Zoom Q4 2024 Earnings

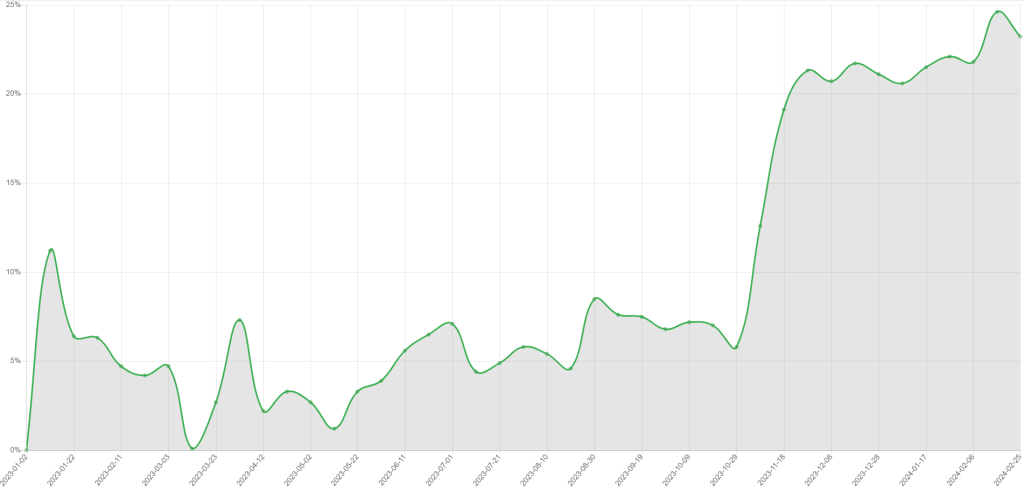

ZM:NAS fourth quarter total revenue of $1,146.5 million, up 2.6% year over year. Fourth quarter Enterprise revenue of $667.3 million, up 4.9%.

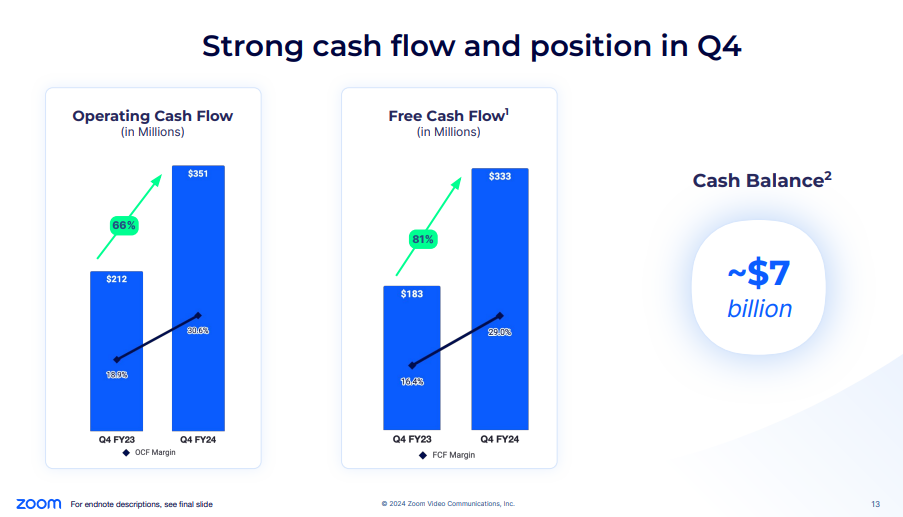

Total cash, cash equivalents, and marketable securities, excluding restricted cash, as of January 31, 2024 was $7.0 billion.