MongoDB

MongoDB, Inc. – Class A Common trades on a stretched PE ratio. However, we’re looking for buying momentum to pick up within the $300 – $360 price range.

MongoDB, Inc. – Class A Common trades on a stretched PE ratio. However, we’re looking for buying momentum to pick up within the $300 – $360 price range.

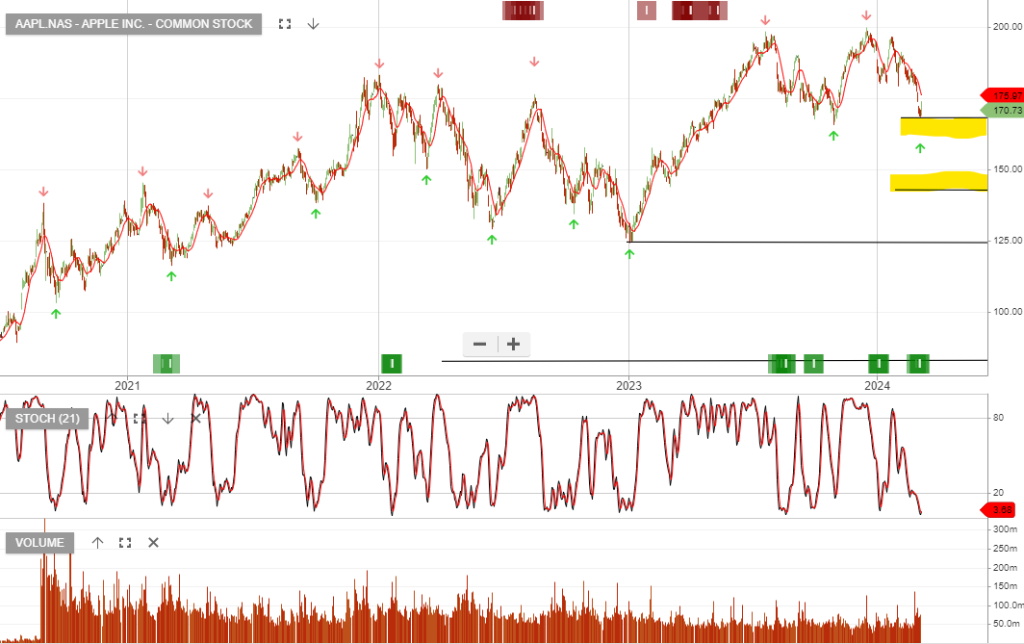

