US Earnings

Earnings spotlight: Tuesday, March 18 – Tencent Music Entertainment Group

Earnings spotlight: Thursday, March 20 – Accenture, Nike, Micron Technology and FedEx.

Earnings spotlight: Tuesday, March 18 – Tencent Music Entertainment Group

Earnings spotlight: Thursday, March 20 – Accenture, Nike, Micron Technology and FedEx.

PayPal Holdings, Inc. – Common is a trade we intend to take once the price action exceeds the 10-day average.

NAS:CMSCA is under Algo Engine buy conditions.

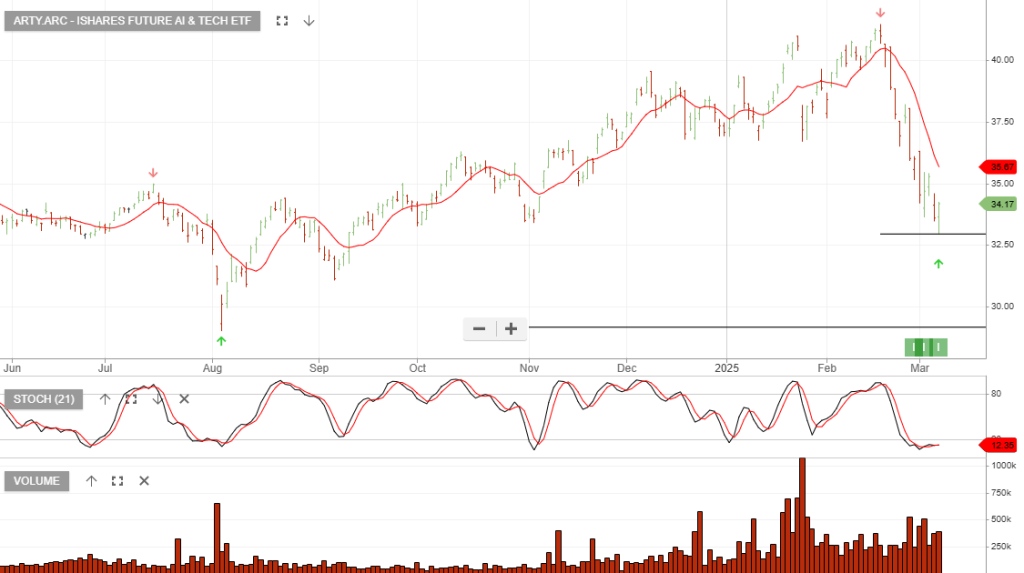

iShares Future AI & Tech is under Algo Engine buy conditions.

Alphabet Inc. – Class C Capital is under Algo Engine buy conditions.

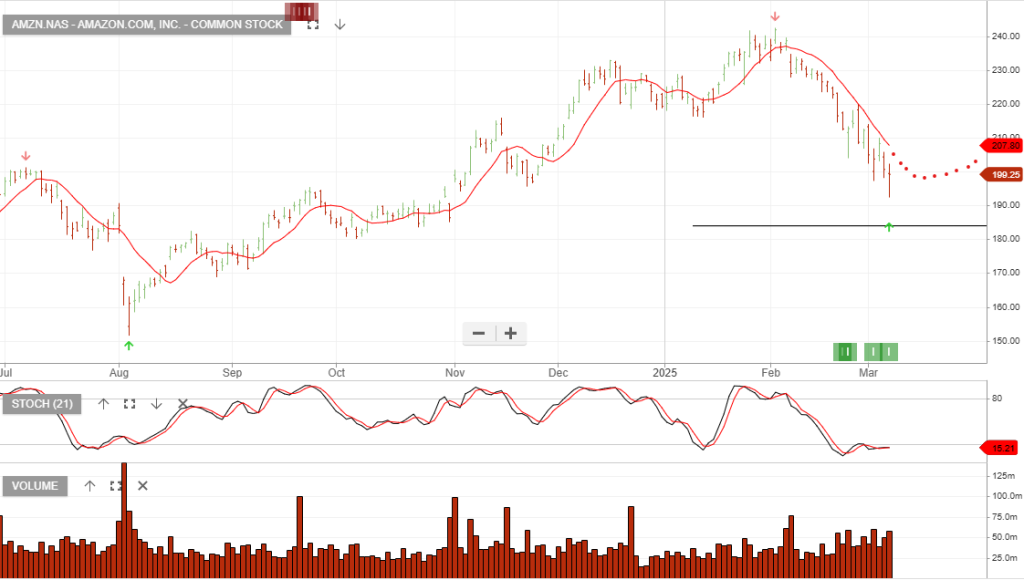

Amazon.com, Inc. – Common is under Algo Engine buy conditions.

The Carlyle Group Inc. – Common is under Algo Engine buy conditions.

iShares Evolved U.S. Technology is under Algo Engine buy conditions.

NVIDIA Corporation – Common is under Algo Engine buy conditions.

Early economic data for the first quarter of 2025 is pointing towards negative growth. Gross domestic product is on pace to shrink by 1.5% for the January-through-March period.

Annualized GDP growth will likely slow from 2.3% to 1.3%.

Or start a free thirty day trial for our full service, which includes our ASX Research.