Honeywell

HONEYWELL ANNOUNCES FOURTH QUARTER

AND FULL YEAR 2023 RESULTS; ISSUES 2024 GUIDANCE

- Fourth Quarter Earnings Per Share of $1.91 and Adjusted Earnings Per Share1

of $2.60, Above Midpoint of

Previous Guidance - Fourth Quarter Sales of $9.4 Billion, Reported Sales Up 3%, Organic1

Sales Up 2% - Full Year Operating Cash Flow of $5.3 Billion and Free Cash Flow1

of $4.3B, at High End of Previous Guidance - Deployed $8.3 Billion of Capital to Share Repurchases, Dividends, Capital Expenditures, and M&A in 2023

- Expect 2024 Adjusted Earnings Per Share2,3 of $9.80 – $10.10, Up 7% – 10%

- Vimal Kapur to Become Chairman of the Board; New Independent Lead Director Announced

Mega-cap US tech

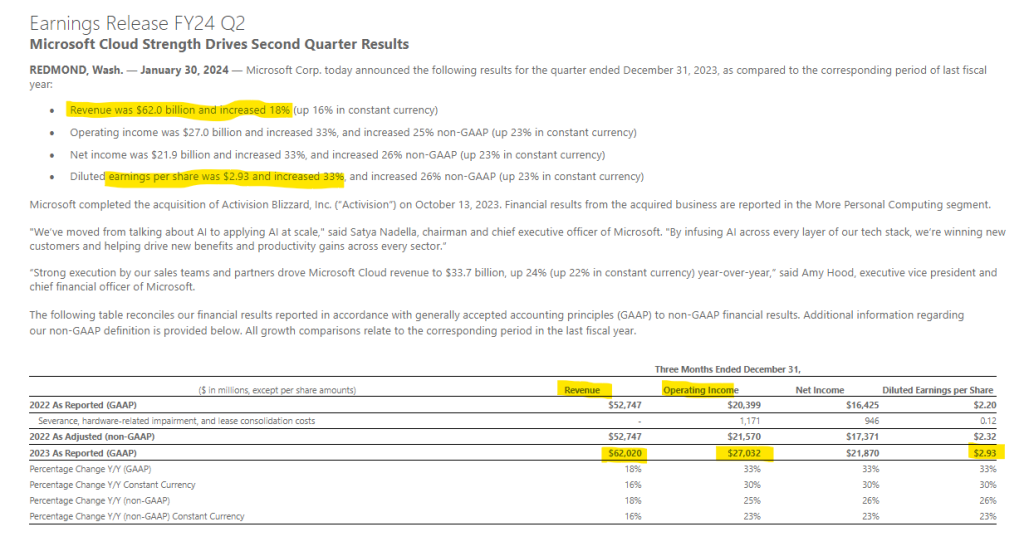

Mega-cap US tech stocks Microsoft, Alphabet, Amazon, and Meta will all report this week. Microsoft will be the most important earnings report and conference call as the launch of Copilot success and early adoption of AI is likely see earnings exceed the Street’s top-line revenue of $US61 billion and EPS of $US2.77.

Microsoft

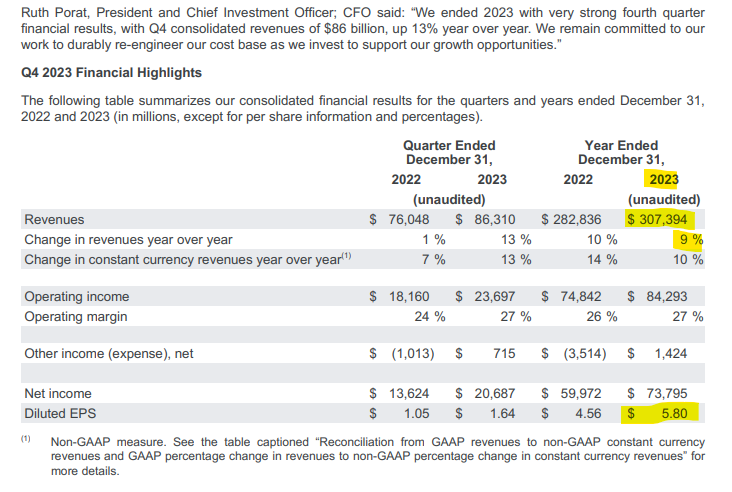

Alphabet

Meta

Intel

INTC:NAS is under Algo Engine buy conditions. We suggest accumulating Intel within the $40 – $44 price range. Patient investors can expect Intel shares to double over the next 3 – 5 years.

US Earnings

Monday, January 29 – Whirlpool and Nucor.

Tuesday, January 30 – General Motors, United Parcel Service, Sysco, Pfizer, Alphabet, Microsoft, Starbucks, Mondelez International, and Advanced Micro Devices.

Wednesday, January 31 – Phillips 66, Boeing, Mastercard, MetLife, Qualcomm, and Boeing.

Thursday, February 1 – Merck, Honeywell, Altria, Amazon, Apple, Meta Platforms, Royal Caribbean Cruises and Post Holdings.

Friday, February 2 – Exxon Mobil, Chevron, AbbVie, and Charter Communications.

Future Security ETF

SPDR S&P Kensho Future Security ETF is a unique defense ETF that takes a differentiated, forward-looking approach to national security and the defense industry.

US Earnings

Monday, January 22 – Brown & Brown, United Airlines Holdings, and Zions Bancorporation.

Tuesday, January 23 – Johnson & Johnson, Procter & Gamble, Netflix, Verizon Communications, Texas Instruments, General Electric, and Lockheed Martin.

Wednesday, January 24 – Tesla, Abbott Laboratories, IBM, AT&T, General Dynamics, Las Vegas Sands, and CSX.

Thursday, January 25 – Visa, Intel, Comcast, Union Pacific, American Airlines Group, Southwest Airlines, Levi Strauss and Alaska Air Group.

Friday, January 26 – American Express, Colgate-Palmolive, Norfolk Southern, and Autoliv.

S&P500 & Market Direction

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

US Earnings

Tuesday, January 16 – Morgan Stanley, Goldman Sachs, PNC Financial, and Interactive Brokers.

Wednesday, January 17 – Prologis, Charles Schwab, U.S. Bancorp, Kinder Morgan, and Alcoa.

Thursday, January 18 – Truist Financial, KeyCorp, Fastenal Company, and Birkenstock.

Friday, January 19 – Ally Financial, Comerica, Fifth Third, and Travelers.

Crude Oil Futures

Oil needs to hold above the $70.13 higher low support level.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.