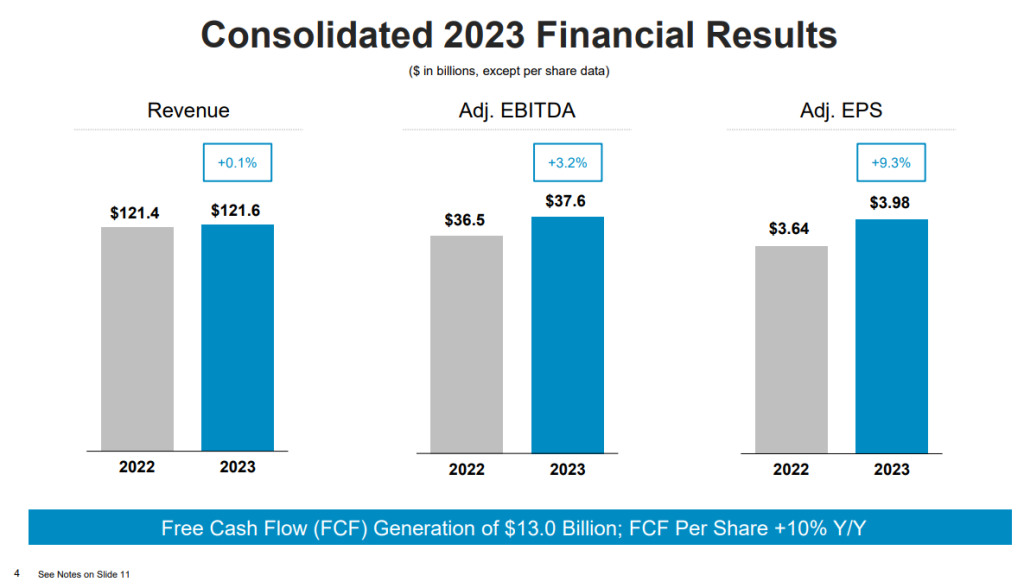

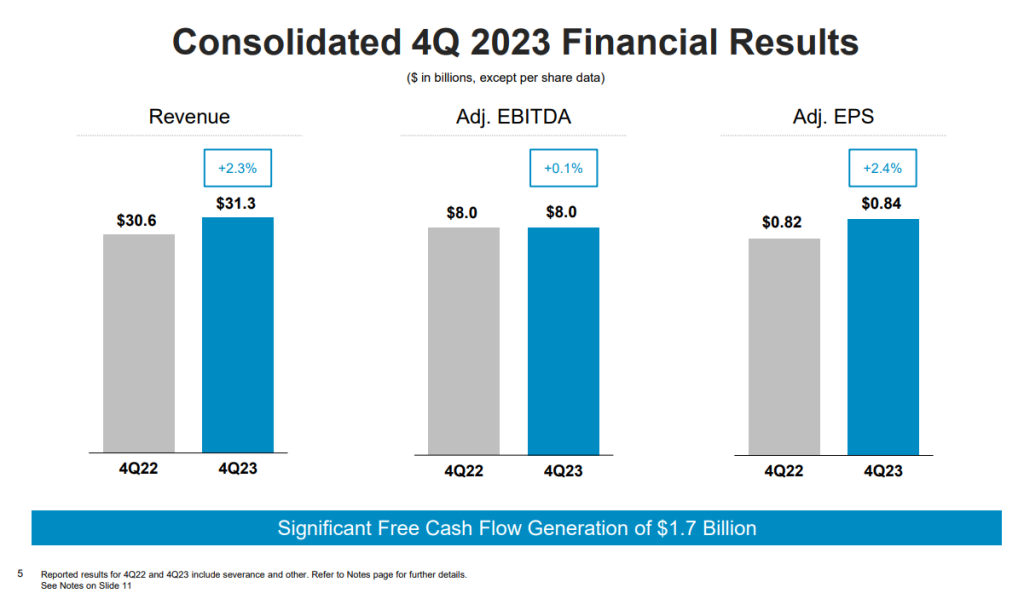

In Q4 2023, the group achieved a market-weighted average of 60% YoY operating profit expansion, while Apple contributed an underperforming 11%.

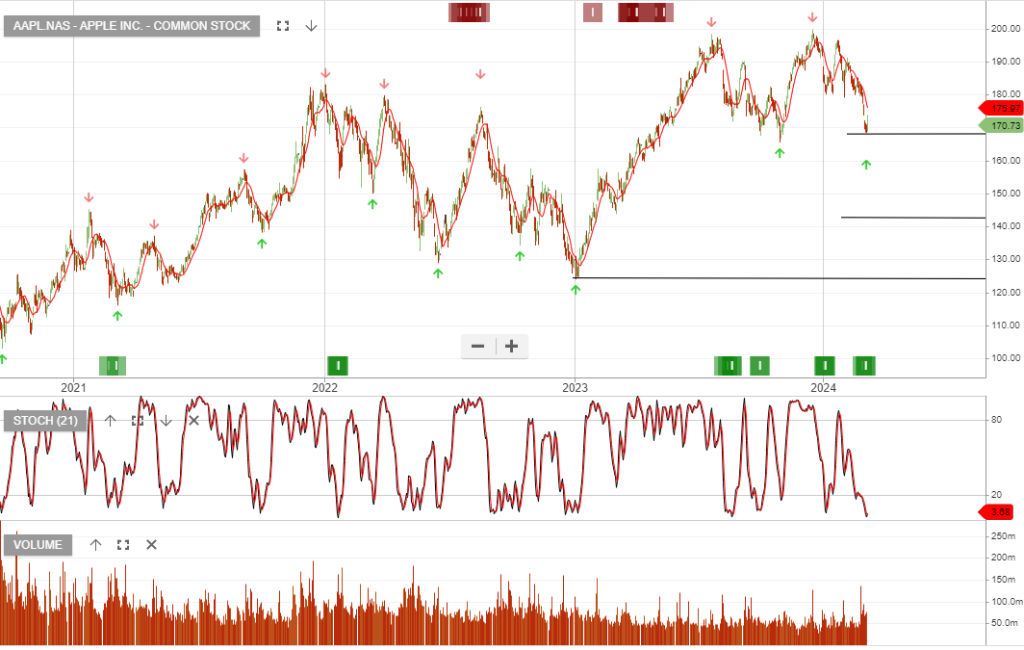

Apple and Google are under recent algo engine buy signals, and we’re now building exposure within the identified value ranges.

