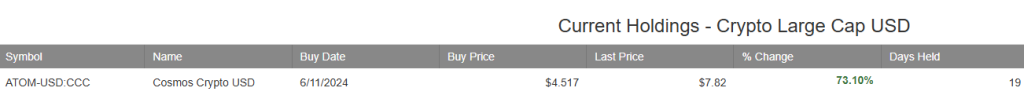

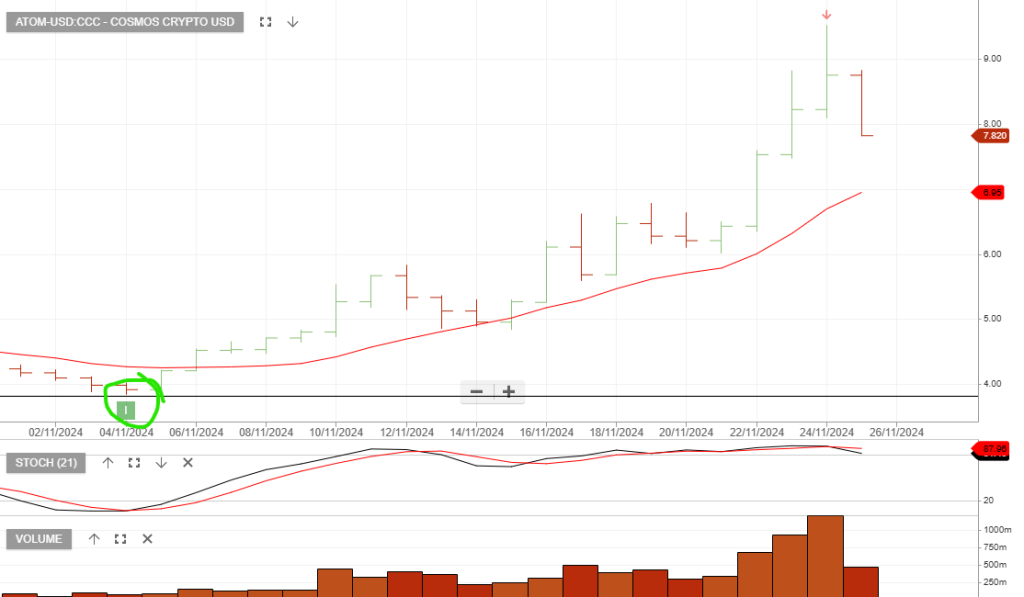

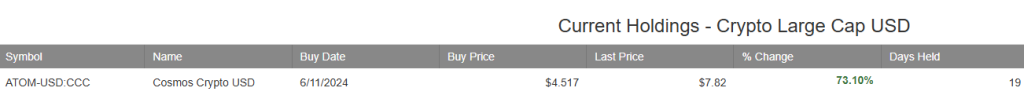

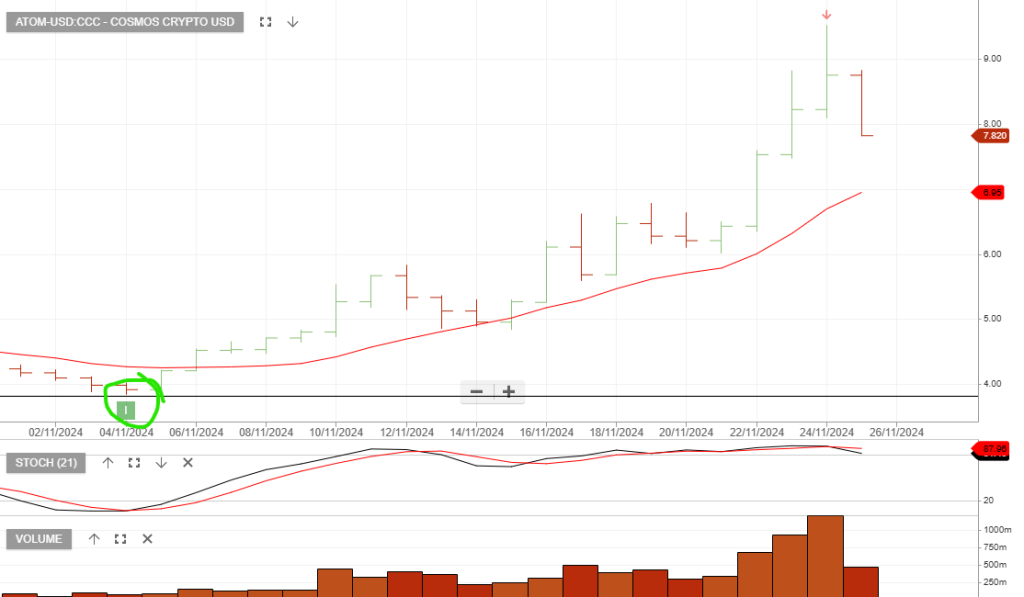

Cosmos up 73%

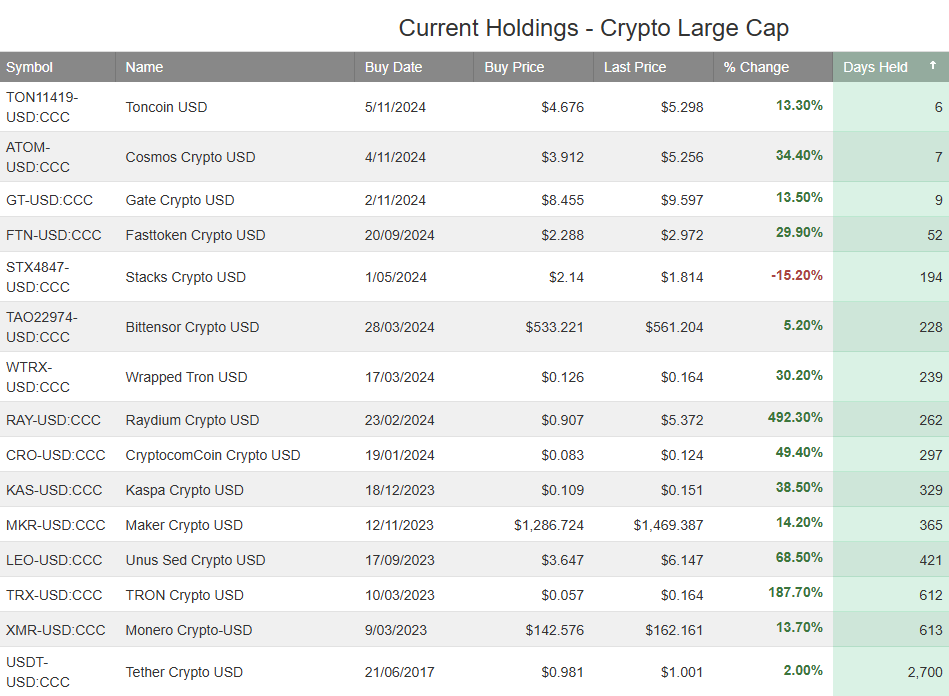

Our Large Cap Trade Table added Cosmos 19 days ago, and the trade is up 73%. Make sure you’re tracking the movements and watching for the email sell instructions.

Our Large Cap Trade Table added Cosmos 19 days ago, and the trade is up 73%. Make sure you’re tracking the movements and watching for the email sell instructions.

The S&P 500’s forward annual earnings per share are tracking at $260, $100 higher than six years ago. The P/E on a forward estimate is 23x. The earnings yield is 4.39%, nearing the June 2020 low of 4.11%.

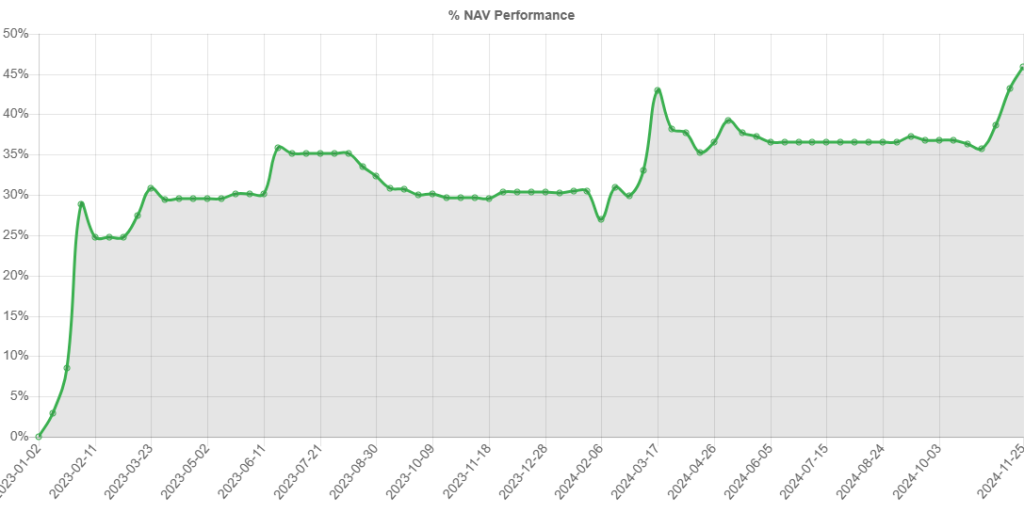

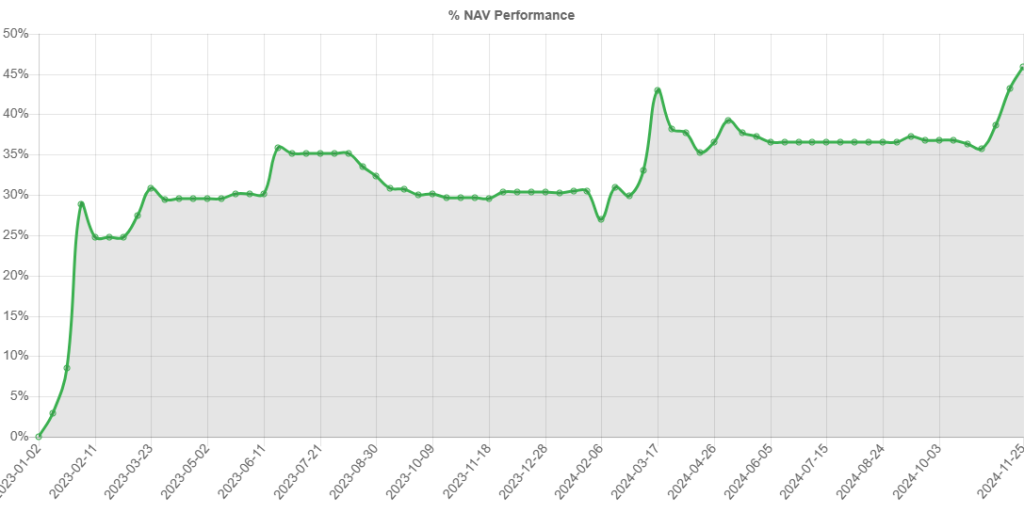

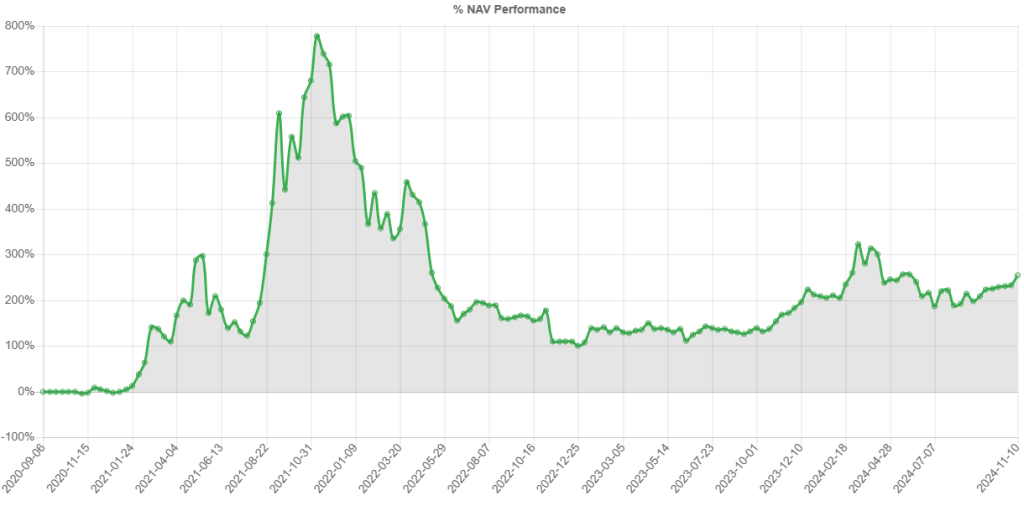

Our Crypto Large Cap model portfolio is up over 80% in the last 12 months.

Pinterest’s Q3 FY24 earnings showed 18% YoY revenue growth.

Okta, Inc. – Class A Common is under Algo Engine buy conditions.

Okta is a leading company providing cloud-based solutions for secure user authentication and identity management.

ASX:NXP is under Algo Engine buy conditions. NXP Semiconductors is navigating a cyclical downturn, particularly in the Industrial, IoT and automotive markets. Despite this, we see value within the $200 – $220 price range.

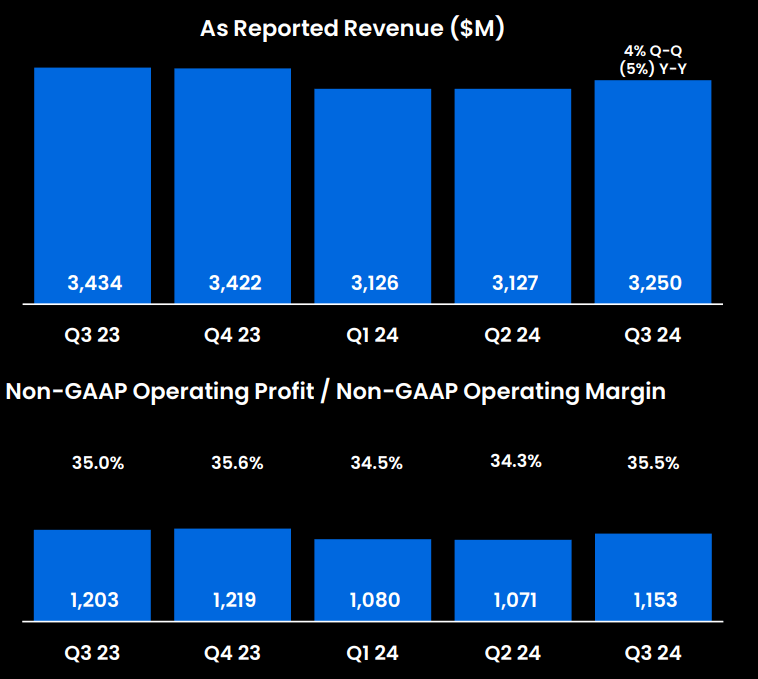

NXP Semiconductors released its Q3 FY24 on November 4th after the market close, reporting a 5% year-over-year revenue decline.

NXP Semiconductors is guiding for $3 billion-$3.2 billion in revenue for Q4, which a 9% year-over-year decline.

QUALCOMM Incorporated – Common is under Algo Engine buy conditions.

Qualcomm reported $33.19 billion in total revenue in its fiscal 2024, a 9% increase from 2023.

Turn on the notifications to receive email alerts when a trade is opened or closed.

META:NAS is under Algo Engine buy conditions and remains a current holding, up 100% after a 444-day holding period.

Meta reported better-than-expected Q3 earnings on the top and bottom line, growing revenue at double digits. Meta outperformed other big tech companies by a large margin.

Or start a free thirty day trial for our full service, which includes our ASX Research.