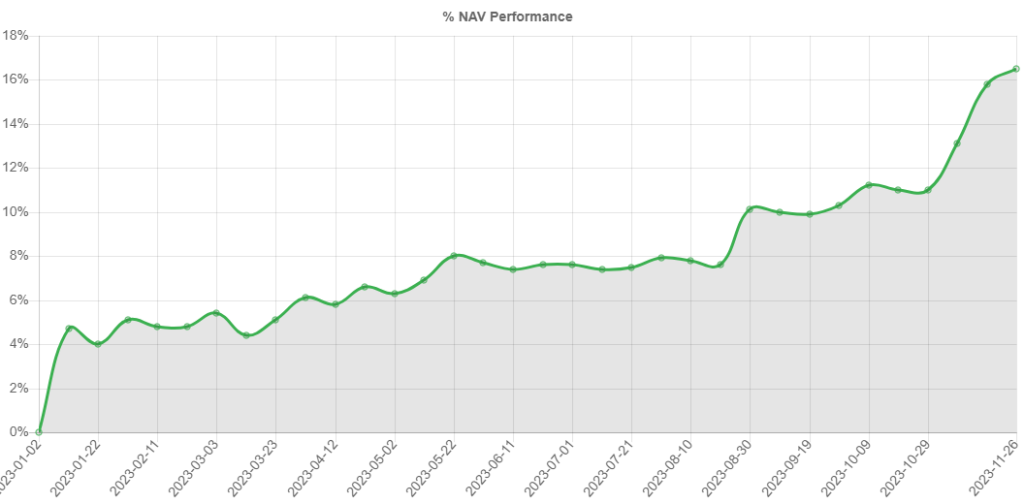

US Technolgy Disruptors is up 16.5% YTD

This week, I’m watching the following US earnings.

Monday, November 27 – Zscaler.

Tuesday, November 28 – Intuit, Workday, Splunk, NetApp, Hewlett Packard Enterprise, and CrowdStrike.

Wednesday, November 29 – Salesforce and Snowflake.

Thursday, November 30 – Dell Technologies, and Kroger.

Friday, December 1 –

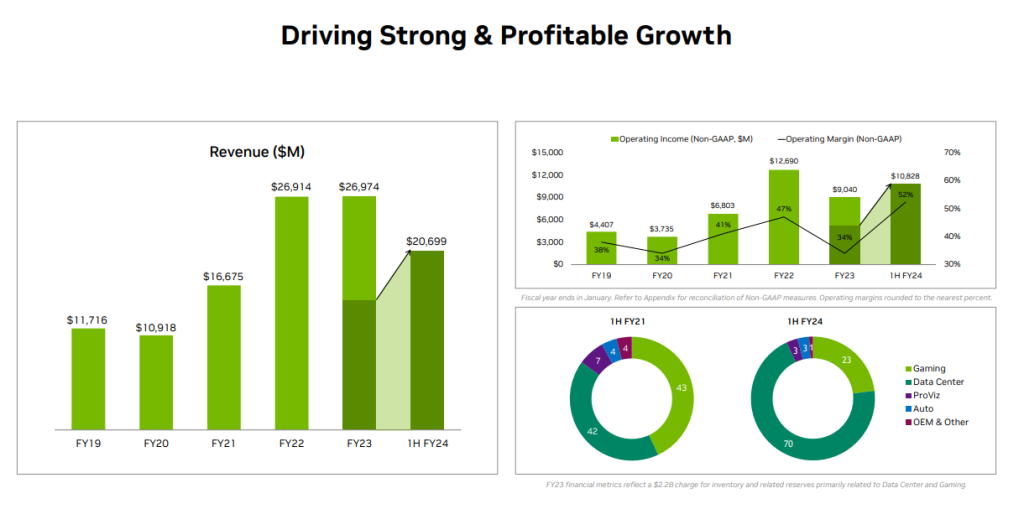

Third-quarter revenue increased 34% from the prior quarter and 206% from a year ago, reflecting how increased demand for AI has boosted the company’s sales throughout 2023.

The company’s revenue guidance for the current quarter also topped estimates, coming in at $20 billion.

These are the US companies reporting earnings that I’m watching this week.

Monday, November 20 – Zoom Video.

Tuesday, November 21 – Nvidia, Medtronic, Analog Devices, Autodesk, Baidu, HP.

Wednesday, November 22 – Deere.

Intel Corporation – Common is a current holding in our US Trade Table, after 20 days the trade is up 22%

Or start a free thirty day trial for our full service, which includes our ASX Research.