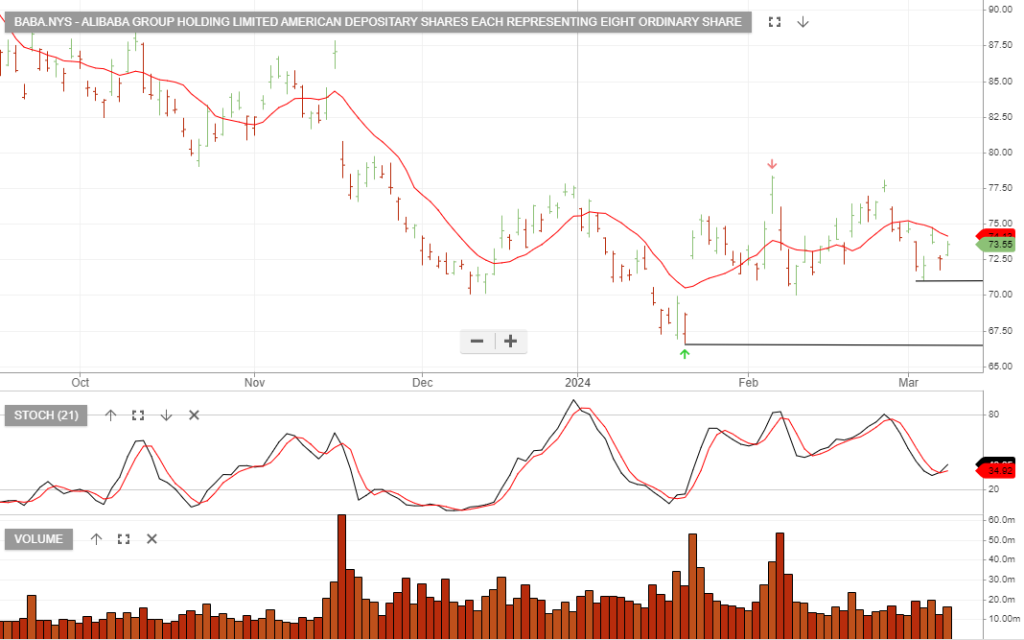

We’re bullish on China tech giants following the increased buyback programs now in place.

JD recently announced that it would increase its buyback program by $3 billion, representing 7% of its market cap.

Alibaba upped its authorized buybacks by $25 billion and committed to retiring 3% of shares annually.

