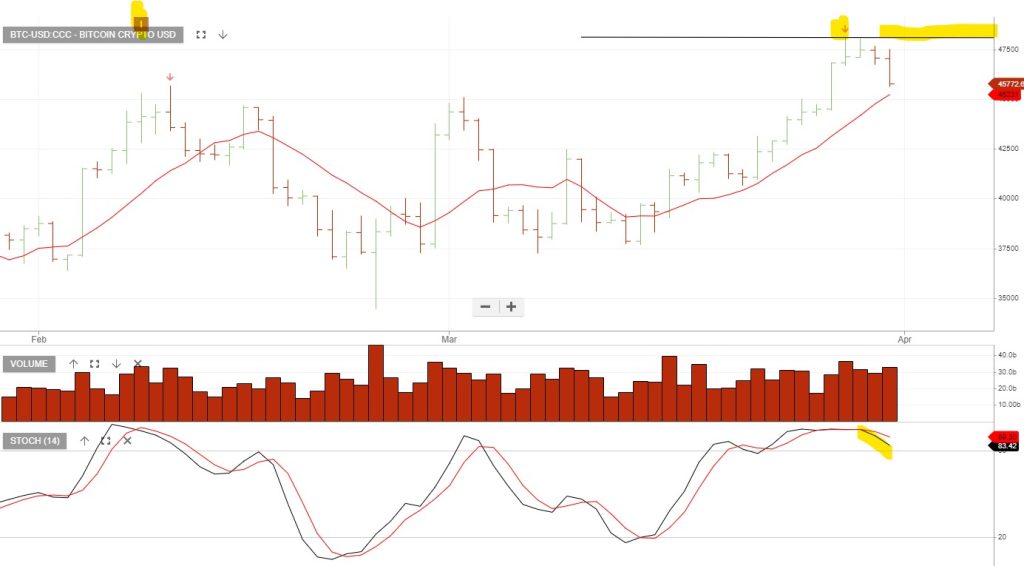

Bitcoin – Sell Signal

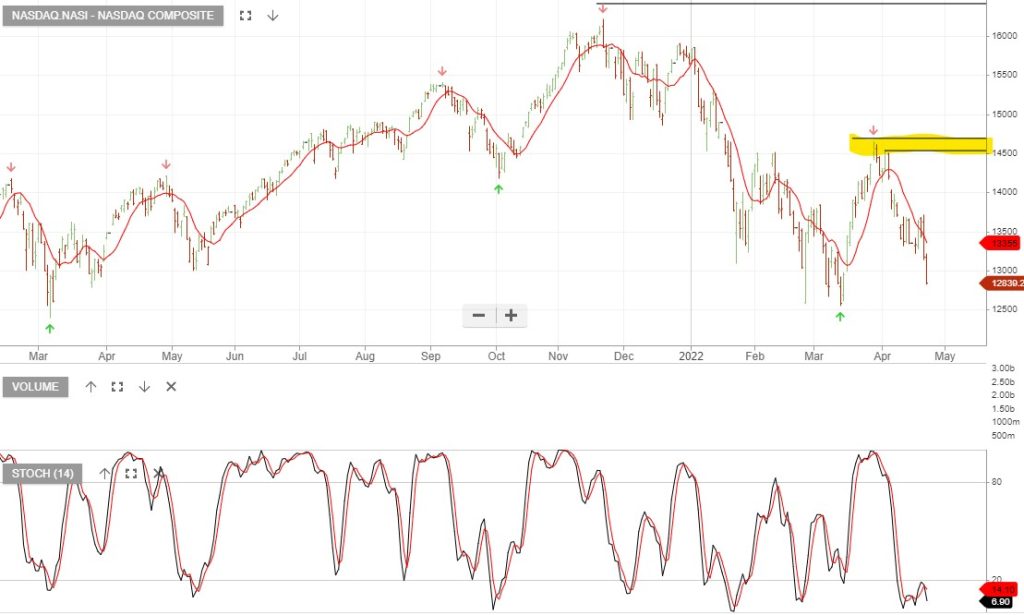

The rebound in the NASDAQ has been sharp and it’s possible we’re now looking at a level of overhead resistance. For crypto investors, this provides an opportunity to consider hedging or an outright short position.

The strategy requires a stop loss which means any short exposure is closed out if the market rally continues.

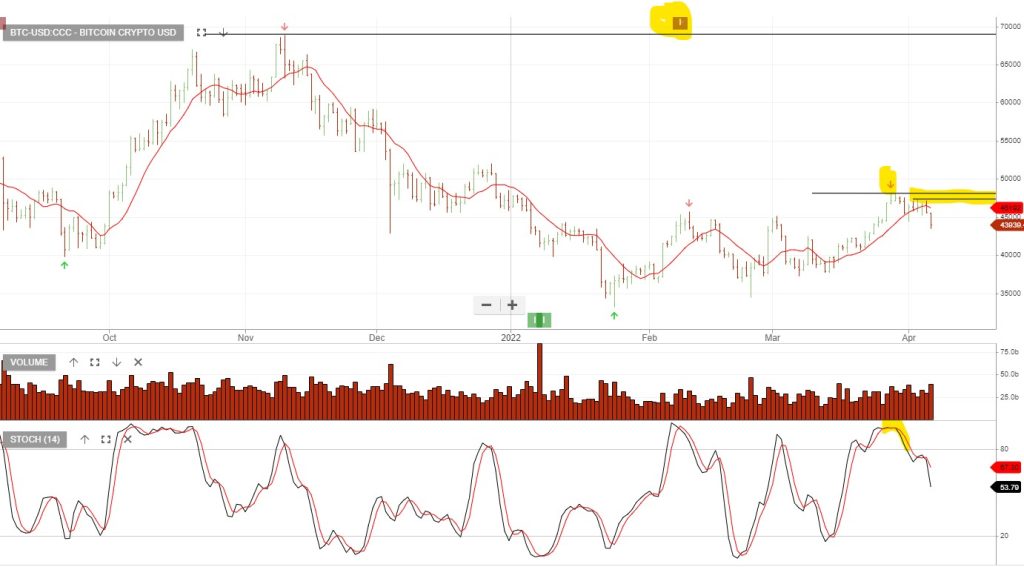

7/4/22 update: BTC-USD has rolled over and the technical setup remains negative.

23/4/22 update: The NASDAQ continues to move lower reflecting a risk-off sentiment, which is also impacting Bitcoin. BTC is under Algo Engine sell conditions and we remain short Bitcoin futures as an open trade.

26/5 update: Bitcoin has continued to trade lower and we now identify the overhead resistance at 30590 as the first level to watch for a potential price reversal. Since flagging the “short” setup in Bitcoin on 7 April, the crypto has lost 15,000 in the move from 45,000 down to 30,000.

15/6/ update: