US GDP Growth

Early economic data for the first quarter of 2025 is pointing towards negative growth. Gross domestic product is on pace to shrink by 1.5% for the January-through-March period.

Annualized GDP growth will likely slow from 2.3% to 1.3%.

Early economic data for the first quarter of 2025 is pointing towards negative growth. Gross domestic product is on pace to shrink by 1.5% for the January-through-March period.

Annualized GDP growth will likely slow from 2.3% to 1.3%.

Monday, March 3 – Okta and GitLab

Tuesday, March 4 – CrowdStrike and Sea Ltd.

Wednesday, March 5 – Marvell Technology and Zscaler

Thursday, March 6 – Broadcom and Costco Wholesale

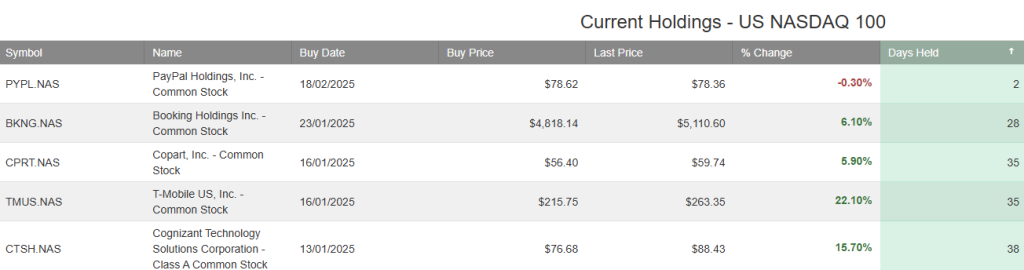

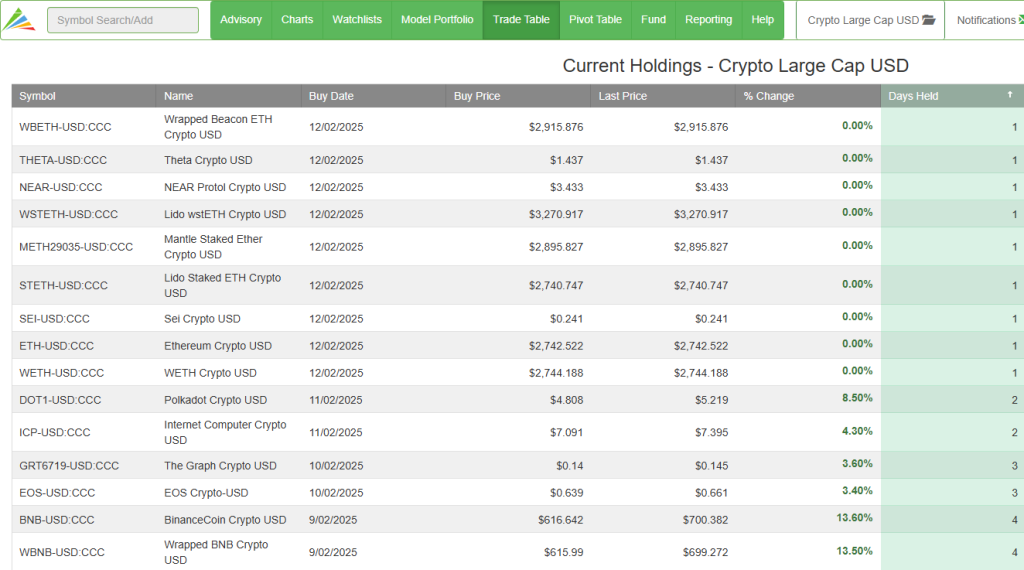

Our current holdings include…

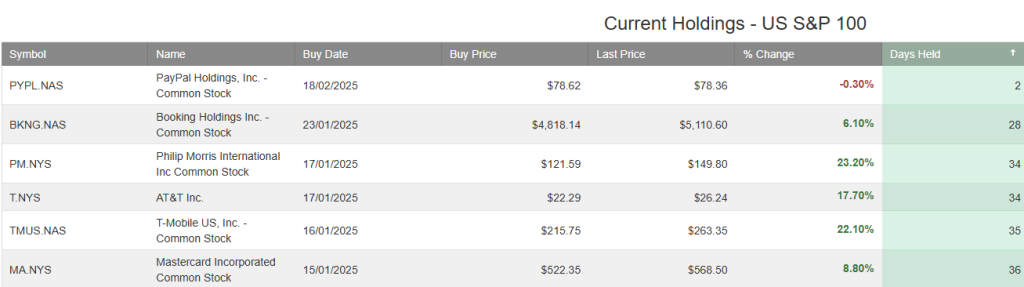

Our current holdings include…

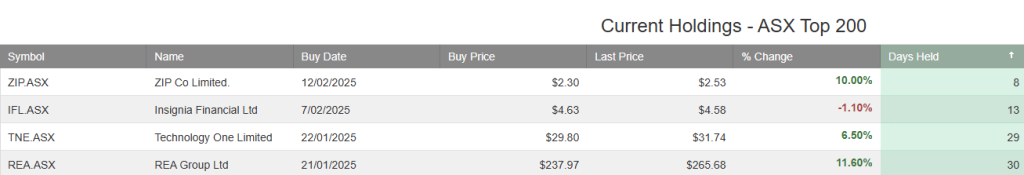

Our current holdings include…

ASX:QCOM has a forward revenue growth of 8% with EPS projected to grow 13% in 2025

PayPal Holdings, Inc. – Common is under Algo Engine buy conditions. PayPal generated $8.4B in revenue in Q4’24, operating income was $1.5B, +2% year-over-year.

PayPal reported strong Q4 earnings, showing growth in active accounts, free cash flow, and operating income margins, and the board approved a $15B stock buyback authorization.

PayPal is trading at 14x P/E.

Guidance FY25: PayPal expects up to 10% year-over-year growth and an adjusted EPS range of $4.95-5.10 per-share.

Invesco PHLX Semiconductor is under Algo Engine buy conditions.

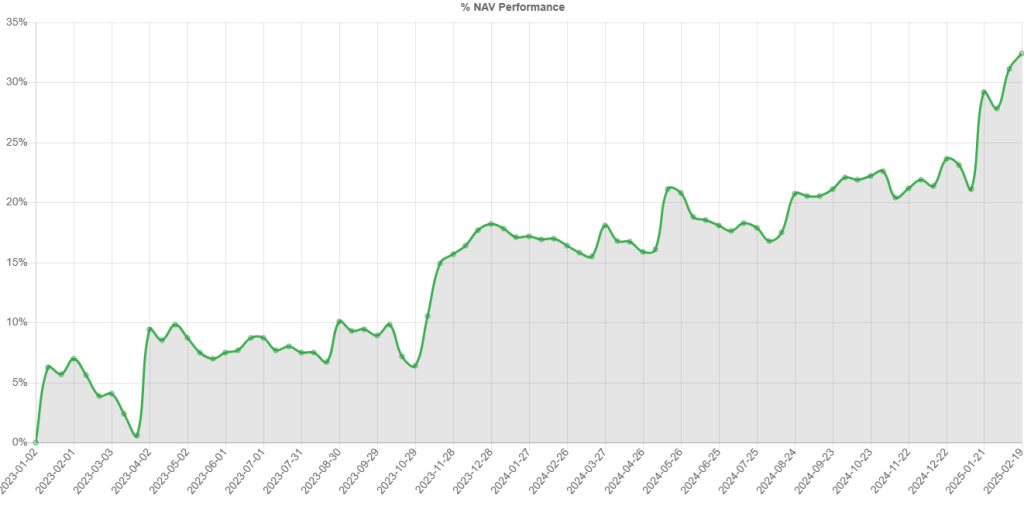

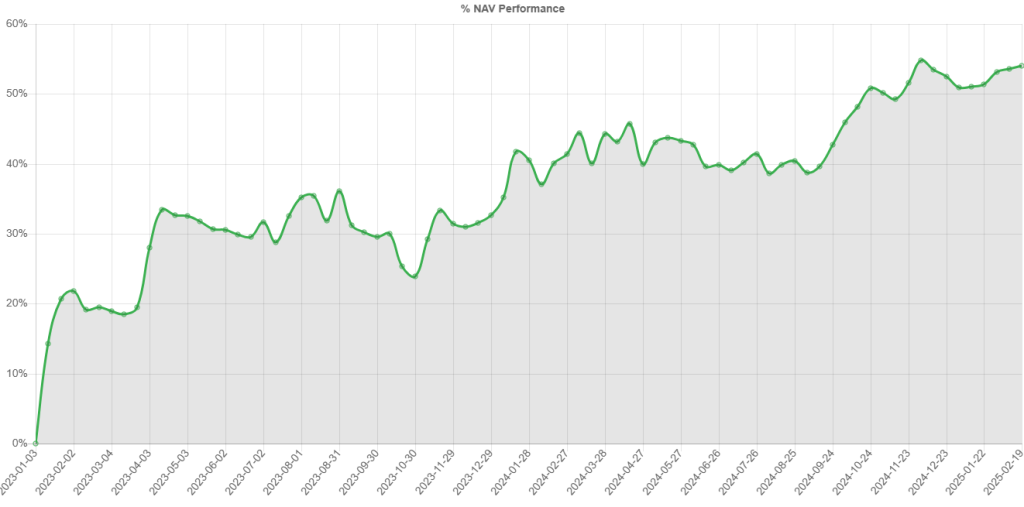

Our large-cap trading model has added nine new positions.

Meta, Amazon, Alphabet and Microsoft intend to spend as much as $320 billion combined on AI technologies and datacenter buildouts in 2025. That’s up from $230 billion in 2024.

Amazon offered the most ambitious spending initiative, aiming to spend over $100 billion.

Amazon is under Algo Engine sell conditions, and we’ll examine the stock more closely following a price retracement back toward $200.

Or start a free thirty day trial for our full service, which includes our ASX Research.