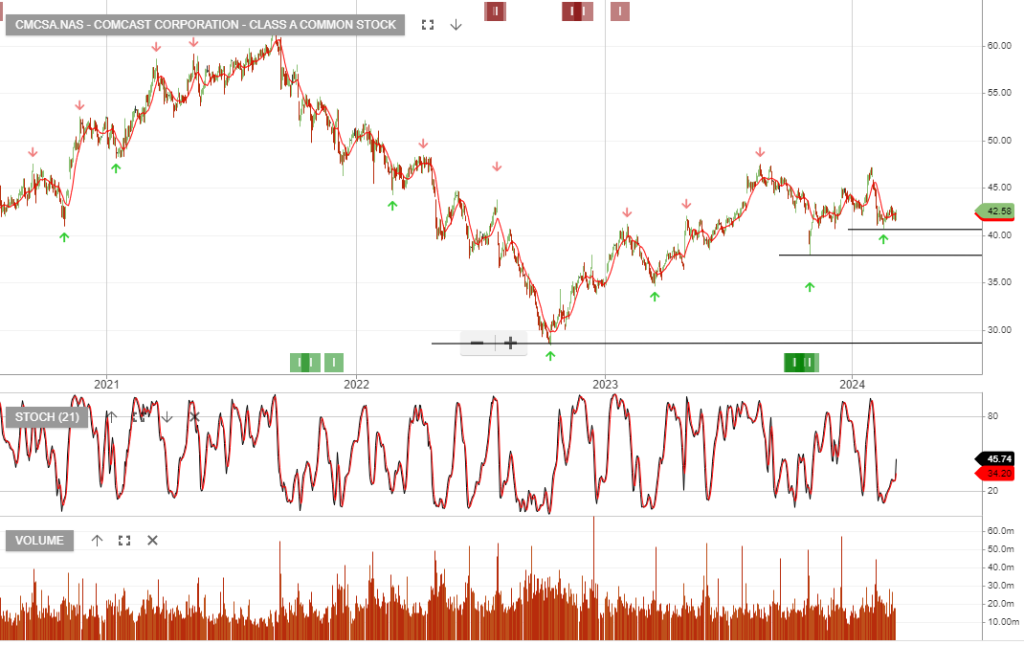

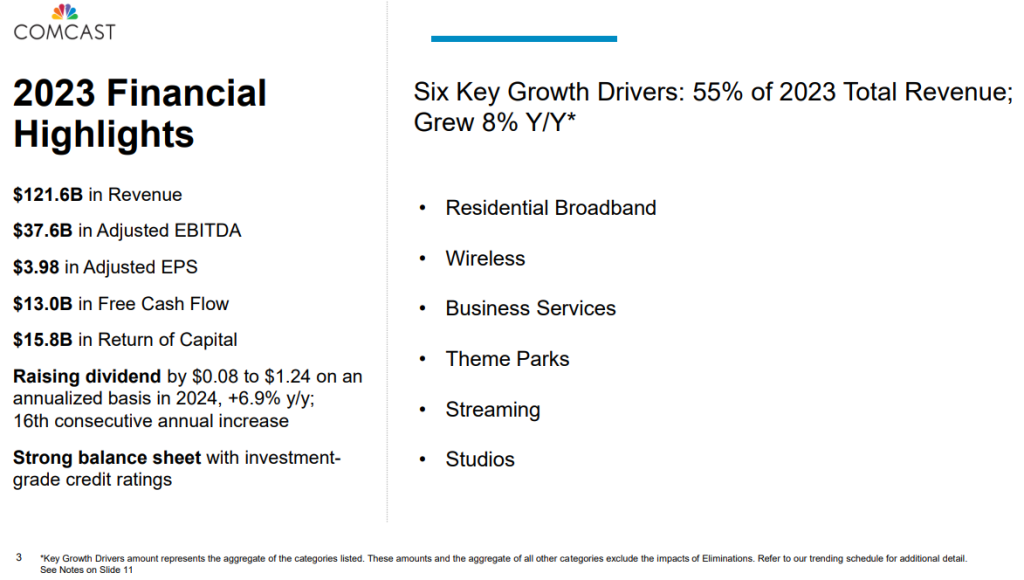

CMCSA:NAS is under Algo Engine buy conditions, and at 10x earnings, the valuation is not demanding.

Peacock revenue increased by 57%, surpassing $1B in quarterly revenue for the first time; Peacock paid subscribers increased nearly 50% year over year to 31M.

Full Year 2023:Total Return of Capital of $15.8B

{ZS.NAS} trades on a high PE ratio, and further selling into the $150 price range is our target.

AAPL:NYS is under Algo Engin buy conditions. We see long-term value for investors within the $140 – $170 price range.

SHOP:NYS is added to our buy list with a stop loss of $72.64

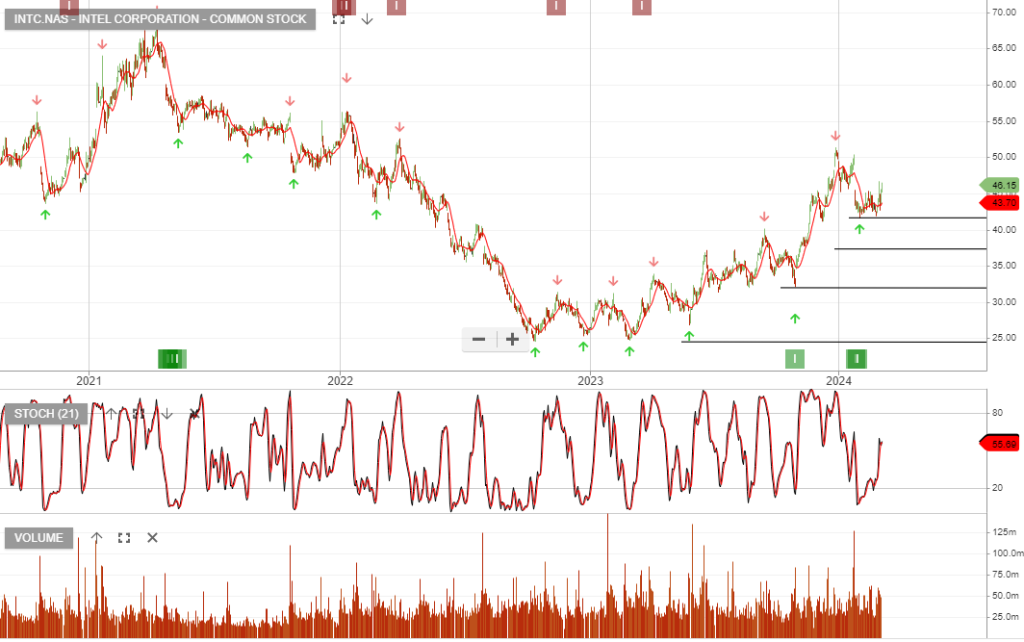

INTC:NAS The U.S. government is expected to invest $3.5B in Intel to make advanced semiconductors for military and intelligence programs. The money is part of the larger $39B Chips and Science Act grant pool aimed at boosting U.S. semiconductor manufacturing.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

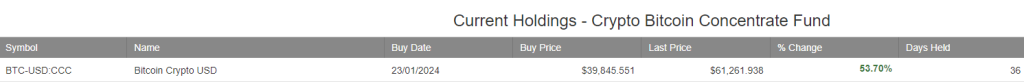

Our Algo Engine generated a buy signal in Bitcoin on 23/1/2024, and the trade is up 53% after 36 days.

Or start a free thirty day trial for our full service, which includes our ASX Research.